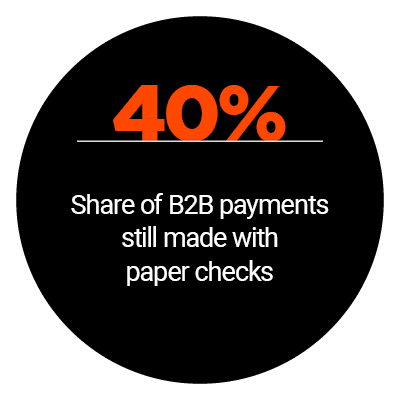

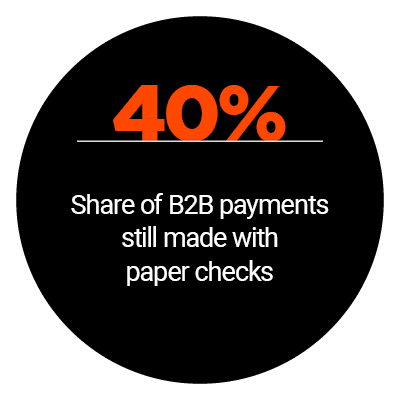

Insurers, especially in segments such as the property and casualty (P&C) space, are experimenting with a wide variety of alternative methods for both business-to-business (B2B) and consumers claims. Many businesses still use paper checks for such payments, however, despite the added need for speed caused by the COVID-19 pandemic. Checks still play a larger role in the B2B world, with 40 percent of all B2B payments still issued via paper checks.

Insurers must, therefore, be careful not to implement payment methods that are too innovative for businesses that still place a significant amount of trust — and moreover, a significant amount of their funds— in paper checks. Payment innovation is still top of mind for the P&C industry, however, leading many to examine methods such as electronic checks or eChecks which are sent out digitally, but with the same familiar format these businesses are used to from decades of paper-based processes tied to their B2B transactions.

Insurers must, therefore, be careful not to implement payment methods that are too innovative for businesses that still place a significant amount of trust — and moreover, a significant amount of their funds— in paper checks. Payment innovation is still top of mind for the P&C industry, however, leading many to examine methods such as electronic checks or eChecks which are sent out digitally, but with the same familiar format these businesses are used to from decades of paper-based processes tied to their B2B transactions.

In the latest Digitizing B2B Payments Tracker®, PYMNTS takes a look at emerging payment trends in the P&C insurance sector, particularly examining the role of emerging payment methods such as eChecks. The Tracker also analyzes how this segment of the insurance industry is responding to the COVID-19 pandemic, and how the pandemic’s impact will affect long-term payment perceptions and usage in the space.

Around The B2B Payments World

California-based P&C insurer CSE Insurance Group is among those looking to add greater efficiency to its payments processes. The group will be tapping a third-party payments provider to build out an electronic platform designed to help support both the accounts payable (AP) and accounts receivable (AR) transactions of the firm. Developing such a solution was aimed at providing CSE clients and claimants with the same kind of seamlessness and speed they have come to expect from payments elsewhere, according to recent statements from the firm.

Advertisement: Scroll to Continue

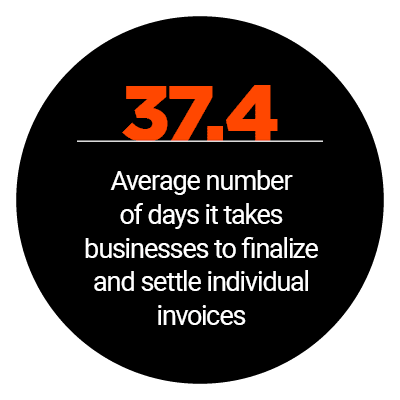

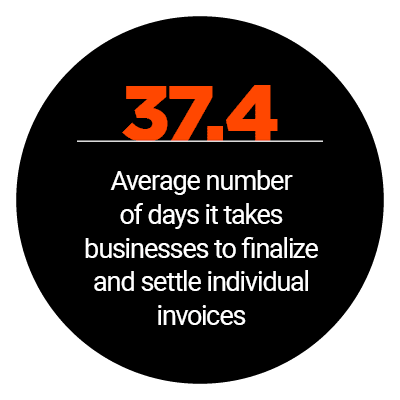

Wawanesa Mutual Insurance is another firm innovating its B2B payment solutions for added speed and security. The Toronto-based insurer has announced it will be using an online brokerage platform to allow it to simplify such transactions, with this solution handling not only the transaction of payments but also the transfer of additional documents such as invoices. This will allow the information included on such documents to be more easily categorized and input into their services, speeding up the payments approval process. Finding ways to cut down on the added paperwork can therefore eliminate much of the traditional friction attached to B2B payments.

Wawanesa Mutual Insurance is another firm innovating its B2B payment solutions for added speed and security. The Toronto-based insurer has announced it will be using an online brokerage platform to allow it to simplify such transactions, with this solution handling not only the transaction of payments but also the transfer of additional documents such as invoices. This will allow the information included on such documents to be more easily categorized and input into their services, speeding up the payments approval process. Finding ways to cut down on the added paperwork can therefore eliminate much of the traditional friction attached to B2B payments.

United Kingdom-based insurer AXA UK is also revamping the way it sends out and collects payments through an extension of its existing business relationship with software provider Verisk to add in video support for these transactions. It will be employing the latter’s ClaimXperience solution, which will let its customers upload photos or videos of the damage done to their personal or professional properties. They will then use another Verisk solution to connect these claimants with its partner suppliers to fix those damages. The suppliers can also upload supporting documents, images or videos to this platform as well, according to the insurer. Both solutions make use of real-time data technology to make categorizing the information attached in the videos or the documents much easier.

For more on these and other stories, visit the Tracker’s News & Trends.

How TMMAS Is Using eChecks To Digitally Transform Payments

Claimants and vendors want to receive funds from their insurers faster, especially as they grow used to receiving faster, digital payments in other areas of their lives both professional and personal. Yet paper checks remain integral the P&C industry for a variety of reasons, including their familiarity to the businesses waiting on these funds. Insurers must, therefore, provide their claimants and business partners with the same security they associate with paper checks, combined with the speed and seamlessness of today’s electronic payment methods. This is why P&C shared service firm Tokio Marine North America Services (TMNAS) is leaning more on eChecks, explained Michael Kelly, treasurer and senior vice president of finance for the company in a recent interview with PYMNTS. To learn more about why TMNAS is employing eChecks, visit the Tracker’s Feature Story.

Claimants and vendors want to receive funds from their insurers faster, especially as they grow used to receiving faster, digital payments in other areas of their lives both professional and personal. Yet paper checks remain integral the P&C industry for a variety of reasons, including their familiarity to the businesses waiting on these funds. Insurers must, therefore, provide their claimants and business partners with the same security they associate with paper checks, combined with the speed and seamlessness of today’s electronic payment methods. This is why P&C shared service firm Tokio Marine North America Services (TMNAS) is leaning more on eChecks, explained Michael Kelly, treasurer and senior vice president of finance for the company in a recent interview with PYMNTS. To learn more about why TMNAS is employing eChecks, visit the Tracker’s Feature Story.

Why The $1.6 Trillion P&C Insurance Industry Is Turning To eChecks To Transform Payments

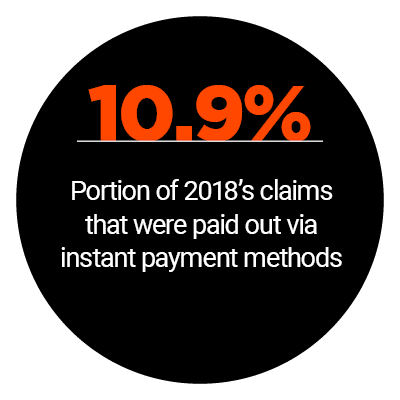

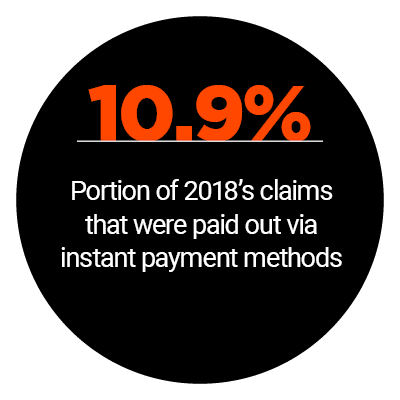

The wider insurance industry was responsible for generating $5 trillion in premiums for 2018, with P&C insurance — covering home, auto and powersports insurance, among other categories — responsible for generating $1.6 trillion of that amount. The P&C insurance segment in particular is heavily reliant on paper checks for paying claims or their industry partners, but growing payment volumes and other concerns are leading both businesses and other insurers to consider alternative methods. eChecks, which add the speed of electronic payments in a format that is familiar to many businesses, are thus presenting as an intriguing option. To learn more about the ways in which payments are changing in the P&C insurance industry and how eChecks are playing a larger role, visit the Tracker’s Deep Dive.

About The Tracker

The PYMNTS Digitizing B2B Payments Tracker®: Taking The Paper Check Digital, a partnership with Deluxe, examines the latest B2B payments trends and events as well as how businesses are using technologies both new and old to keep up with changing client and consumer needs.

The new coronavirus has led many businesses and consumers to seek out ways they can receive payments more quickly, but for some, this is only the latest development in a longer curve toward payment innovation. The financial and insurance industries, for example, have both been attempting to revamp their payments processes for a number of years as electronic payment methods have become more prevalent.

The new coronavirus has led many businesses and consumers to seek out ways they can receive payments more quickly, but for some, this is only the latest development in a longer curve toward payment innovation. The financial and insurance industries, for example, have both been attempting to revamp their payments processes for a number of years as electronic payment methods have become more prevalent.