Today in B2B payments, Black Kite makes the case against ransomware payments, and Bottomline pairs with Autobooks on small business banking. Plus, Baker Tilly Canada Corporate Finance discusses small business M&A, U.K. regulators probe Greensill and Zoho adds corporate T&E features to its platform.

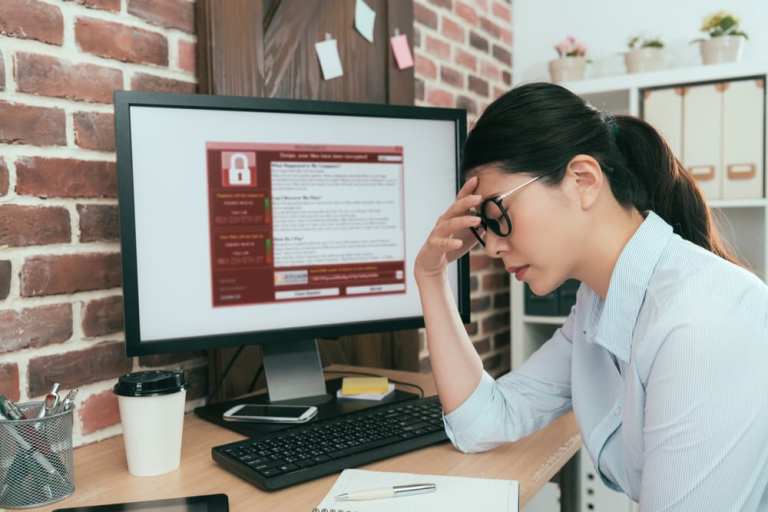

Bringing Clarity To The Messy World Of Corporate Ransomware

The Big Business Of Small Business M&A

Boomers ready to retire, corporate tax reform and a digital transformation push have created an environment ripe for M&A activity — particularly among small and medium-sized businesses (SMBs). But how to account for the black swan event of COVID when deal-making remains a tricky unknown, says Mike McIsaac, CEO and managing director at Baker Tilly Canada Corporate Finance.

Bottomline, Autobooks Team Up On SMB Banking

UK’s FCA Probes Supply Chain Finance Firm Greensill

Advertisement: Scroll to Continue

A financial regulator in the United Kingdom disclosed that it is officially looking into the British business of Greensill, a supply chain finance firm, Reuters reported. The U.K.’s Financial Conduct Authority (FCA) is looking into issues connected with Greensill Capital U.K. and Greensill Capital Securities in addition to Mirabella Advisers LLP’s supervision of Greensill Capital Securities, according to FCA CEO Nikhil Rathi, per the report.

Zoho Boasts Corporate T&E Functions

Global technology company Zoho Corporation has announced that it will be rolling out a new version of its expense management software, which will help midmarket businesses bring changes in the travel and expense (T&E) process, according to a press release emailed to PYMNTS on Wednesday (May 12). The updates will help companies control costs when it comes to COVID-19-related effects, allowing businesses to manage travel as well as gain more visibility and control of global spending, all from one place, the release said.