Deep Dive: How The Pandemic Is Pushing Global B2B Firms To eCommerce Channels, Marketplaces

Business-to-consumer (B2C) payments and processes adapted to digital years ago in the shift to eCommerce. The ongoing pandemic appears to have acted as a flashpoint for B2B eCommerce, however, as businesses have migrated to digital channels to keep their operations functioning in a rapidly changing world. B2B payments have underpinned B2C eCommerce for years, of course. Behind every consumer purchase, a flurry of buyers, sellers and payment players attempt to finalize their own payments to make sure these sales can be completed speedily. Much of the invisible B2B developments behind this curtain have taken place manually, even as eCommerce retailers adopted digital tools, leading to a gap that B2B players — especially those in the cross-border payments space — have struggled to close.

The global health crisis has revitalized interest in bridging that divide, however, with B2B buyers reporting more of a preference for digital since the start of the pandemic. One study found that 75 percent of B2B buyers and sellers now want to make purchases or interact with business partners online, and another report found that 90 percent of B2B sales across 11 countries are now being made using virtual tools, such as videoconferencing or website services.

Interest does not translate to experience, however. B2B firms still have to catch up in the eCommerce sector as they look to bring clunky processes that have been manual for decades into the virtual sphere. B2C sites still remain more user-friendly and easier to navigate, PYMNTS research indicates, and they are also more likely to provide useful features, like product recommendations or discounts. PYMNTS data shows that 11 percent more B2C sites currently allow users to rate products or write reviews than B2B sites, for example.

Including client-friendly features is just one of many steps companies must take to successfully transition to digital commerce. Firms must also work to bridge the gap between the multiple systems they use to manage the moving parts of the order-to-cash (O2C) process with their eCommerce platforms. Companies looking to digitize their B2B payments must also be sure that these solutions can integrate with the other parts of their payments flows, allowing them to seamlessly send all the necessary data as well. Allowing any disconnection can lead to costly errors and frustrations that can slow down invoices or payments, eliminating the speed and transparency granted by digital solutions. Connecting the eCommerce platform with other systems in the ordering process is critical for businesses taking this next step into the eCommerce world.

This Deep Dive analyzes the invisible and important role B2B payments play in B2C eCommerce and details how the pandemic has accelerated the move to eCommerce for B2B firms. It also examines how these trends will continue into the future and identifies the tools, technologies and emerging payment methods that are proving beneficial to these B2B firms.

eCommerce And The B2B Linchpin

Keeping up with an instant industry is difficult both on paper and in practice. B2B firms are crucial to the success of eCommerce staples, like one-day delivery, and have, therefore, sought to bridge the gap between fast service and slow payments on the B2B side. Many companies have looked to address these growing issues for several years: Increased reliance on digital tools for B2C commerce means that clinging to manual or outdated B2B processes can prove detrimental to businesses’ partners and vendors as well as consumers and clients looking for goods. These companies are often left juggling outdated processes that lack interoperability with digital platforms, leading to obstacles when it comes time for these firms to transfer data from one system to the next. One recent PYMNTS study found it can take 67 percent longer for firms using manual processes to finalize overdue payments than it would for those using automated digital processes, for example. This accounts for the fact that participation in B2B eCommerce was already growing: One recent study showed that online B2B sales growth from 2018 to 2019 jumped 18 percent — from $1.1 trillion to $1.3 trillion.

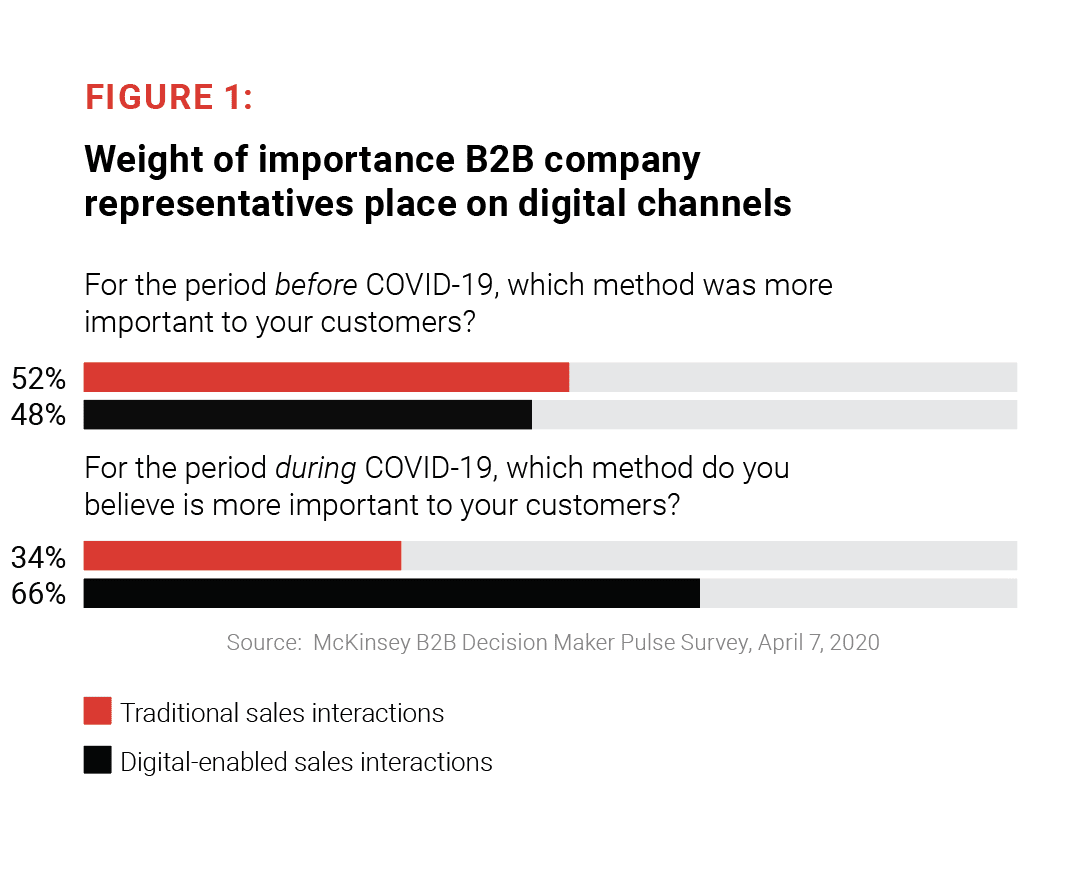

This growth is encouraging, but the pandemic’s impact on B2B transactions — especially cross-border B2B payments — may mean that even firms that increased their digital B2B sales just a year prior may be moving too slow. Nearly 47 percent of businesses claimed that the pandemic affected their payment acceptance processes, PYMNTS’ data found, with an additional 42 percent of B2B companies stating that it also impacted invoice delivery. Another recent study found that B2B firm representatives now view the ability to make sales over digital channels to be more important than they did prior to the pandemic. Forty-eight percent of those surveyed before the crisis stated that enabling digital sales for their customers was more important than doing so for traditional sales compared to the 66 percent who said the same after the pandemic hit.

The pandemic, therefore, appears to have accelerated the adoption of B2B eCommerce tools for firms, yet there are still several challenges companies must address if they want to compete in this evolving environment, including tying all aspects of the O2C process together on one holistic, digital platform. Firms building up their virtual sales abilities or moving to online marketplaces must also consider how factors such as payments must be innovated to keep up with this move.

The Payments Question

Part of the next set of challenges B2B firms face is that the expectations among their clients and customers are changing — B2B partners and vendors are shifting their standards for how quickly they expect transactions to finalize or payments to arrive. The funds from online B2B sales need to move even more quickly, as business clientele seek the same seamless interactions that have typified B2C eCommerce for years.

Meeting these rising expectations will require more than simply listing one’s services or inventory on online marketplaces. B2B companies looking to keep pace within the global B2B eCommerce space must also implement payments tools or technologies such as instant payment networks or automation to reduce friction attached to invoices. Firms could also consider how self-service invoicing solutions or services that use automation for faster reconciliation could provide key benefits. Companies must, therefore, carefully consider what payment methods or features could prove most beneficial to their specific clients in this new environment and how they can best be applied.