Report: Hospitals Turn To Card-On-File Solutions To Fix Payment Collection Pains

Reduced patient visits during the pandemic have strained healthcare providers’ budgets, and many are looking to restore some of their lost appointment volumes and collect timely payments from their remaining patients. Hospitals and clinics are finding plenty of healthcare and payment technologies that can help them address these challenges.

Implementing telemedicine offerings can enable providers to treat patients remotely, serving customers who do not want to risk visiting offices. This can be essential to safeguarding revenue streams, and providers who adopt digital payment acceptance methods can also make it easier for customers to pay their shares of medical bills, which streamlines healthcare providers’ collection processes.

Not all practitioners have the tools on hand to manage these transitions, however. Some may need to procure telemedicine solutions from vendors. Others have determined that handling business-to-business (B2B) transactions using swift, electronic payment methods instead of traditional paper-based ones can streamline their processes.

Not all practitioners have the tools on hand to manage these transitions, however. Some may need to procure telemedicine solutions from vendors. Others have determined that handling business-to-business (B2B) transactions using swift, electronic payment methods instead of traditional paper-based ones can streamline their processes.

The Digitizing Healthcare Payments Report examines healthcare providers’ technology adoptions, including the solutions that help them reach patients and those that enable them to more seamlessly transact with suppliers and patients.

Around The Healthcare Payments Digitization Space

Consumers of all ages are showing considerable interest in telehealth solutions. A recent survey of 3,000 British, Dutch and German patients ages 56 and older found that half preferred digital consultations to in-person doctors’ visits during the pandemic, for example. This suggests that healthcare providers may need to pay close attention to their remote care offerings to best reach this population.

Healthcare providers are also adopting more than just patient-facing solutions, with many also looking for tools that can boost their back-end operations and payment collection efforts. A healthcare sector survey in the United States found that 65 percent of healthcare executive respondents were using offerings powered by artificial intelligence (AI) to improve revenue cycle management, while others planned to invest in such software in coming years.

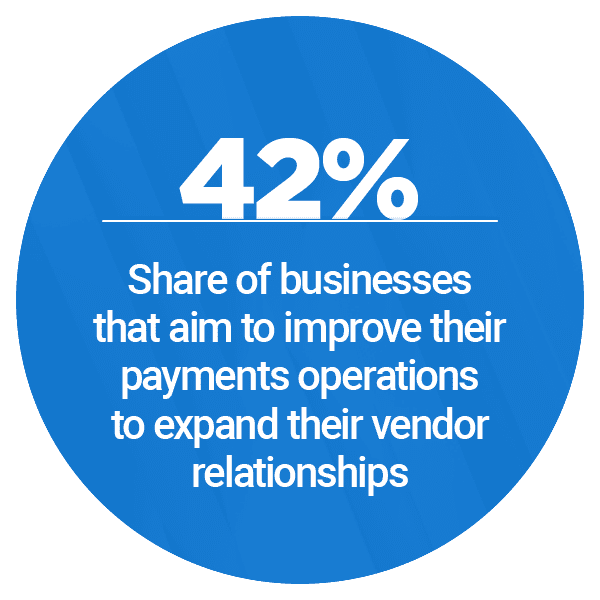

Numerous healthcare organizations are working to improve their transactions with telemedicine solution providers and other suppliers, which can mean leaving paper check-based B2B payments behind. Digital healthcare services provider Nurx has been moving toward using more digital transaction tools, according to Ori Franco, the firm’s chief financial officer. He explained that such methods could allow for swifter, simpler transactions.

Numerous healthcare organizations are working to improve their transactions with telemedicine solution providers and other suppliers, which can mean leaving paper check-based B2B payments behind. Digital healthcare services provider Nurx has been moving toward using more digital transaction tools, according to Ori Franco, the firm’s chief financial officer. He explained that such methods could allow for swifter, simpler transactions.

Find out more about these stories and other headlines in the Report.

How Card-On-File Patient Payments Boost Collections

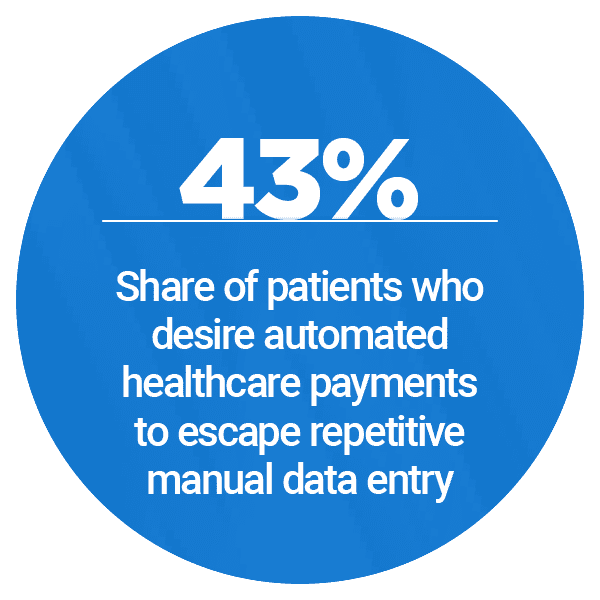

Healthcare providers need to receive patients’ payments as quickly as possible to maintain smooth cash flows, and the rise of high-deductible health plans — which see consumers responsible for greater shares of their healthcare costs — have made this need only more pressing. Tracking down patients and requesting their payment details after they have received treatment can be cumbersome, and switching up this approach can make a considerable difference, said Markiyan Malko, vice president of product-revenue cycle management at healthcare technology provider Phreesia. In the Feature Story, Malko explains how card-on-file transactions can simplify healthcare providers’ payment flows.

Read the full story in the Report.

Deep Dive: Fueling Telemedicine Adoptions With Digital B2B Payments

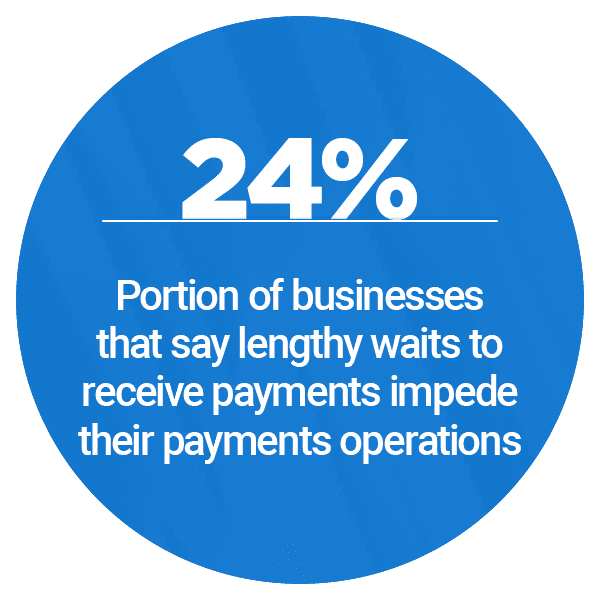

The pandemic has prompted many healthcare organi zations to examine how telemedicine solutions and other digital tools can help them operate more effectively. They are turning to software vendors to obtain the technologies they need to get their systems up and running. Paying these suppliers via paper check-based methods can be expensive and inconvenient for healthcare organizations, leaving many to seek more seamless digital methods. The Deep Dive examines the growing demand for telemedicine and how B2B credit card transactions and other digital payment methods can help providers acquire these offerings.

zations to examine how telemedicine solutions and other digital tools can help them operate more effectively. They are turning to software vendors to obtain the technologies they need to get their systems up and running. Paying these suppliers via paper check-based methods can be expensive and inconvenient for healthcare organizations, leaving many to seek more seamless digital methods. The Deep Dive examines the growing demand for telemedicine and how B2B credit card transactions and other digital payment methods can help providers acquire these offerings.

Read more in the Report.

About The Report

The Digitizing Healthcare Payments Report, a PYMNTS and American Express collaboration, offers coverage of the most recent news and trends regarding healthcare providers’ digital patient and vendor payment strategies and telemedicine procurements.