2023 Demands Better Cash Flow Management for SMBs

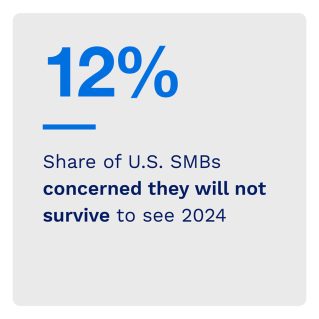

A new PYMNTS survey reveals 12% of SMBs are concerned they won’t survive beyond 2023. The Main Street Health Report shows increasing costs and fluctuating revenues are at the root of their worries, as cash flow challenges already impact roughly 1 in 4 small and medium-sized businesses (SMBs). Inflation, cited by nearly 4 in 10 U.S. SMBs, and late payments, which hindered the growth of half of companies surveyed in the U.K., are the most immediate threats to cash flow.

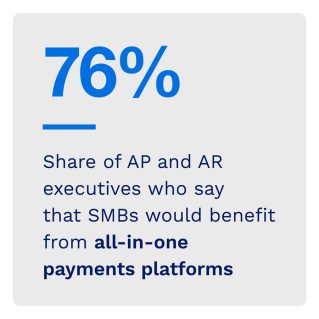

More companies, banks and other payments service providers are turning to digital solutions. PYMNTS research found that 41% of SMBs in the U.S. are already using an all-in-one payments solution. Meanwhile, a global report found that 64% of SMBs believe distributed ledger technology can complement existing payment networks.

This edition of the “B2B And Digital Payments Tracker®” explores how small to mid-sized businesses are bracing for headwinds while still planning for increased revenues. They will need better cash flow to weather the coming storm, and those companies that can integrate solutions quickly can protect their working capital and stay afloat.

Around the B2B and Digital Payments Space

Despite the many challenges in the current business environment, companies are still eyeing growth. A report found that 83% of SMBs in Canada are optimistic about their growth prospects for the next few years, with 85% boosting productivity, 83% identifying operational efficiencies and 82% managing costs by increasing prices.

Despite the many challenges in the current business environment, companies are still eyeing growth. A report found that 83% of SMBs in Canada are optimistic about their growth prospects for the next few years, with 85% boosting productivity, 83% identifying operational efficiencies and 82% managing costs by increasing prices.

End-of-the-year cash flow will be a priority for many SMBs this year, as 74% of online retailers and 71% of brick-and-mortar retailers report Q4 as their most profitable time of year, according to an American Express survey. The survey also revealed that 42% of those businesses report costs increasing as much as 25% in the final three months of the year, driven by 41% purchasing more inventory, 31% spending more on employees for holiday gifts or parties and 25% increasing their advertising spend.

For more on these and other stories, visit the Tracker’s News and Trends section.

An Insider’s Checklist for All-in-One Payments Success

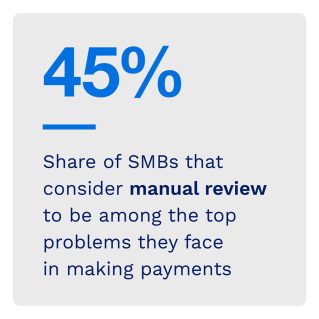

All-in-one payments platforms promise a comprehensive solution, but if they do not provide end-to-end transaction assistance, users will be left unsatisfied and likely with less predictable working capital. Using data and artificial intelligence, a platform with collaborative tools can supercharge cash flow.

To get the Insider POV, we spoke with Craig O’Neill, CEO at Versapay, to learn more about how SMBs should approach all-in-one payments platforms.

To get the Insider POV, we spoke with Craig O’Neill, CEO at Versapay, to learn more about how SMBs should approach all-in-one payments platforms.

How Technology Can Align SMB Buyers’ and Suppliers’ Payment Priorities

There are clear differences between how buyers and suppliers prefer to get paid. An all-in-one payments platform is one solution to which many SMBs are turning. According to PYMNTS research, 52% of SMBs say these platforms result in easier cash flow management. Technical partnerships can help facilitate faster payments, which in turn increase cash flow.

To learn more about how technology can reduce payments friction, read the Tracker’s PYMNTS Intelligence.

About the Tracker

This edition of the “B2B and Digital Payments Tracker®,” a collaboration with American Express, examines how SMBs can improve cash flow management in 2023.