When you’re the CEO of an online community that includes tens of thousands of banking and credit union professionals and millions of interactions, you know what’s happening in the industry.

Tom Ferries, CEO at CBANC, told PYMNTS that he’s been seeing two trends. One is that about half of the conversations taking place on the site are about products, vendors and product categories. The other trend is that the vendors that have been hosting webinars and adding content to the site in order to get in front of bankers have kept reupping every year and finding value in it.

Outside the online community, banks and FinTechs have also been asking Ferries similar questions. Some are using phone banks and industry conferences to reach these professionals.

“I come from marketing in other verticals, as does my [chief marketing officer], and we both just looked at each other and were like, ‘Oh, my gosh, this is so antiquated — data-driven analysis, so on and so forth, has not made it into this world,’” Ferries said.

Launching an Online B2B FinTech Marketplace

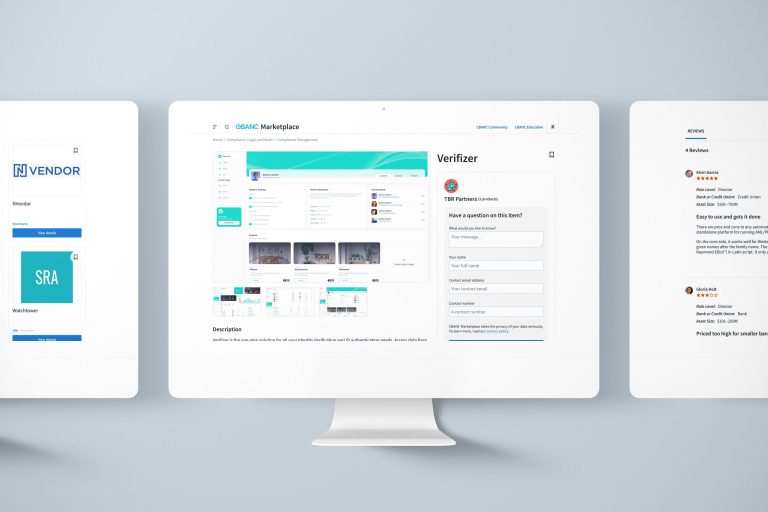

On Jan. 10, CBANC announced that it is offering a new solution to these problems: an online B2B FinTech marketplace for credit unions and community banks.

The idea is to serve as connector between the vendors that want to get in front of bankers and the bankers who want to keep up on the latest innovations, Ferries said.

“We already had the community, and the community is already a safe space for bankers and credit union professionals to talk, share knowledge, collaborate and so forth,” Ferries said. Adding a marketplace can also provide a place for these professionals to see the options available in mortgage-origination systems, for example.

Like consumers shopping for a toaster, these professionals shop by going online, educating themselves, going to their peers, going to their families, looking for ratings, looking for reviews — all before engaging with anyone who is selling the product.

Making Connections Between Vendors and Banks

CBANC was already contributing to this process by featuring webinars and other vendor-created content on its site.

Now, with the marketplace, “We’re just putting that on steroids,” Ferries said. Among other things, it will enable industry professionals to see the options that are available and to read reviews that have context — such as the size of the bank writing the review — so they can see if products are relevant to their own needs.

Vendors can list their products for free and post as much content as they’d like. CBANC will monetize the marketplace by offering vendors such services as providing qualified leads, hosting sponsored webinars and placing them higher in the listings.

Over time, as CBANC sees newly launched marketplace is being used, the company plans to continue adding features.

“There will be more functionality coming, both on the banker side and on the vendor side,” Ferries said. “But if we can just make those connections between vendors and banks, that’s a good first step.”