Businesses Using Real-Time Payments Face Less Fraud Than Those That Don’t, Says Modern Treasury

Costs, technical concerns and even just the idea of a payment that cannot be revoked lead some businesses to take a cautious view of real-time payments. But as the reality dawns that the true decision about real-time payments will be “when,” not “if,” hesitation ultimately becomes a matter of delaying the inevitable.

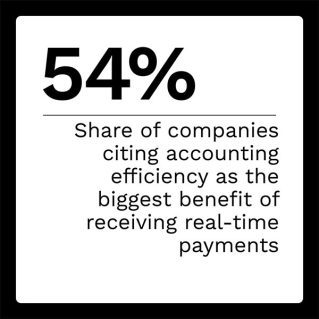

From gaining ready access to funds and more predictable balance sheets to realizing the benefits of transparent transactions and the ability to automate reconciliations, the advantages of real-time payments are pushing larger companies to emphasize adoption on a broader scale. Smaller companies that want to be competitive will have to embrace real-time payments, but fortunately, it is easier to get started than some may realize.

This month’s issue of the “Real-Time Payments Tracker®” explores the obstacles hindering real-time payments’ implementation, the benefits that make it worth overcoming these obstacles and the resources that make it easier.

Around the Real-Time Payments Space

As popular as faster payment options have become with consumers, small businesses may be falling behind in their adoption, but not because they do not want faster payment options. Leading banks have begun providing small businesses with real-time payments and invoicing tools, but a recent survey shows a significant gap between what is available and what small business owners are looking for.

As popular as faster payment options have become with consumers, small businesses may be falling behind in their adoption, but not because they do not want faster payment options. Leading banks have begun providing small businesses with real-time payments and invoicing tools, but a recent survey shows a significant gap between what is available and what small business owners are looking for.

As The Clearing House’s RTP® network continues to grow with new participants regularly added, more small financial institutions (FIs) are gaining access — along with the customers they serve. Third parties such as the Open Payment Network play a significant role in this growth by facilitating connections to the network, bringing in community banks and similar-sized institutions.

For more on these and other stories, visit the Tracker’s News and Trends section.

Modern Treasury on Turning Challenges Into Benefits With Real-Time Payments

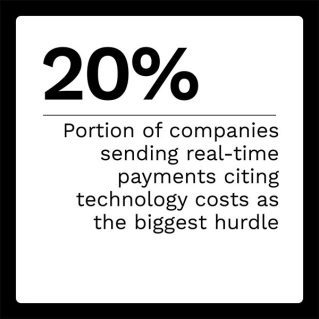

While many businesses are interested in the potential benefits of real-time payments, others may be bogged down in concerns over costs, technical details or even understanding what risks may be involved.

In this month’s Feature Story, Rachel Pike, chief growth officer at payments software provider Modern Treasury, discusses overcoming the challenges businesses face when successfully implementing real-time payments.

Weighing the Benefits and Challenges of Corporate Real-Time Payments

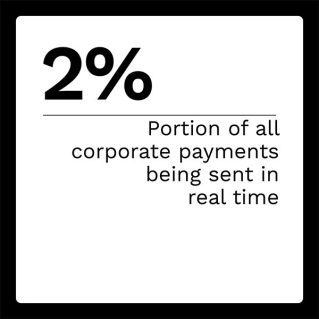

Just 2% of corporate payments are currently sent in real time, even as executives’ interest in real-time payments grows. Most organizations are aware of the potential for faster payments — let alone real-time payments coupled with automated reconciliation processes — to revolutionize not only their internal workflows but also their external relationships.

The major roadblocks slowing wider implementation appear to be cost concerns and the unfamiliar process that introduces irrevocable transactions into the payments equation. In reality, a better understanding of real-time payments and the resources third parties provide can address many of the concerns shared by companies that have yet to take steps toward using these payments.

To learn more about overcoming roadblocks to realize the advantages of real-time payments, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Real-Time Payments Tracker®,” a collaboration with The Clearing House, examines real-time payments implementation, from overcoming obstacles to realizing organization-wide benefits.