As part of our 3rd annual Visa B2B Payments Month series, we spoke with 250 CFOs in the retail and manufacturing sectors to see where companies are today in terms of their transformation but also to find out which of the urgent adjustments they made nearly three years ago were kept, which were gotten rid of — and more importantly, what they’re thinking and where they’re headed today.

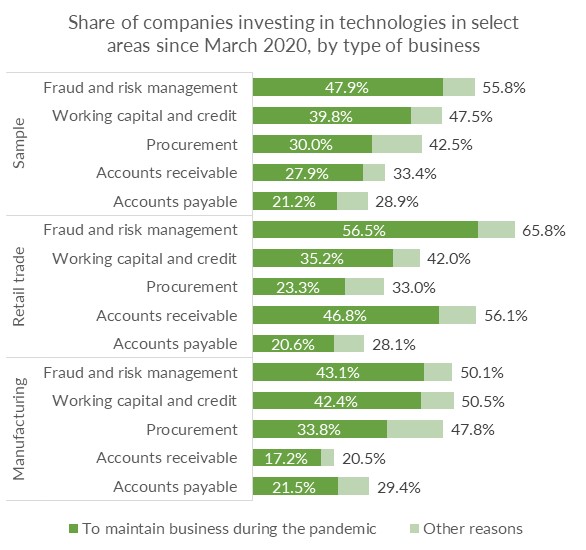

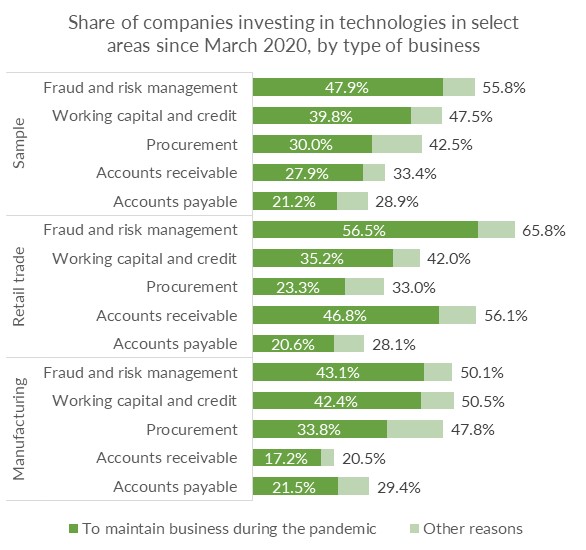

While the study found that nearly every CFO did something to digitize at least one part of their business and that this momentum literally disappeared overnight, it also showed that the most common move made was not to digitize payments but rather, to invest in fraud and risk management.

“I think this is becoming a priority even at the board level and with audit committees that are asking their companies, ‘What are we doing around security and fraud and risk management?’” Corcentric President and COO Matt Clark said in response to the survey findings that showed 66% of CFOs in the retail trade and 50% of manufacturing firms took this route.

“Everybody’s seeing in the news, lots of stories and anecdotes where companies are getting hurt, that don’t have the proper controls in place from that perspective,” Clark said of the findings which also showed companies made outsized investments to improve their working capital and procurement procedures.

The Scrap Heap

Advertisement: Scroll to Continue

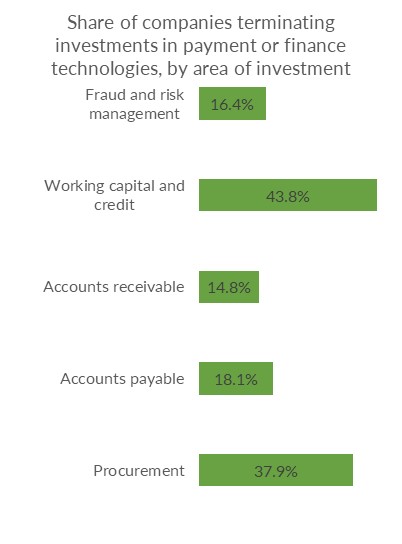

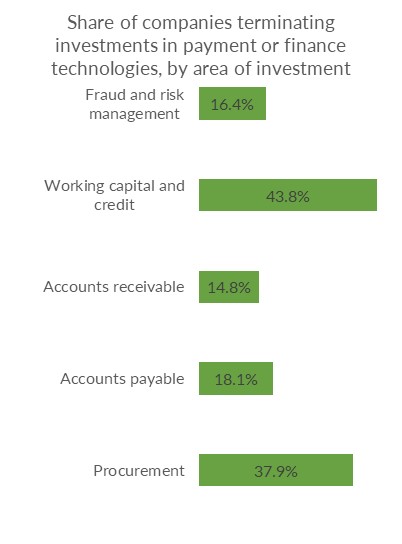

Those latter two points are noteworthy, as they also were mentioned among the most common technologies that companies scrapped. Even though nearly 80% of CFOs were happy with their investments, 44% of respondents said they had since dropped at least one investment in digital solutions for working capital and credit, and another 38% said they sidelined at least one investment in procurement tech that was implemented to maintain business during the pandemic.

“I think something we saw in the middle of the pandemic was this mindset of ‘I gotta preserve my supplier’s health almost above even my own’ to make sure that we can still get the goods and services we need to operate our business,” Clark said, noting that some of that thinking has now subsided.

“People are now saying, ‘Okay, I think the suppliers are stable.’ There might still be supply chain issues, but they’re stable from a cash flow position,” Clark added, “So now that shift is going back to more of an inward focus on ‘What do we need to be doing as a company to optimize our own world?’”

The Optimization Phase

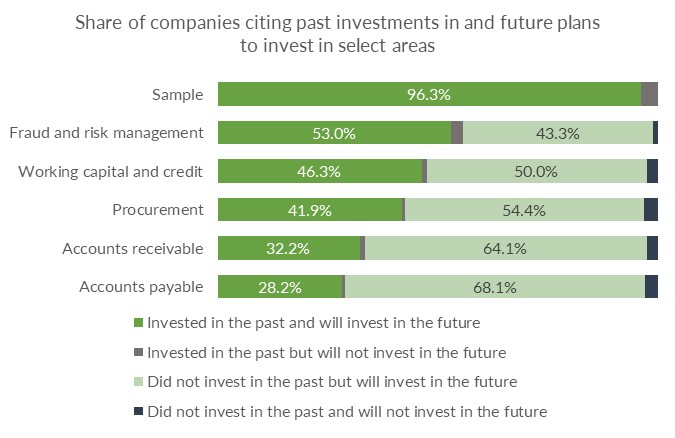

Alongside the widespread reports of satisfaction with prior moves made, the study also found that nearly all companies (94%) were currently investing in at least one area of payments, with 87% saying they planned to do so in the next 2 years.

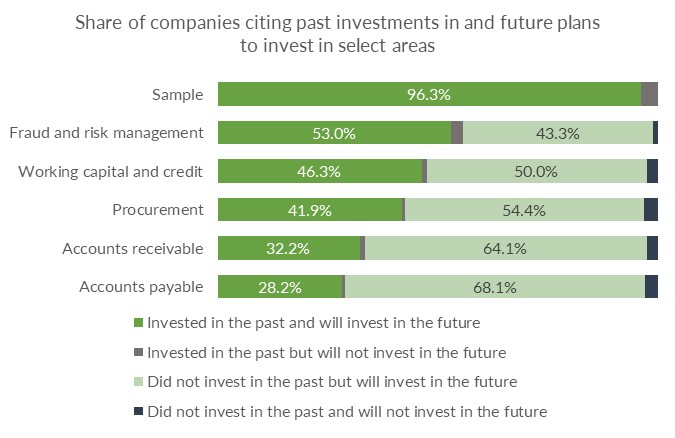

As the above graph shows, the areas of impending investment vary widely: 53% of companies pointed to a continued financial focus on fraud and risk management, while only 28% of companies that invested in accounts payable upgrades previously planned to do so in the future.

At the same time, many companies that had not invested in a particular area in the past signaled that they were highly likely to do so in the future, with 68% pointing to Accounts Payable investments, 64% eyeing Accounts Receivable, and 54% looking into Procurement investments.

“I think CFOs are sitting there with this mindset of knowing they’ve done a lot of good things on an incremental basis to improve what they’re doing,” Clark observed. “But now there’s this mindset of let’s step back and look at this whole life cycle from an end-to-end perspective and see if there’s a way to address it on a more holistic basis versus a kind of point-solution incremental basis,” he added.

But the Economy…

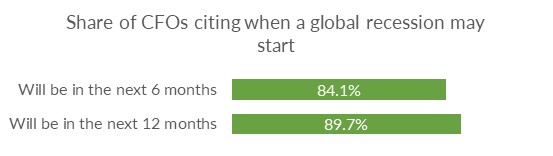

Not surprisingly, the current state of economic uncertainty has created a new sense of urgency among CFOs to prioritize digital payments and finance investments in the face of unpleasant recessionary concerns.

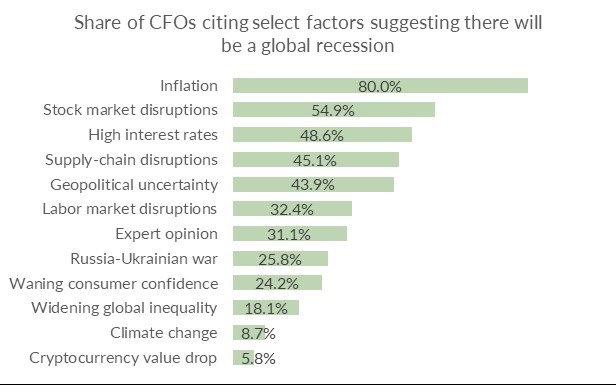

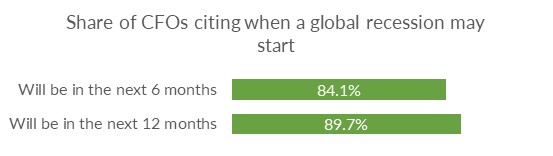

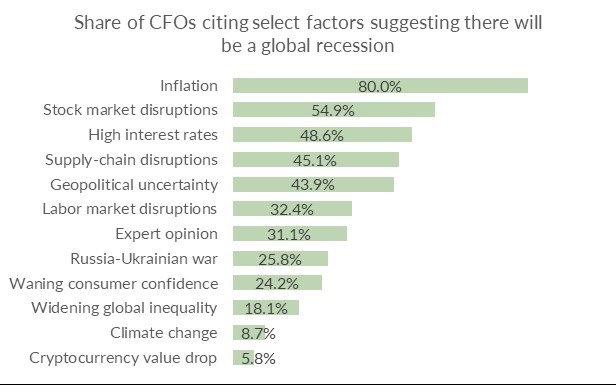

To that point, PYMNTS found that 84% of CFOs believe we are heading into a global recession in the next 6 months, with 90% expecting that to happen within the next 12 months. Inflation is cited as the most common catalyst behind these fears, followed by 55% of CFOs who cited stock market disruptions as a triggering event.

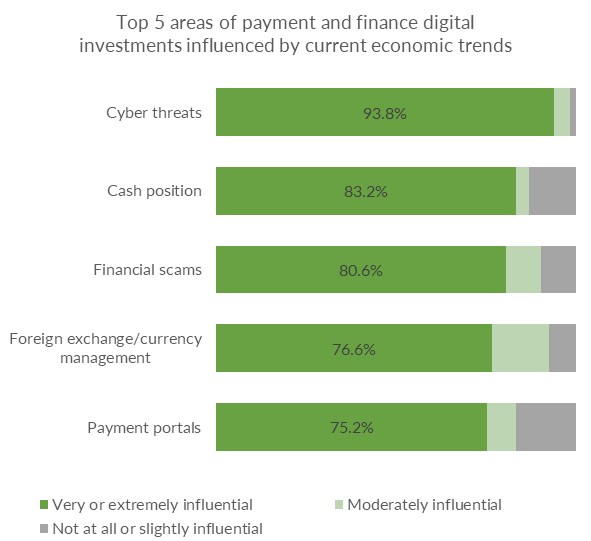

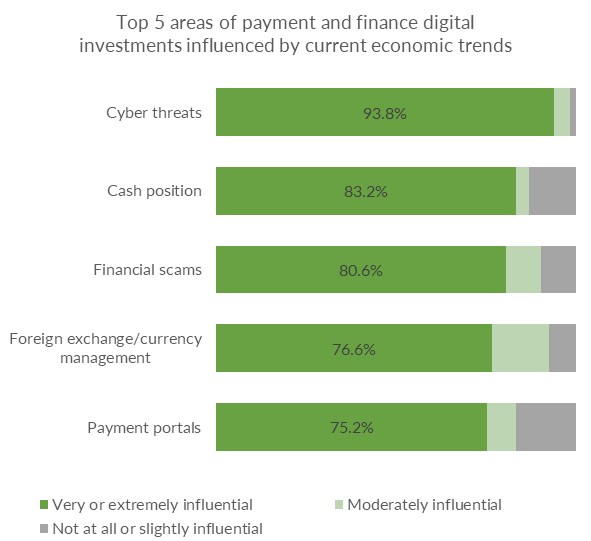

Amid this mounting worry and expected disruption, investments in digitizing the office of the CFO are again coming into focus, with particular attention being made again to fraud and risk management investments amid widespread concerns about financial scams.

Other findings revealed that investments in AR and procurement are also heavily influenced by uncertain economic times and that many companies also want to increase efficiency in terms of how they collect cash and manage spend.

At the same time, rising wages and complications related to remote work were also a big driver in companies’ plans to digitize and automate labor issues, with 84% of firms citing headcount shortage as being “very to extremely” influential in their decision to invest in automation of accounts receivable.

“On the receivable side, I think that’s historically been something that companies have under-invested in,” Clark said. “There’s been a lot of focus on the procurement and accounts payable side of the equation and the accounts receivable side has gone somewhat under-addressed,” he added, while also noting a shift in mindset on this front to accommodate the needs of customers in terms of how they want to be exchanging purchase orders and invoices and how they want to be processing payments.

Fear Factors

To be sure, the fear and uncertainty that shocked the world and catalyzed CFOs and decision-making in 2020 is a different brand of uncertainty than that which presently clouds the market.

While finance leaders have shown that they are glad they made the digital leap, so to speak, they have also shown a willingness to replace, improve and modernize processes that didn’t work out as well.

Fast forward to the present, with another wave of stress looming in the form of a global recession and uncertain demand for products and services, and CFOs are investing in digital once again — albeit with a greater degree of confidence this time that their outcomes will be positive — even though their motivations are different.

Unlike efforts aimed at keeping the lights on in 2020, this time investment is also about maintaining business, ensuring the ability to collect and post cash efficiently while managing the fraud and risk of onboarding a bad vendor, all with the goal of keeping the business humming.