Payments are both an integral and a problematic part of higher education. They are integral because of how costly college is. The average annual cost of tuition during the 2021-2022 school year at a public four-year university stood at $10,740 for in-state students and $27,650 for out-of-state students, but tuition is only one of many payments students are making.

• Students make payments on supplies, textbooks, food and a variety of other activities and entertainment, such as sporting events and club dues.

• Students make payments on supplies, textbooks, food and a variety of other activities and entertainment, such as sporting events and club dues.

• At public four-year institutions, students spend an average of $1,240 on books and supplies. Room and board is another major source of costs.

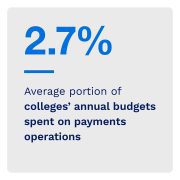

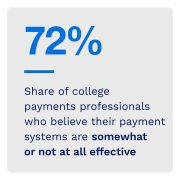

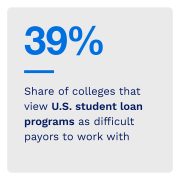

While payments are an essential part of college, however, they are also a problematic aspect. Many schools are relying on legacy payments systems that are unequipped to handle modern payments needs, giving rise to a range of problems. According to PYMNTS data:

• Nearly 39% of colleges view U.S. student loan programs as difficult to work with.

• A striking 20% of financial leaders on college campuses identified losing too much money to fraud as the top challenge.

This edition of the “B2B And Digital Payments Tracker®” examines the types of payments students make in higher education, the challenges they face in doing so, and how college payments innovation can solve these pain points.

Around the Higher Education Payments Space

In response to the growing desire for better, technology-driven payments experiences on campus, the University of Notre Dame shifted to having a cashless retail environment on Aug. 1.  Beginning on that date, payments related to everything from buying food in the dining halls to concession purchases at sporting events became cashless. The move was made in an effort to reduce health risks and make the payments experience on campus more efficient. Notre Dame took steps to help students who do not have credit or debit cards by installing machines across campus that allow students to exchange cash for gift cards that can be used throughout the campus.

Beginning on that date, payments related to everything from buying food in the dining halls to concession purchases at sporting events became cashless. The move was made in an effort to reduce health risks and make the payments experience on campus more efficient. Notre Dame took steps to help students who do not have credit or debit cards by installing machines across campus that allow students to exchange cash for gift cards that can be used throughout the campus.

For more on this and other stories, including how Michigan State expanded where students can use the campus’s dining currency, visit the Tracker’s Companies To Watch section.

TouchNet’s President on How Legacy Payments Systems Cost Schools More Than Money

The college payments experience is rife with issues, and schools need to innovate to meet the needs of a modern higher education environment. This is especially true because the new generation of students consists of digital natives who expect technology-driven payments experiences on campus. In this month’s Insider POV, PYMNTS spoke with Adam McDonald, president of TouchNet, on the need for schools to streamline their payments infrastructures to avoid losing students as well as money.

Innovating to Improve the College Payments Experience

By college financial officials’ own admission, there is a widespread need to boost the performance of their payments operations. PYMNTS found that 53% of school financial leaders say they need to expand their billing and subscription management capabilities, while 7% need to introduce such capabilities in the first place. Beyond billing and subscription management needs, colleges admit to wanting a range of other innovations, including real-time access to payment transaction data as well as new and local payment methods.

By college financial officials’ own admission, there is a widespread need to boost the performance of their payments operations. PYMNTS found that 53% of school financial leaders say they need to expand their billing and subscription management capabilities, while 7% need to introduce such capabilities in the first place. Beyond billing and subscription management needs, colleges admit to wanting a range of other innovations, including real-time access to payment transaction data as well as new and local payment methods.

To learn more about how colleges can improve their payments infrastructures and why ID cards are a prime place to start innovating, read the PYMNTS Intelligence section.

About the Tracker

This edition of the “B2B And Digital Payments Tracker®” Series, a collaboration with American Express, examines how colleges currently lack the proper payment operations to handle students’ increasingly digital needs and how technology solutions can rectify this.