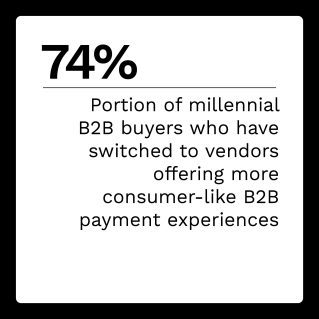

Nearly three-quarters of working United States millennials are now involved in their companies’ purchasing, operational and organizational decisions. The same priorities driving their business-to-consumer (B2C) payment choices — convenience, flexibility, speed, immediacy, transparency and simplicity — are quickly forcing companies to adopt solutions to “consumerize” their business-to-business (B2B) ecosystems away from traditional payment processes. Amid that demand, embedded finance solutions are quickly gaining ground in the B2B space.

In the May edition of the Embedded Finance Tracker®, PYMNTS explores how today’s millennial and Generation Z sensibilities are becoming tomorrow’s business priorities and how the onus will be on financial institutions (FIs) serving the B2B space to fulfill those demands, leading to better products that take a human-centric approach.

Around the Embedded Payments Space

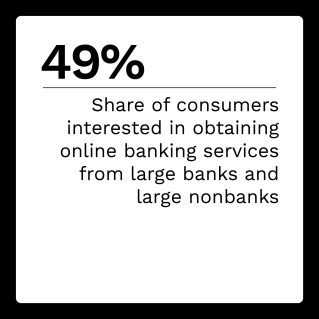

Millennial and Gen Z consumers are increasingly turning to digital-first technologies to fulfill their banking and payment needs, with mobile methods especially popular. A March 2022 study found that 38% of millennials used mobile wallets to pay for their purchases in the month preceding the survey, compared to 22% of baby boomers.

Millennial and Gen Z consumers are also mor e likely to use embedded finance tools such as buy now, pay later (BNPL) solutions, according to another study. Younger consumers are early adopters of these solutions, with India and the U.S. leading this trend. Seventy-four percent of millennials and 73% of Gen Z consumers in India reported paying with BNPL tools. U.S. millennials are following closely behind those in India, with 61% now tapping BNPL methods to meet their payment needs.

e likely to use embedded finance tools such as buy now, pay later (BNPL) solutions, according to another study. Younger consumers are early adopters of these solutions, with India and the U.S. leading this trend. Seventy-four percent of millennials and 73% of Gen Z consumers in India reported paying with BNPL tools. U.S. millennials are following closely behind those in India, with 61% now tapping BNPL methods to meet their payment needs.

For more on these and other stories, visit the News & Trends section.

B2B Payment Ecosystem Shifting From Pull tTo Push

The future of the B2B payment ecosystem is shifting from a pull-driven one, in which a merchant “pulls” money from a customer, to a push-driven dynamic, with the customer “pushing” money to businesses instead. This shift allows for payments at a lower cost and higher speed, with faster and less expensive instant-payment processes dictating future growth. In a recent interview with Rodney Robinson, CEO and co-founder of TabaPay, PYMNTS took an inside look at how embedded finance is ushering in a new “faster and cheaper” instant-payment reality.

To learn more about how millennial and Gen Z consumers are reshaping the future of B2B embedded finance, visit the Tracker’s Feature Story.

PYMNTS Intelligence: Millennial and Gen Z Ushering in New Embedded Finance Era

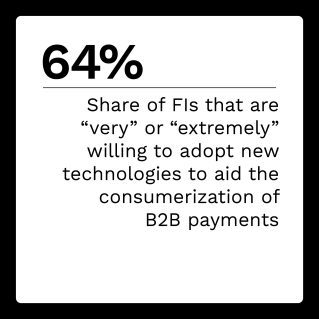

Millennial and Gen Z digital natives are climbing the corporate ladder and taking thei r B2C frictionless payment expectations into the B2B boardroom with them. An estimated 73% of U.S. millennials are now in charge of making buying decisions at their companies. This month’s PYMNTS Intelligence examines how these preferences fuel a new effort to innovate and adopt a new suite of embedded finance solutions into the B2B payment space.

r B2C frictionless payment expectations into the B2B boardroom with them. An estimated 73% of U.S. millennials are now in charge of making buying decisions at their companies. This month’s PYMNTS Intelligence examines how these preferences fuel a new effort to innovate and adopt a new suite of embedded finance solutions into the B2B payment space.

To learn more about how millennial and Gen Z consumers are reshaping the future of B2B embedded finance, visit the Tracker’s PYMNTS Intelligence section.

About the Tracker

The Embedded Finance Tracker®, created in collaboration with Galileo Financial Technologies, examines the latest embedded payment market trends, including how the millennial and Gen Z generations are reshaping the B2B purchasing ecosystem as they carry their B2C payment preferences into the boardroom.