Real estate and property management firms were among the many businesses forced to reexamine how they make and receive payments due to the pandemic, which made conducting such processes in person essentially impossible for a time. Many such firms have taken steps to digitize both their accounts payable (AP) and accounts receivable (AR) operations accordingly. One recent PYMNTS study noted that 91% of chief financial officers (CFOs) within the real estate space cited AR digitization as a top priority.

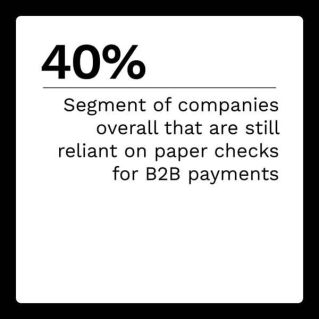

Upgrading these processes with the necessary swiftness means real estate entities must let go of their grip on paper checks and the manual methods used to send and receive funds for decades. However, making such a switch can present notable challenges for property managers, as many are still dependent on legacy payment infrastructure that may be incompatible with emerging digital payment tools.

In The Treasurer’s Guide To AR Payment Optimization Tracker®, PYMNTS analyzes how payment needs within the property management space are changing, and why selecting the right payment partner can be vital to addressing some of the obstacles payment managers face when innovating their AR and AP processes.

Around the B2B Payment Optimization World

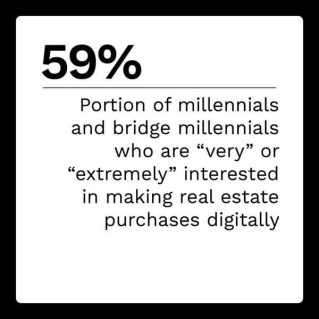

Both tenants and property managers appear to be seeking online payment tools that help speed up and simplify the rental transaction experience for both parties. For example, one online rent payment provider service recently noted that applications for digital payment solutions rose 20% in 2021 compared to application levels before the pandemic. The lengthy shutdowns of brick-and-mortar offices and other in-person activities during the early days of the health crisis have highlighted the inefficiencies of manual payment methods for businesses and individuals, contributing to a growing need for more streamlined online payment tools.

The rising attention to digital solutions also prompts some financial players to consider the potential role of emerging payment methods in the future of the real estate industry, notably that of digital currencies. Specialty finance company RTLY Capital recently announced it would be offering real estate agents  the ability to be paid in cryptocurrency, a service that would enable brokers to access their commissions speedily by way of digital currencies. This would help brokers avoid any additional fees, as well as cut out intermediaries and other frictions that could slow down the payment process, according to statements by the company. The move indicates that emerging payment tools could play a more prominent role within the property management and real estate industries in the near future.

the ability to be paid in cryptocurrency, a service that would enable brokers to access their commissions speedily by way of digital currencies. This would help brokers avoid any additional fees, as well as cut out intermediaries and other frictions that could slow down the payment process, according to statements by the company. The move indicates that emerging payment tools could play a more prominent role within the property management and real estate industries in the near future.

For more on these and other stories, visit the Tracker’s News and Trends.

U.S. Bank on the Property Management Space Push to Adopt Digital Payments

Adjusting their business models, including how they made or received payments, was a necessity for most industries during the early days of the pandemic when a significant number of brick-and-mortar offices were closed. Many commercial real estate companies moved forward with initiatives to digitize their payment processes accordingly, but many property managers remain wary of relinquishing their use of legacy methods such as paper checks entirely, explained David Nielson, senior vice president and head of commercial treasury management consulting for U.S. Bank in a recent PYMNTS interview. To learn more about what may be keeping property managers from adopting digital payment tools and how such challenges can be overcome, visit the Tracker’s Feature Story.

PYMNTS Intelligence: Why Property Managers Must Move to Support Electronic Payments

The outlook for 2022 appears positive in the property management space as interest in emerging technologies and digital solutions grows. One recent report found 80% of the study’s respondents in the industry expect to see their organizations’ revenue grow throughout the year. The impacts of the global health crisis have left significant marks upon the industry, however, including thickening some of the existing frictions associated with sending or receiving payments, especially those made with paper checks, within the space.

Moving to electronic payment methods is therefore becoming a necessity for property managers. This month, PYMNTS examines why supporting digital payments is becoming more important for the property management space. Visit the Guide’s PYMNTS Intelligence to learn more.

About the Tracker

The Treasurer’s Guide To AR Payment Optimization Tracker®, a PYMNTS and CheckAlt collaboration, examines the latest B2B and consumer payment trends and how businesses can keep pace with them. It also outlines which solutions and technologies are becoming key to companies’ payment optimization efforts.