The impacts of the global health crisis pushed forth many businesses’ efforts to digitize their payments and internal financial processes, providing new key opportunities for both consumers and businesses alike. Digital-first financial institutions (FIs) and FinTechs are moving to offer new experiences using emerging technologies to keep consumers engaged and satisfied as they seek out more personalized, seamless services.

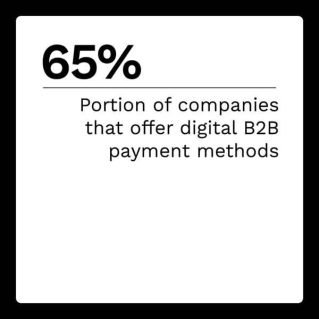

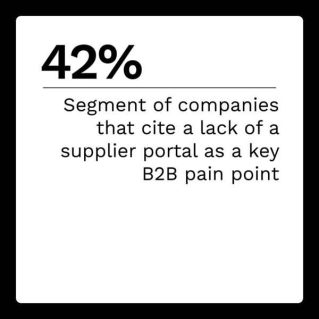

Businesses have also moved to reevaluate their internal business-to-business (B2B) payment processes as these streamlined, digital-first consumer experiences become the norm. Tapping embedded finance in the same way FinTechs and other services do to keep consumers engaged could provide key benefits for businesses looking to digitize their B2B payment processes to keep pace with the changing needs of industry partners and clients.

Businesses have also moved to reevaluate their internal business-to-business (B2B) payment processes as these streamlined, digital-first consumer experiences become the norm. Tapping embedded finance in the same way FinTechs and other services do to keep consumers engaged could provide key benefits for businesses looking to digitize their B2B payment processes to keep pace with the changing needs of industry partners and clients.

In the inaugural Embedded Finance Tracker®, PYMNTS examines the growth of embedded finance and how businesses can implement such solutions to keep pace with the changing needs of their industry partners and customers alike.

Around the Embedded Finance World

Interest in embedded finance’s potential benefits has risen significantly among businesses as the payment expectations of their partners, suppliers and consumers have steadily become more digital. The embedded finance market is expected to reach a valuation of more than $138 billion globally for both B2B and business-to-consumer (B2C) applications by 2026, compared to the $43 billion valuation it reached by the end of last year. This expected growth could also have a large-scale impact on the way both consumer-facing and B2B payments are made in the future as embedded finance experiences become more commonplace for various new potential use cases.

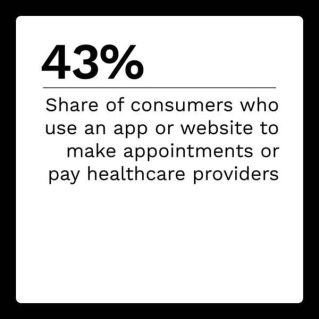

While businesses are examining the potential use of embedded finance within their B2B payment processes, consumers have been tapping such tools to conduct more of their transactions for years, despite many never hearing of embedded finance. One recent study found that while 23% of United States adults report having made payments via social media platforms and 32% of such consumers reported using rideshares such as Uber, just 11% had heard of the term previously. This shows consumers may be more widely accepting of embedded finance experiences outside of these areas as time moves forward.

While businesses are examining the potential use of embedded finance within their B2B payment processes, consumers have been tapping such tools to conduct more of their transactions for years, despite many never hearing of embedded finance. One recent study found that while 23% of United States adults report having made payments via social media platforms and 32% of such consumers reported using rideshares such as Uber, just 11% had heard of the term previously. This shows consumers may be more widely accepting of embedded finance experiences outside of these areas as time moves forward.

For more on these and other stories, visit the Tracker’s News and Trends.

Ordoro: Implementing Embedded Finance Can Bring Swift Funding to eCommerce Merchants

Any merchant selling any physical good, from clothing to jewelry, must keep up a steady flow of inventory to keep pace with their expected demand — and even the slightest delay or friction in this supply chain can lead to customer frustration and loss of engagement. Ensuring orders and payments can be conducted and fulfilled as quickly and seamlessly as possible is essential for merchants seeking to stay competitive. This is especially true for those within the increasingly saturated eCommerce economy where companies are looking to stand out, Jagath Narayan, CEO and co-founder of eCommerce shipping and fulfillment software provider Ordoro, explained in a recent PYMNTS interview.

To learn more about how embedded finance can help bring swift funding to eCommerce merchants, visit the Tracker’s Feature Story.

How Embedded Finance Can Help Businesses Streamline Their B2B Payment Processes and Stay Competitive

Businesses in nearly every industry were forced to reconsider the way they conduct their  daily operations when the pandemic hit. FIs, healthcare providers and retailers alike are now looking to digital technologies to innovate their B2B and other internal processes, leading to a keener interest in the potential benefits of embedded finance. One report predicted that the overall value of embedded finance for both B2B and B2C applications is expected to jump rapidly by 2030 as companies across multiple verticals look to better streamline their B2B payment processes to meet changing needs.

daily operations when the pandemic hit. FIs, healthcare providers and retailers alike are now looking to digital technologies to innovate their B2B and other internal processes, leading to a keener interest in the potential benefits of embedded finance. One report predicted that the overall value of embedded finance for both B2B and B2C applications is expected to jump rapidly by 2030 as companies across multiple verticals look to better streamline their B2B payment processes to meet changing needs.

To learn more about how embedded finance can help businesses innovate payment processes to strengthen client and vendor relationships and remain competitive, visit the Tracker’s PYMNTS Intelligence.

About the Tracker

The Embedded Finance Tracker®, done in collaboration with Galileo Financial Technologies, examines the latest embedded finance developments on a global scale, how implementing embedded finance can provide key benefits to businesses across multiple industries and what role technologies such as APIs play within this space.