B2B payments are notoriously slow and costly — witness the continued use of paper checks sent via snail mail — which is driving more operations to seek the efficiency platforms provide.

For The AP/AR Quick-Start Guide: How All-In-One Payment Platforms Can Transform B2B Transactions, a PYMNTS and Plastiq collaboration, we surveyed 500 small and medium-sized businesses (SMBs) across a variety of sectors and company sizes, finding that the problem is universal, but fixable.

By bridging the payment preference of buyers and suppliers, the asymmetry often encountered in B2B transactions is evened out using platforms combining accounts payable (AP) and accounts receivable (AR) features and function as a single unified solution are saving time and seeing more convenience bringing B2B payment in line with digital expectations.

See it now: The AP/AR Quick-Start Guide: How All-In-One Payment Platforms Can Transform B2B Transactions

This study revealed that 4 out of 10 SMBs have used an all-in-one solution, and nearly two-thirds of this cohort used an all-in-one option both to make and receive payments.

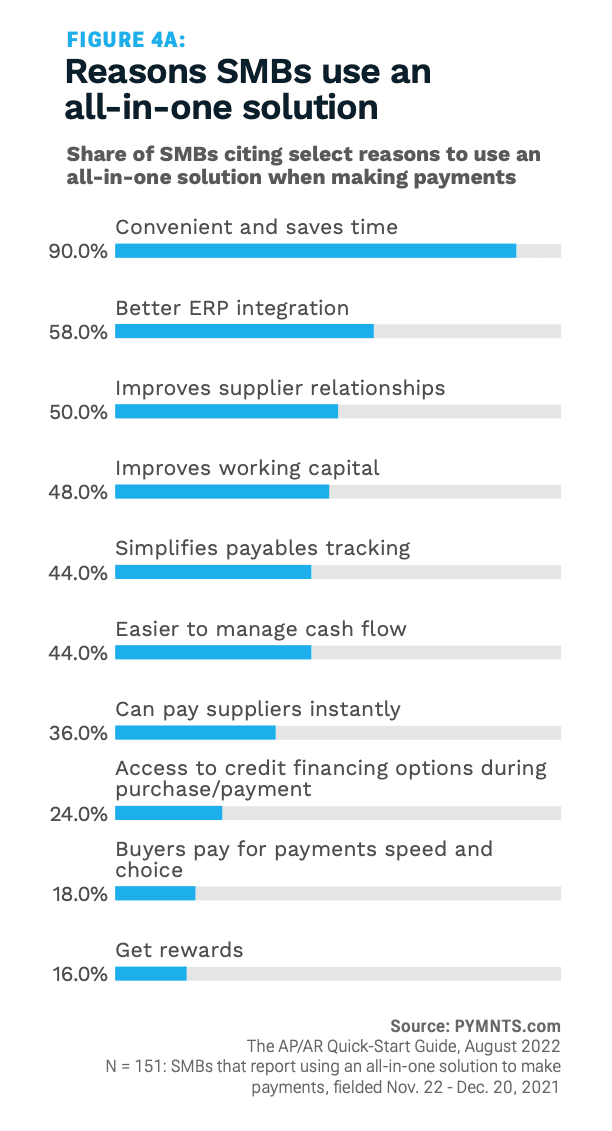

“SMBs identified convenience and saving time as top reasons for implementing an all-in-one solution, both for those making payments, at 90%, and those receiving payments, at 81%.”

Additionally, payment platform executives surveyed believe “choice in how to be paid and gaining the ability to receive payments instantly would benefit 73% and 59% of their SMB customers, respectively.”

Get your copy: The AP/AR Quick-Start Guide: How All-In-One Payment Platforms Can Transform B2B Transactions