Wholesaler Platform JOOR Unveils B2B Payments Tool

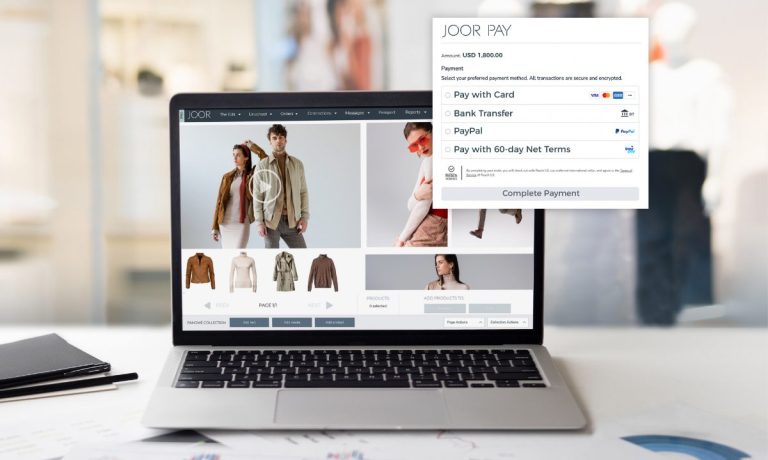

Wholesale management platform JOOR has unveiled a tool for wholesalers called JOOR Pay, which can be embedded into checkout systems to speed the collection of payments from retailers.

JOOR Pay works with 135 currencies, according to a Tuesday (Sept. 13) press release. Wholesalers can offer 60-day payment terms to select buyers through the tool, which generates payouts within days of transaction processing and reduces the complexity of foreign exchange transactions.

The tool also includes fraud protection, and JOOR said the product should be especially helpful for small- to medium-sized businesses (SMBs), given the challenges many face expanding internationally.

JOOR Pay also features multiple payment types, including PayPal, credit cards and bank transfers, per the release.

“Recognizing the pain points our clients face with the traditional offline invoicing and payments process, we developed a comprehensive solution to address their needs and support their growth,” said Kristin Savilia, chief executive of JOOR. “JOOR Pay empowers brands and retailers to build a future for their businesses without bearing the pain of accepting global payments.”

According to JOOR, the New York-based company works with more than 13,700 brands and 394,000 retailers, processing $1.7 billion in wholesale transactions each month. Retailers using its tools include Harrods, Neiman Marcus, Harvey Nichols, Printemps and Bergdorf Goodman.

In an August interview with PYMNTS’ Karen Webster, JOOR Chief Customer Service Officer Jennifer Rosado said that digital tools adoption among wholesalers is growing, noting how the fashion industry is embracing omnichannel experiences.

See also: Fashion Wholesalers Try on Digital Payments, Virtual Trade Shows

“Hybrid is the new normal for everyone: both brands and retailers,” Rosado said.

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.