As reported Tuesday (March 21) by The Wall Street Journal, the Fed is expected to continue raising rates in its ongoing effort to combat inflation. Combined with increased regulatory banking industry scrutiny following the collapses of SVB and Signature Bank, it is nearly guaranteed that repercussions will be felt by businesses seeking lending. This may hit Main Street businesses especially hard, as they generally have less collateral for lenders than their larger competitors. Small business loans are particularly susceptible as banks reassess the amount of risk they are willing to handle.

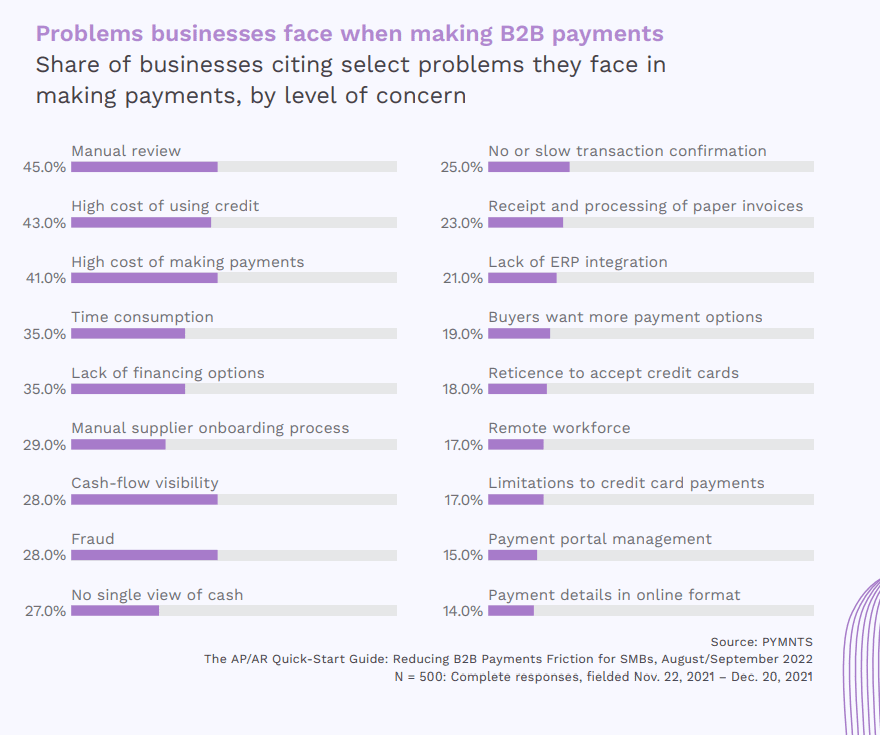

The expected loan tightening through traditional financing means could not come at a worse time for small businesses seeking aid to stay afloat. As noted in the March/April PYMNTS collaboration with Splitit, “Buy Now, Pay Later Tracker®,” high costs and lack of financing rank high in the list of concerns business face when it comes to making payments.

Average small business loans are tied to current interest rates plus a fixed percentage, depending on the borrowed amount. Even without the sector’s current decreased appetite for risk, the current and continued high rates could possibly put on-time repayments out of reach for many small- to medium-sized businesses (SMBs).

These challenges are the main drivers behind businesses turning to alternative financing, such as buy now, pay later (BNPL), once considered a strictly B2C solution. However, businesses increasingly see BNPL as a long-term financing opportunity. BNPL providers tap businesses’ unused credit lines and transform them into installment plans, meaning no new underwriting for loan-seeking SMBs. It also provides businesses with a larger potential pool of possible lenders than might be found through traditional means.

In a PYMNTS interview, Obvi CEO and Co-founder Ronak Shah details this view. “Businesses need to create runways for themselves … and if you’re not using BNPL to do that, you’re not thinking in 12- to 18-month landscapes. You’re looking at only a few months.”

Advertisement: Scroll to Continue

Fortunately, BNPL providers are popping up to fill the traditional financing gap SMBs may face. In the U.S., Tranch recently raised $100 million in a seed round to expand its B2B-specific BNPL platform. Tranch intends to use the new capital to bring its solution to more software-as-a-service sellers and service providers by growing its U.S. team and expanding to more industry verticals. With the firm’s “Pay with Tranch” checkout, suppliers get paid upfront, while buyers can settle invoices of up to $500,000 over two to 12 months.

In Canada, Tabit and Lenovo are partnering to offer a similar service. With the collaboration, Tabit’s B2B BNPL platform will be integrated with Lenovo’s offerings so Lenovo business customers can access fully automated financing at the point of sale. This enables qualified business buyers to get terms of up to 12 months, including a 30-day option at 0% interest.

As interest rates seem likely to continue climbing in the coming months — or, at best, hold steady, small businesses especially may consider BNPL to serve as a bridge until rates return to reasonable levels.