High inflation, rising interest rates and the eddying threat of further economic headwinds just around the corner are sending executives across industries scrambling for working capital and cash flow management solutions that help them get paid, as well as pay their vendors faster and more seamlessly.

After all, it’s their money and they want it now. But nearly one in three executives say they are not fully satisfied with their organizations’ current bill payments ecosystem.

That’s according to the December edition of PYMNTS’ “The One-Stop Bill Pay Playbook,” which found that nearly two in three surveyed executives (68%) expect to integrate business-to-business (B2B) payment innovations into their operations in the new year, including prioritizing one-stop bill payment solutions, to help close the satisfaction gap.

Companies that self-report as “more highly digitized” are more likely to invest in payment innovations in 2023, with 73% saying it is a priority for them, compared to a still-majority 64% of “less digitized” companies.

Modernizing the Accounts Receivable Office

Advertisement: Scroll to Continue

The contemporary B2B payment space is rife with recurring inefficiencies that create AR headaches and leave much-needed capital stuck in limbo.

“Because of the expected recession, companies want to convert to cash as quickly as possible — but their customers want to hang on to cash for as long as possible,” Joe Payne, senior vice president of Source to Pay at Corcentric, told PYMNTS in an earlier conversation.

Common obstacles include manual processes and legacy operations around reconciliations, customer service and other key touchpoints along the bill pay journey that frustrate both bill payers and receiving businesses.

PYMNTS’ research suggests that smaller and midsize companies carry outstanding receivables of more than a trillion dollars for their larger suppliers.

This situation continually puts the resiliency of many businesses to an unnecessary and avoidable test, one whose effects are felt particularly acutely as macroeconomic headwinds dampen 2023 outlooks.

Until the pandemic ushered in a hyper-rapid digital transformation, things sure looked as though CFOs and accounts professionals would be content to juggle PDFs, paper checks and repetitive manual processes even as the rest of the world moved increasingly online.

Now, as digital payment systems increasingly become operational table stakes, payments processing modernization that improves timely access to capital while seamlessly smoothing out recurring friction points is seen as critical to business growth.

CFOs surveyed by PYMNTS report near unanimous support (94%) for integrating digital payment tools that maximize efficiency into their organizations’ operational processes.

Payments frictions, including disputes, lack of compatibility with payor preferences, decoupled remittances and square-peg-round-hole accounts payable (AP) and AR systems, can slow business growth or even bring it to a complete halt.

After all, 25% of B2B payments are still made by check.

In today’s technologically advanced day and age, there is no reason for organizations to endure inconsistent payment processing experiences or to force those experiences on their business suppliers and vendors.

Research in PYMNTS’ latest report, “The AR Transformation Solution: Easing And Accelerating Payments From Business Customers,” shows that digital B2B payments network tools can solve for AP and AR friction in four key ways: first, they provide a seamless connection between suppliers and the marketplace; second, they streamline invoicing to avoid payment delays; third, they build better customer relationships from day one; and fourth, they make transaction visibility and invoice reconciliation seamless.

By offering customers access to third-party digital payment hubs, or “one-stop shops,” businesses can rewrite the script on B2B payments by offering their payors a single, agile system that is easy to access and use, and provides faster processing times, increased security, and reduced costs.

Taking Cues From the B2C Payment Journey

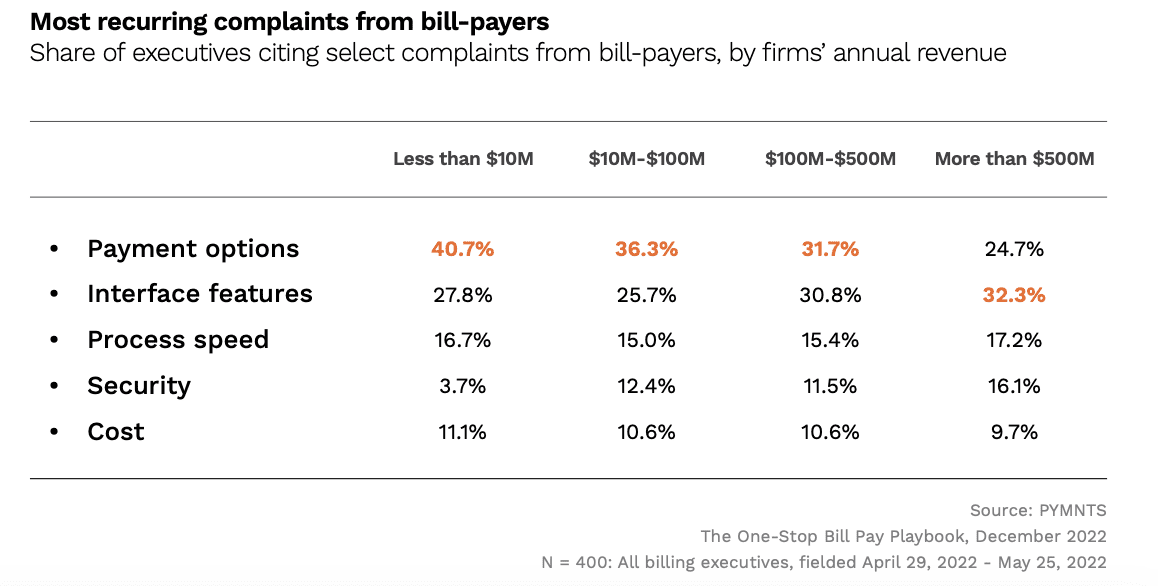

Findings in “The One-Stop Bill Pay Playbook” show that a majority (60%) of bill payer complaints are tied to a lack of payment options and shortcomings in the payment process.

Fortunately, a growing expectation for consumer-style payment experiences is separately evolving the B2B payment journey and addressing those pain points directly with single-solution digital tools and comprehensive platforms that allow finance and accounting teams to add greater value to their organizations’ business partners.

Additional PYMNTS research shows that more than nine in 10 businesses (93%) plan to add at least one new payment method in the future and that over eight in 10 CFOs (85%) have recently increased their use or acceptance of digital payments. Separately, 91% of CFOs agree that accelerating payments digitization has made their operations more efficient.

One-stop bill pay solutions can strengthen enterprise organizations by simplifying and streamlining payments flows and modernizing inefficient AP and AR processes that are often hamstrung by legacy interoperability constraints.

As B2B partners increasingly expect financial transactions to be instantaneous and frictionless, forward-thinking organizations are turning to integrated payments networks that allow for greater cash flow transparency and working capital access, as well as provide for true visibility over accounts, data reporting and invoice management on both sides of the transaction.

AR modernization over the next 12 months will be a critical space to watch as payments-related innovations and proactive digital strategies geared toward reducing and eventually eliminating B2B headaches further enter the marketplace.

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.