Real-time payments have the potential, and the promise, to overhaul all corners of commerce.

The recent introduction of the FedNow® System is only the latest entrant in the instant payments realm, and the new rails take their place alongside the six-year-old RTP System offered by The Clearing House.

For business to business (B2B) payments, where ACH transactions take days to settle, where checks still dominate — and certainly stretch out paying and getting paid — the question is when the shift to real time will occur, and just where it will occur.

As noted here, PYMNTS Intelligence has found that 6 in 10 firms use legacy methods to pay for commercial goods and services. That includes paper checks, of course — tied to 40% of commercial transactions — and yet two-thirds of CFOs say they “definitely need” more automation for their accounts receivable (AR) processes. Automation would include the ability to interact more closely with trading partners’ accounts payable (AP) processes, and to accelerate the payments processes as buyers and suppliers interact. And it would cut down on check fraud, which is on the rise and which, earlier this year, had impacted at least half of U.S. businesses.

A spate of recent announcements underscores the inroads digital, and faster payments, are making in commercial fund flows.

Just this week, B2B payments platform Melio said it had added real-time payments to its suite of offerings. The real-time payments feature, backed by J.P. Morgan Payments, can process payments within seconds, as payors get funds to vendors. Separately, Tranch debuted an expanded version of its B2B payments platform, and its Pay Now offering integrates with the RTP Network and the FedNow® Service to accelerate transactions.

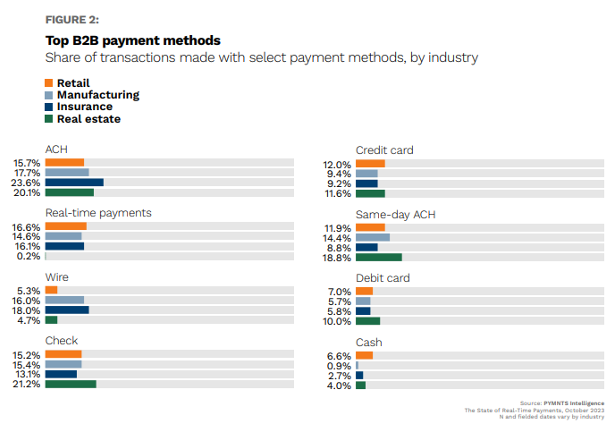

In “The State of Real-Time Payments,” a PYMNTS Intelligence and TCH collaboration, we found increasing recognition of the value inherent in speedier payments across a quartet of industries. The study found 17% of B2B payments made by large retailers are done in real-time fashion, and 90% large real-estate firms expect to receive real-time payments in 2024. The accompanying chart shows that ACH, wire and check still account for a significant slice of payments activity. But real-time payments have a roughly mid-teens percentage point “share” across most segments (though are almost negligible for real estate transactions).

Manufacturing shines as an industry in the need of, and in the midst of, a digitally driven, faster payments pivot. As PYMNTS wrote recently, 99% of manufacturers already utilizing real-time payments for their B2B transactions, surpassing other methods such as automated clearing house (ACH) payments, wires, and checks. Overall, real-time payments account for 15% of outbound and 14% of inbound B2B transactions. And 47% of companies plan to decrease their reliance on checks, while 38% expect to do the same with debit cards.