Manufacturing is about as labor- and material-intensive a sector as might be seen, in any economy.

The sheer volume of raw materials, machinery, plant and orders that must be juggled to keep things running illuminates the need to have speedier payment methods on hand, as well as close relationships between buyers and suppliers.

To that end, the October reading of the Philadelphia Federal Reserve’s Manufacturing Business Outlook Survey showed how volatile the macro environment has become, and likely, will remain.

The report recorded the sentiment and outlook of more than 250 manufacturers based in the Federal Reserve District that includes Philly and stretches out to New Jersey and Delaware.

The latest report indicated a reading of negative 9, which was worse than the negative 6.4 that had been expected. In terms of overall activity, the Fed reported a decidedly mixed picture, as “almost 35% of the firms reported decreases in general activity this month, while 26% reported increases; 38% reported no change.”

The percentage of firms reporting increases in input prices — at 29% — exceeded the percentage reporting decreases (6%); 65% of the firms reported no change. Inflation has already had an impact on margins. Given the fact that a third of respondents saw their input (and thus operating) costs on the rise, it may be the case that getting paid in a timelier manner could help offset some of those pressures.

Simply passing those costs along is no sure bet. More than 21% of the firms reported increases in prices received for their own goods in October, 7% reported decreases, and 70% reported no change.

PYMNTS Intelligence data showed that this essential corner of the economy is turning toward technology and an overhaul of back-office functions to improve supply chains and cash flow.

The report “Digital Payments: Modernizing Procurement Processes,” a collaboration with Corcentric, found that 44% of manufacturers are planning to make investments in procurement processes into the next year. As many as 42% of manufacturers are already investing in upgrades to their procurement technology.

Procurement ties in directly with the Fed dada, as manufacturing companies must buy those goods, raw materials and semi-finished materials to produce what they sell into their chosen markets.

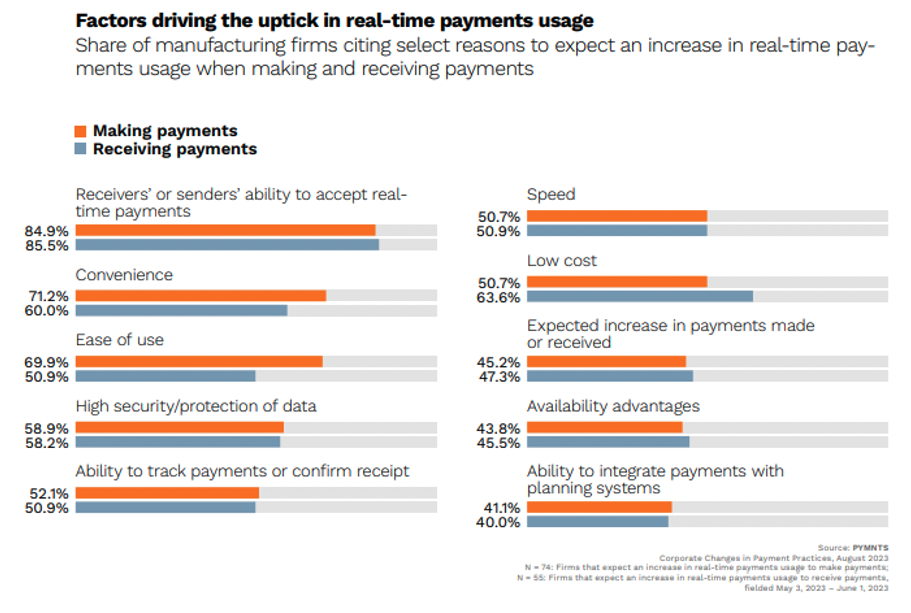

Separately, in the report “Corporate Changes in Payment Practices: Manufacturing Companies Embrace Real-Time Payments,” a PYMNTS Intelligence and The Clearing House collaboration, 85% of manufacturing firms said they expect to make more real-time payments, citing counterparty acceptance as a reason. A vast majority of smaller companies in the sector, at 85%, said the ability to make real-time payments is “highly important.” An overwhelming 98% of manufacturers said real-time payments will replace traditional checks.

Most manufacturers said convenience and ease of use are key reasons for both making and receiving real-time payments. Roughly 40% of firms eyeing an increase in their use of real-time payments pointed to the ability to integrate those payments with planning systems.