Whatever challenges they may be facing, small- to medium-sized businesses (SMBs) undoubtedly have a powerful ally in consumers. A survey from American Express and PayPal and conducted by studioID’s Retail Dive on what shoppers want found that 94% said SMBs play a vital role in a community, and 39% said these businesses offer better customer experiences than larger brands.

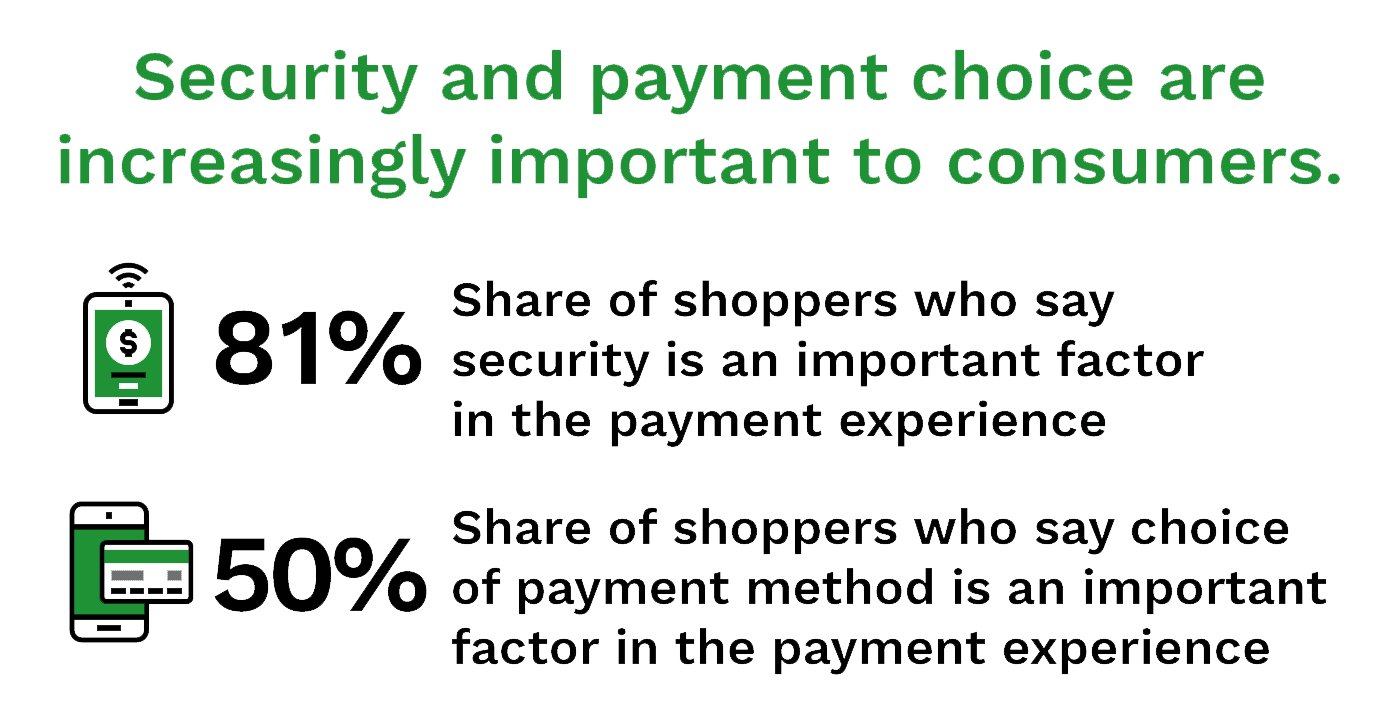

Nevertheless, the survey suggested that consumers’ payment needs are evolving at an unprecedented rate. The two most important factors to shoppers in the payment experience were security and choice of payment method, with 81% and 50% citing these features, respectively. In addition, more than one-quarter of respondents — 27% — said it was very or extremely important to them to be able to pay with a mobile wallet, such as PayPal or Apple Pay.

PYMNTS research also showed that consumers from six countries are 67% more likely to shop with SMBs that offer their ideal payment methods. Taken together, these results indicated that SMBs can leverage the goodwill working in their favor if they meet customers where they are on payment options. Those that do not — despite strong consumer sentiment — may risk being left behind.

Innovations Needed for Cross-Border and B2B Payments

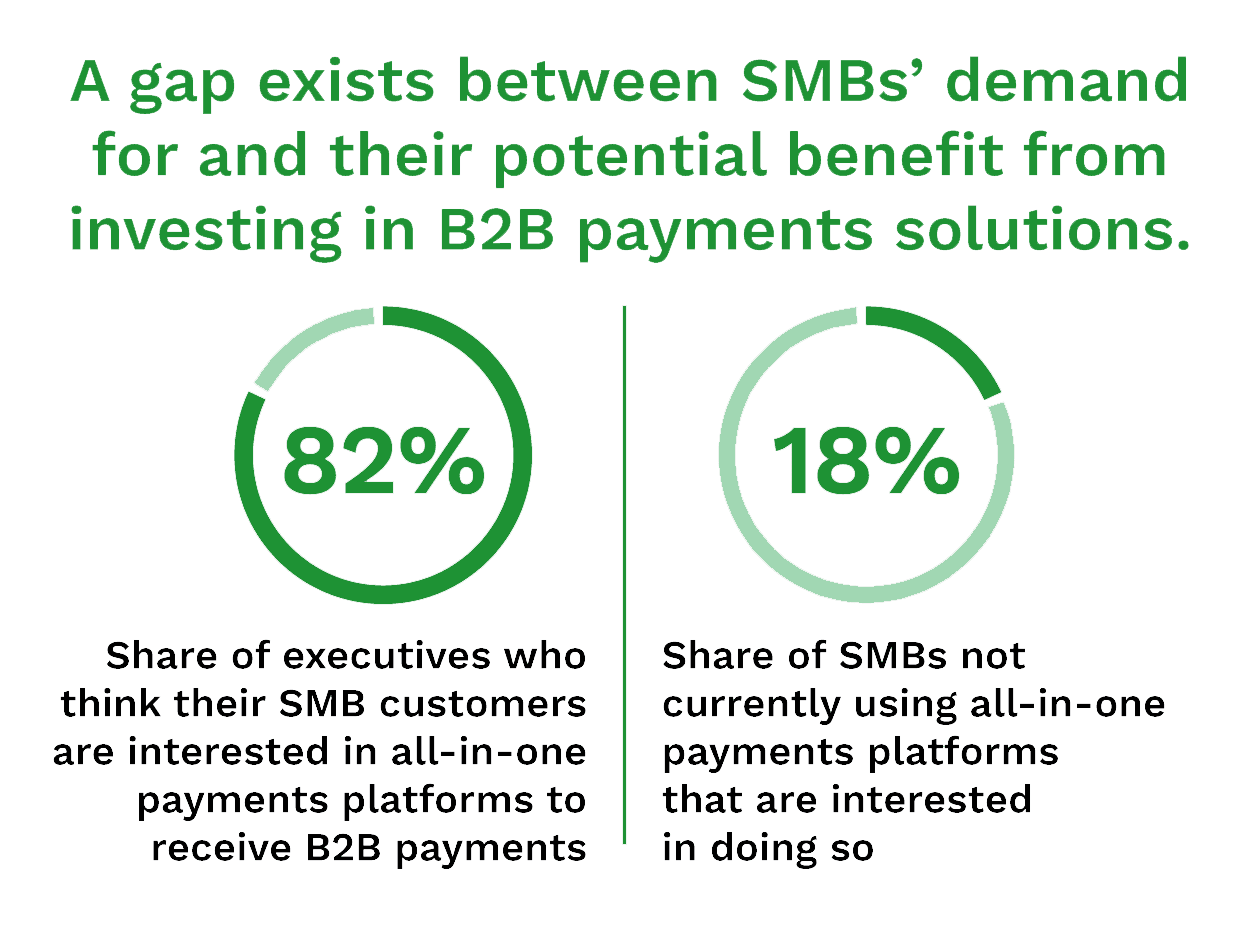

In addition to more digital payments for consumers, better B2B solutions for accounts receivable (AR), particularly as they apply to cross-border transactions, can be a boon for the many SMBs looking to expand globally. Some 65% of medium-sized businesses are spending 14 hours per week on administrative tasks for payment collection. According to one report, 88% of finance professionals admitted the complex nature of cross-border payments collection hampers their ability to grow internationally, and 95% said they could accelerate global expansion if they had an easier way to deal with exchange rates.

In addition to more digital payments for consumers, better B2B solutions for accounts receivable (AR), particularly as they apply to cross-border transactions, can be a boon for the many SMBs looking to expand globally. Some 65% of medium-sized businesses are spending 14 hours per week on administrative tasks for payment collection. According to one report, 88% of finance professionals admitted the complex nature of cross-border payments collection hampers their ability to grow internationally, and 95% said they could accelerate global expansion if they had an easier way to deal with exchange rates.

U.S. SMB owners and financial decision-makers cited access to a wider range of products and services (43%) and supply chain diversification (35%) as some of the top business benefits of cross-border B2B spending. However, one-quarter (27%) cited complexity of the process as one of the top obstacles when making cross-border payments. When asked about the attributes that SMB owners and financial decision-makers are looking for in a cross-border payments solution, nearly half (48%) said transparent fees and rates, on par with a simple user experience (44%).

Eight in 10 financial institutions (FIs) said their digital payment solutions were very or extremely effective in addressing friction points of cross-border B2B payments. Some 93% were very or extremely willing to add new technologies that make B2B payments feel more like business-to-consumer (B2C) payments for corporate customers.