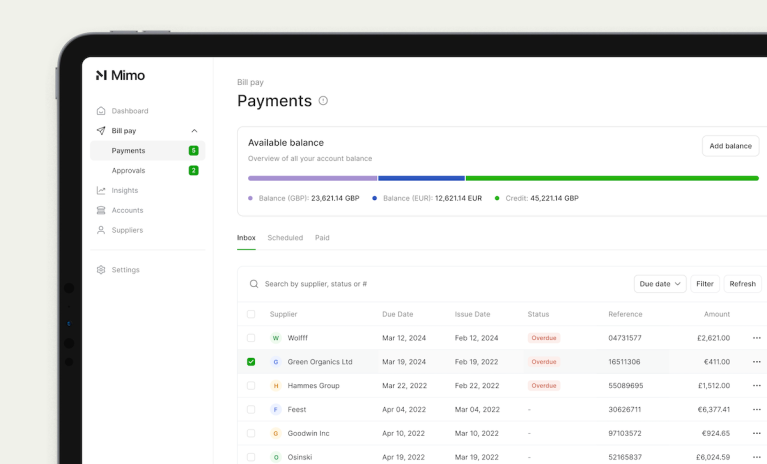

The platform helps these businesses simplify global payments, cash flow and financial management, the company said in a Thursday (April 11) press release.

The company’s solution is designed to help SMBs and accountants pay invoices, make or chase international payments, and manage cash flow, without having to use multiple apps and spreadsheets, as many do now, Henrik Grim, co-founder and CEO of Mimo, said in the release.

“Mimo bundles this into a single tool so that businesses can easily manage the movement of their money and receive payments in any currency, faster,” Grim said. “We’re delighted to be backed by our investors to help give SMBs full control of their finances.”

The company was founded in 2023 and has already deployed its platform via an early access offering to more than 50 SMBs and finance professionals, according to the release. The platform processes several million pounds per month.

Mimo’s platform allows these businesses to pay suppliers, access working capital, get paid faster by customers, and manage invoices and multiple currencies, the release said.

Advertisement: Scroll to Continue

With the new funding, Mimo will continue to build out its B2B payments solution and expand its headcount, per the release. The company has 14 employees and offices in London and Stockholm.

Mimo’s funding was led by Northzone, according to the release.

“Companies today face a real pain when it comes to coherently managing payments, cash flow and financing,” Jessica Schultz, partner at Northzone, said in the release.

Cross-border transactions have traditionally had the highest frictions and costs of any form of payment, PYMNTS reported in September. Solving for these historical bottlenecks has drawn the attention of nonbank platforms and firms offering alternative payment methods, as well as an increasing interest from incumbent financial institutions.

In another development in the space, Tide said in March that it will launch its business financial platform in Germany. Already available in the United Kingdom and India, Tide’s platform is designed for small businesses that don’t have a finance function.

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.