The main sponsor of a law that would protect banks that do business with cannabis companies from the penalties of federal regulators said there’s new hope for the bill.

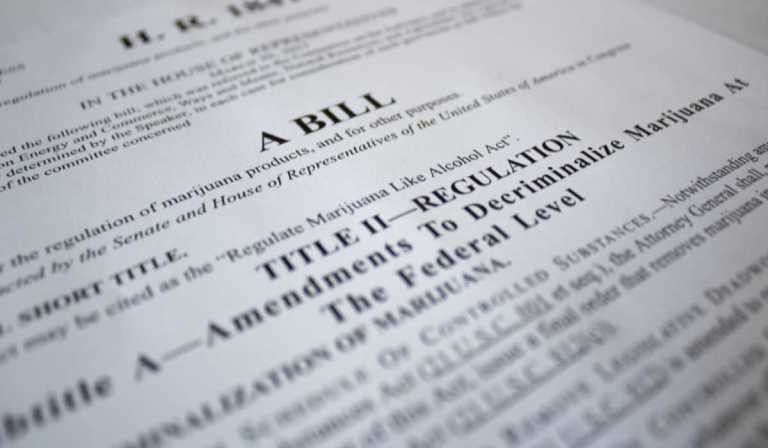

As Seeking Alpha reported Tuesday, Rep. Ed Perlmutter (D-Colo.), who has for years championed the SAFE Banking Act, said that the recent introduction of the Cannabis Administration and Opportunity Act (CAOA) in the Senate removes a “hurdle” in getting his legislation passed.

The congressman said the CAOA doesn’t yet have the votes to pass but said it will allow for a new debate on his marijuana banking legislation.

Learn more: Cannabis Firms See Prices Rise Ahead of Senate Hearing on Decriminalization

“I think there’s a real opportunity to pass not as sweeping a piece of legislation as [Senate Majority Leader Chuck] Schumer has introduced, but something that really will benefit the industry and make things safer,” said Perlmutter, noting SAFE Banking has more bipartisan backing than CAOA.

The Senate Judiciary Subcommittee on Crime and Terrorism, helmed by Sen. Cory Booker (D-NJ), met Tuesday for a discussion titled “Decriminalizing Cannabis at the Federal Level: Necessary Steps to Address Past Harms.”

Read more: House Passes Cannabis Banking Initiative as Part of Defense Bill

Perlmutter added that other incremental reforms such as Small Business Administration (SBA) lending to small marijuana businesses and cannabis research could be added to SAFE Banking.

SAFE Banking has made it through the House in one form or another seven times. Perlmutter said he hopes it will become law this time before his retirement at the end of the year.

Last year, he argued the legislation is a matter of safety and national security, saying the SAFE Banking Act will prevent violent crime and keep “foreign cartels out of the cannabis industry.”

“By dealing in all cash, these businesses and their employees become targets for robberies, assaults, burglaries and more,” Perlmutter said.