Cloud Unlocks Embedded Finance Use Cases for Banks, Says Green Dot

Digital services have become par for the course in modern banking, and banks are scrambling to offer the most impressive experiences. Some of the most common services banks offer include automated account validation, digital lockboxes and immediate transaction confirmation, but these represent just a small fraction of the possibilities that digital innovation can bring. Customers want fast, seamless and secure solutions and will reward banks that step up to provide them.

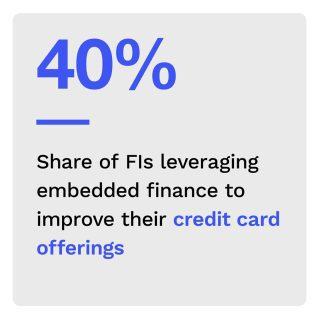

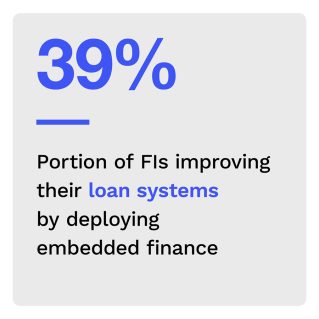

Embedded finance solutions are some of the most efficient ways to enable these digital offerings. PYMNTS’ research found that 92% of financial institutions (FIs) are currently innovating or have plans to innovate embedded finance experiences within their digital suites, with large international FIs taking the lead, as they have a leg up when it comes to available resources and IT expertise. National banks may be following behind but are catching up fast.

The “Embedded Finance Tracker®” examines how cloud banking can enable embedded payments and deliver satisfactory customer experiences.

Around the Embedded Finance Space

FIs are scrambling to meet customers where they are when it comes to quick and seamless services, namely online. A recent survey found that 81% of banks increased their technology budgets in 2022, an 11% increase from last year. Forty-five percent of these banks reported that their current technology was outdated, resulting in a host of deficiencies. More than half said their biggest threat was small banks and credit unions, and one-third said their biggest threat was not banks but technology firms such as Apple.

FIs are scrambling to meet customers where they are when it comes to quick and seamless services, namely online. A recent survey found that 81% of banks increased their technology budgets in 2022, an 11% increase from last year. Forty-five percent of these banks reported that their current technology was outdated, resulting in a host of deficiencies. More than half said their biggest threat was small banks and credit unions, and one-third said their biggest threat was not banks but technology firms such as Apple.

Open banking is one of the most important innovations for improving banking technology. It allows third-party FinTech companies to develop new products and services that integrate seamlessly into any bank’s systems via application programming interfaces (APIs). A recent report found that as of the end of Q2 2022, there were 1,578 banking APIs available worldwide, allowing tech companies to make 5,564 open banking API products available to customers. This is a vast improvement compared to the 4,831 products available in Q1, signifying a massive increase in the variety of banking products available to businesses and consumers.

For more on these and other stories, visit the Tracker’s News and Trends section.

Green Dot Corporation on Leveraging Cloud Technology to Unlock the Advantages of Embedded Finance

Consumers have increasingly demanded digital services in recent years, especially due to pandemic restrictions and closures. Seamlessness and ease of use are the names of the game, with customers expecting payments to be just as easy to navigate as eCommerce, social media or any other online interaction in their lives.

In this month’s Insider POV, PYMNTS talked with Alex Zerio, head of solution and platform architecture at Green Dot Corporation, on how embedded finance and cloud technology can deliver these customer experiences.

How Cloud Banking Can Enable Embedded Payments

According to PYMNTS research, 92% of FIs are currently implementing or plan to implement embedded finance experiences. Embedded finance systems can be difficult or impossible to implement on outdated core systems, however.

This month’s PYMNTS Intelligence explores the risks banks face when relying on legacy banking systems and how cloud banking can enable embedded payments.

About The Tracker

The “Embedded Finance Tracker®,” a collaboration with Galileo, examines how outdated banking systems are a common factor impeding embedded finance solutions and how cloud infrastructure offers banks an efficient way to upgrade to take advantage of all the benefits embedded payments have to offer.