Over the past 10 years or so as FinTechs came to dominate payments innovation disintermediation was the ticket, breaking out individual banking functions and building financial products with a singular focus. Now, it’s getting too cluttered for many consumers.

As more consumers look to super apps and the like to streamline and simplify their financial lives, banking is on deck as needing to bundle more of what’s been unbundled in banking.

For the study “Bundled Banking Products: How Credit Cards Secure Customer Loyalty,” an Amount and PYMNTS collaboration, we surveyed nearly 2,300 U.S. consumers on where they stand on having an assortment of card products versus feature-filled cards from single entities.

See the study: Bundled Banking Products: How Credit Cards Secure Customer Loyalty

Only 30% of those with more than five credit cards are interested in keeping all their accounts at one bank, whereas others see value in bundling based on how many cards they carry.

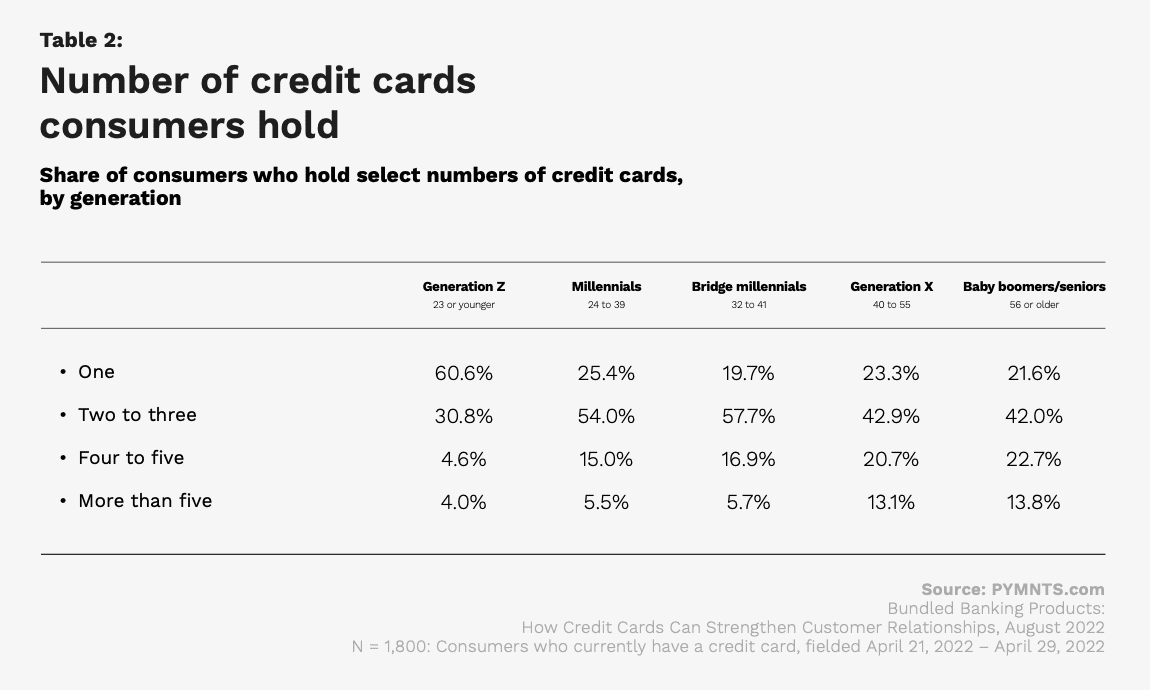

“The youngest age groups — Generation Z, millennials and bridge millennials — are more likely than their older Generation X and baby boomer and senior counterparts to keep three cards or fewer,” the study states. “For example, 58% of bridge millennials have two or three cards and 20% of them have just one. Among baby boomers and seniors, 42% have two to three cards and 22% have just one credit card.”

Tracking spend and other digital-first features are alluring to cardholders, especially among younger demos, but by no mean exclusive to younger cohorts.

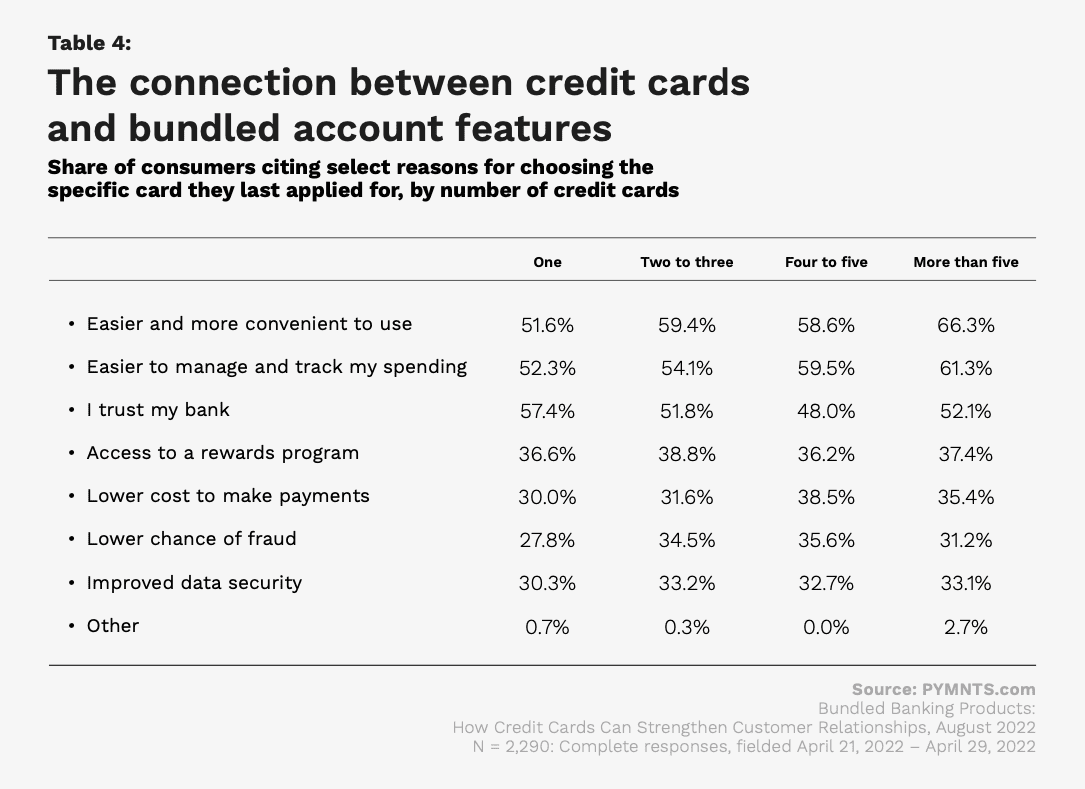

Per the study, “The more cards consumers have, the more likely they are to view bundled banking solutions as a way to improve spending management and tracking. This may reflect the difficulty consumers have tracking their spending as they obtain more spending options and open more accounts, and it may help explain why some consumers want assistance with spend management. Fifty-two percent of consumers with one credit card say bundled banking solutions would help them with their spending, as do 54% of consumers with two to three cards and 60% of consumers with four to five cards.”

As to why consumers lean this way or that, loyalty rewards play an important role.

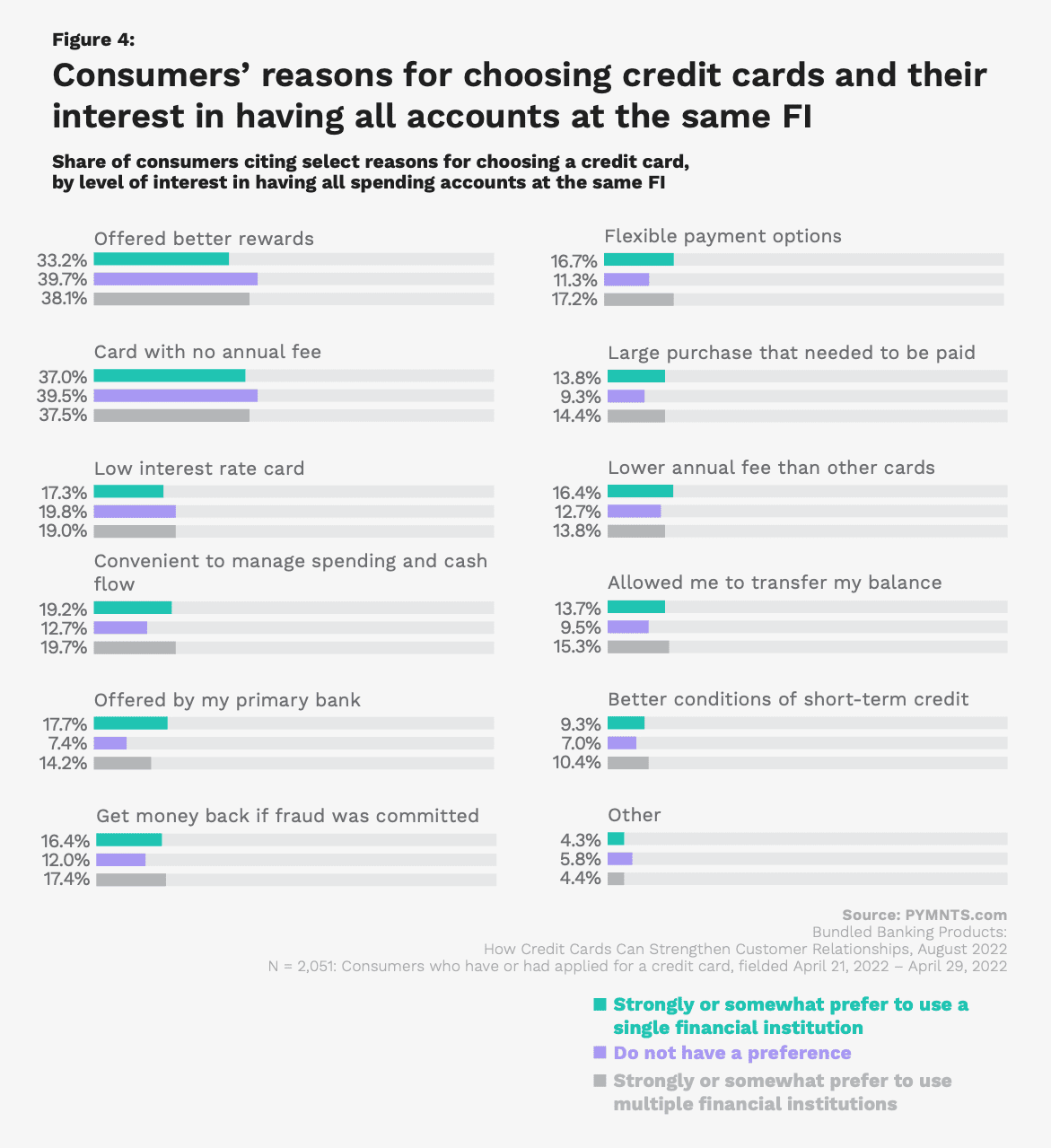

“Consumers express solid interest in credit cards’ rewards programs regardless of their level of interest in keeping all their accounts at one FI,” per the study.

It notes that 33% of consumers who prefer to keep all their accounts at one FI “say they chose their credit cards because of the quality of the rewards programs. Similarly, 40% of consumers with no preference say their cards’ rewards programs drove their decisions to select them, as do 38% of consumers who prefer to keep their accounts at different FIs. In addition, consumers’ level of interest in having all their accounts at one financial institution does not appear to affect the extent to which they want a card with no fee.”

Get it now: Bundled Banking Products: How Credit Cards Secure Customer Loyalty