Embedded Finance Expands Payments Options, Reduces Merchant Risk, Says KeyBank

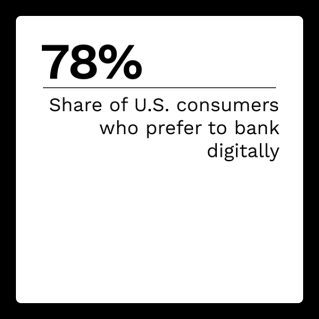

Both individual consumers and businesses are increasingly changing how they conduct their financial affairs. Instead of relying on the traditional, physical-based methods of banking, more people are turning to digital solutions. PYMNTS data shows that 78% of Americans currently prefer to bank digitally, while another study found that 68% of small- to medium-sized businesses (SMBs) seek to digitally manage as many aspects of their businesses as possible.

The preference for digital solutions is particularly true when making payments. Most consumers are now interested in making payments via digital channels, as exemplified by the increasing use of digital wallets. A similar trend is underway in the business world, as businesses are using digital channels more than ever.

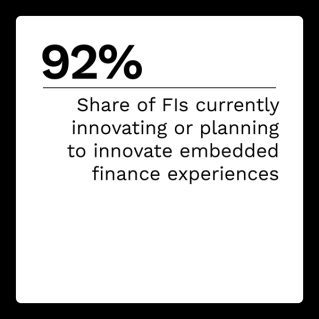

The Embedded Finance Tracker® explores how consumers’ and businesses’ digital payment needs are evolving and how embedded finance can help financial institutions (FIs) meet both their business and consumer customers’ digital banking needs.

Around the Embedded Finance Space

Consumers’ interest in using digital solutions to handle their financial needs extends well beyond just banking. A recent consumer survey found that 58% of respondents viewed investment, money management and other financial apps as key to meeting their financial objectives. In fact, 54% of respondents wished for technology capable of completely handling their finances.

In fact, 54% of respondents wished for technology capable of completely handling their finances.

Although consumers are interested in using technology to handle more of their financial needs, it appears as though FIs are not currently meeting this preference. According to a survey of 3,000 financial services customers in 15 countries, 93% of respondents want personalized financial assessments from their banks, yet just 30% have received the interactions they expect. Moreover, more than half of respondents reported frustration with being unable to reply to mobile messages from their banks. For younger consumers, rates of frustration were even higher.

For more on these and other stories, visit the Tracker’s News and Trends section.

KeyBank on Why the Future Is Already Here With Embedded Banking

Digitally making and receiving payments has become increasingly popular among consumers. Digital payments are quicker and easier than traditional, physical payment methods. Despite the convenience of digital payments, consumers face several challenges when completing digital transactions.

In this month’s Feature Story, PYMNTS talked with Bennie Pennington, vice president of embedded banking and integrated payments at KeyBank, about how embedded finance can provide consumers with the digital experiences they want.

With Digital Payment Needs Growing, Embedded Finance Can Help

For consumers and businesses alike, digital payment solutions are more expected and needed than ever before. One-quarter of consumers who reported that their payment habits changed due to the pandemic said they are using digital wallets more frequently than they were a year ago. In turn, the need for businesses to support digital payment solutions such as these is growing, and embedded finance can help.

To learn how embedded finance can aid FIs in meeting customers’ growing needs, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The Embedded Finance Tracker®, a collaboration with Galileo, examines how consumers’ and businesses’ digital banking needs are changing and how FIs can leverage embedded finance to meet these evolving needs.