Banking-as-a-Service Gives Corporates New Ways to Cement, Monetize Customer Relationships

PYMNTS’ new “Banking-As-A-Service Opportunity Report” examines how FIs and Banking-as-a-Service providers are creating the invisible, frictionless financial services experiences their customers expect.

Businesses across a multitude of verticals were forced to reconsider the way they conduct previously routine payments in the wake of the pandemic, with many taking steps to move their operations online following the global health crisis’s onset. Businesses making the jump to eCommerce for sales and business-to-business (B2B) payments must find ways to stand apart in an increasingly crowded field, making seamless, instant payment features a must, said Roy Ng, co-founder and CEO of banking-as-a-service (BaaS) and embedded banking provider Bond, in a recent PYMNTS interview.

“Obviously, with the pandemic, a lot of things that were previously [done] in the physical world were pushed to the virtual world, so you saw the emergence of all these one-click checkout types of vendors, trying to really smooth out the process of getting the payments executed without having to go through typing a bunch of information over and over again,” Ng explained. “So this whole one-click checkout war obviously is happening.”

Winning the checkout war requires companies to take a second look at not only how they are offering payments but the role they play within the payment process. Creating space for payment or financial services to be integrated into one’s own platform through the use of BaaS solutions — often driven via application programming interfaces (APIs) — could help businesses better engineer lasting customer loyalty as the payments environment continues to change.

BaaS and Changing Payment Needs

Interest in convenient and swift payment solutions has risen sharply among businesses, following the lead of consumers who have come to expect the same simple, connected payment processes they experience on sites such as Amazon reflected in all their digital activities. Many companies still face barriers when offering such solutions, however, Ng explained, many struggle to fit emerging payment tools into outdated infrastructure.

“I would say that there’s a dichotomy between how quick and flexible our payment systems [are], at least the existing payment systems, [and] what [businesses] would like to offer to their end customers,” he said. “Their end consumers’ expectations, especially coming out of the pandemic, [are for] this real time, instant gratification type of approach. [It is] that type of demand, but the reality is, much of our underlying infrastructure is pretty dated.”

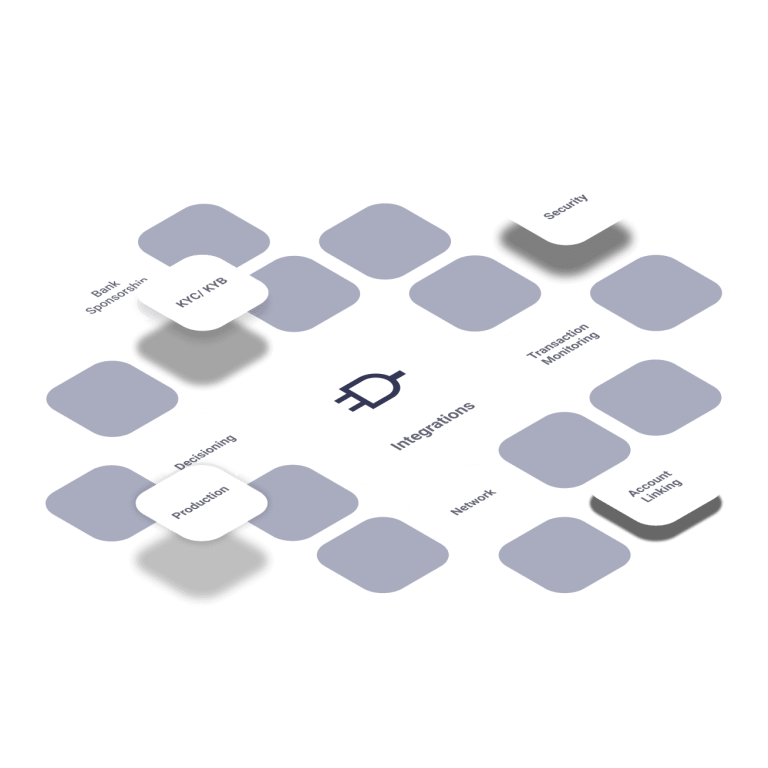

Implementing BaaS solutions through a third-party provider can help companies bridge this innovation gap, creating space for them to be able to offer the one-click payment experiences today’s consumers expect. BaaS services use APIs to seamlessly connect disparate platforms and services, allowing third-party partners such as i2c to remove much of the traditional frictions involved when businesses send or receive funds. This represents a key opportunity for businesses, especially nonfinancial companies, to slip into the digital financial ecosystem alongside legacy banks and FinTechs.

“I think [nonfinancial companies’] push will be around, ‘Well, I’m not going to accept the status quo: This is what my clients want, and this is how we’re going to satisfy a particular use case,’” Ng said. “Embedded finance platforms serve as a catalyst for more payment options under the hood that enable our customers to be able to meet their end users’ needs.”

Meeting those needs requires nonfinancial companies to pay careful attention to how consumers’ payment preferences are changing, as well as those of their vendors and industry partners, and what tools or technologies can help them keep pace with such shifts.

Offering Next-Gen Payment Experiences

Companies looking to stand apart in the saturated online payments environment must think differently about the payment process as part of their customer service experience to help capture and retain consumers’ loyalty. This means many may be taking on more of a robust role in their own payment processes, effectively eroding the lines between businesses and banks — something that could profoundly impact the global financial ecosystem.

“I think as we continue to innovate and as embedded finance enables every tech company — or any company — to offer their own banking products, that will put more pressure on these decision-makers around payment methods to really think about alternatives outside of the usual suspects,” he said.

Implementing BaaS services that can make way for such payment alternatives should therefore be top of mind for today’s companies. Finding the right BaaS partner and payments processor to enable these next-generation embedded finance experiences is becoming essential to allow businesses across multiple verticals to remain competitive as the wants and needs of both their industry partners and customers evolve.