PYMNTS Intelligence: Digital Demands: What Corporate Banking Clients Want

![]() Corporate banking clients want more from their financial institutions (FIs) than ever in terms of advanced digital tools and support. Small- to medium-sized businesses (SMBs) and larger companies alike have accelerated digitization efforts since the pandemic struck, making it critical for commercial banks to understand these needs and deliver on digital as FinTechs compete for their customers.

Corporate banking clients want more from their financial institutions (FIs) than ever in terms of advanced digital tools and support. Small- to medium-sized businesses (SMBs) and larger companies alike have accelerated digitization efforts since the pandemic struck, making it critical for commercial banks to understand these needs and deliver on digital as FinTechs compete for their customers.

The economic and financial landscape has transformed since 2019, along with the demands of corporate banking clients. Businesses increasingly expect to engage with their banks across digital channels rather than in person or by phone. They also require access to more advanced digital tools, including embedded finance and digital payments integration.

A PYMNTS survey of chief financial officers at middle-market companies found that 59% viewed payments digitization as essential for a healthy balance sheet, and 71% had increased their payments digitization efforts since the pandemic began.

Too many commercial banks fail to deliver on digital, however, especially for SMB clients. A large-scale industry report found that 68% of SMBs want to digitally handle all banking and finance issues, but 38% do not feel they currently receive a satisfactory digital experience from their FI. The same study, which globally polled more than 5,600 SMBs, found that 36% of the companies were open to changing their primary financial services providers.

A separate industry survey of SMBs found that just 32% believe their banks understand their needs, and 37% feel their banks appreciate their business. Another study, meanwhile, found that most small business owners in the U.S. would prefer to open accounts and apply for loans online, but most end up doing so in person, suggesting that they believe their FIs do not offer viable digital options.

The Growing Importance of Embedded Finance

One area of greater importance for commercial banks will be embedded finance, which refers to the back-end integration of financial services software into online stores and other digital channels. This integration gives customers access to banking products such as buy now, pay later (BNPL) and consumer loans within a merchant’s website or digital ecosystem, rather than being redirected to the FI providing the underlying service, delivering more seamless and secure transactions.

Research has found that embedded finance is rapidly gaining popularity with SMBs. It could take over more than one-quarter of total annual SMB banking revenue globally by 2025, capturing $124 billion. Most of this projected value, $92 billion, will result from embedded finance reaching untapped segments of the SMB banking market, while $32 billion will directly displace existing banking revenue. The report identifies transactional banking products as the revenue category most exposed to competition from embedded finance.

The study also included a survey of more than 2,500 SMBs in North America and Europe, which found that 41% would be interested in banking services offered by nonbank digital services providers, though 44% would prefer such products to be in collaboration with traditional banks. Forty-seven percent would be willing to pay as much or more for embedded finance as for traditional banking services, and more than half of SMBs with at least 10 employees would be open to paying such a premium.

Embedded finance connects to the broader emergence of Banking-as-a-Service (BaaS), where corporate banking clients can “subscribe” to various embedded finance and other financial products from their FIs at will, allowing them to adjust to customer preferences and changing conditions. A study by EY found that 82% of SMBs have at least some interest in sharing data with their primary FIs so that these providers can personalize clients’ experiences, and SMBs would be willing to pay extra for this if it generated revenue opportunities. The report also found that 56% of SMBs believed an integrated platform for financial services products would help them run their businesses.

Banks Should Lead the Digital Conversation

Banks Should Lead the Digital Conversation

A PYMNTS survey of CFOs at 400 companies with $400 million to $2 billion in annual revenues highlights the ongoing surge in payment digitization. Eighty-five percent of the respondents say their firms utilize more credit card-enabled digital payments via an external app or portal than before the pandemic. They also report greater use of direct bank transfers at 71%, PayPal at 62% and debit cards at 55%, with smaller increases across all other significant categories.

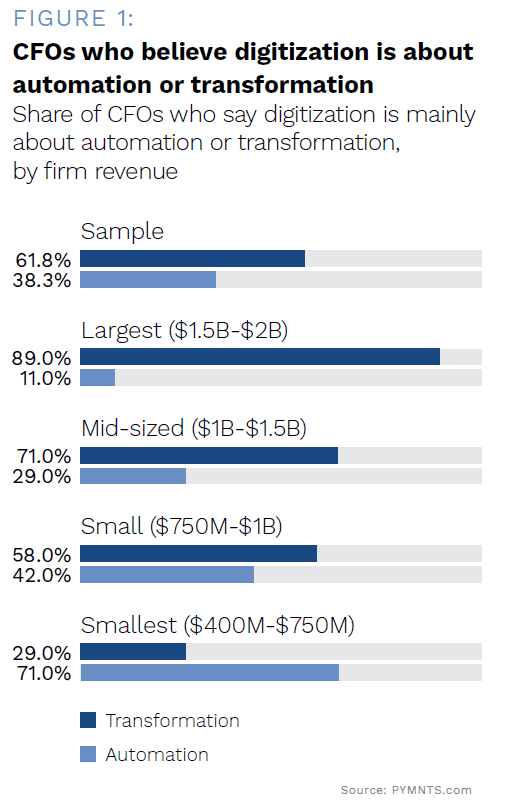

Our research also reveals a critical issue that banks must address to better meet the evolving demands of corporate clients. Nearly 40% of the CFOs surveyed view digitization as dealing mainly with automation and therefore being primarily about efficiency. This indicates that a large portion of firms fail to see the bigger picture of how digitization can completely transform a business. The data shows this is especially true for businesses with less than $750 million in annual revenue, 71% of whose CFOs said digitization is primarily for automation.