Simple Plug-In Bill Pay Solutions Snag Businesses’ Attention and Loyalty

As the pandemic has pushed all sectors of the economy toward greater digitization, B2B payment functions have become increasingly dependent on technological solutions, and that trend is not going away. Among billing and collections professionals at utility and consumer finance companies, nearly half of those surveyed said digitization would drive growth in their organizations in the next five years, and 51% said that improving digital payment capabilities is either “very” or “extremely” important.

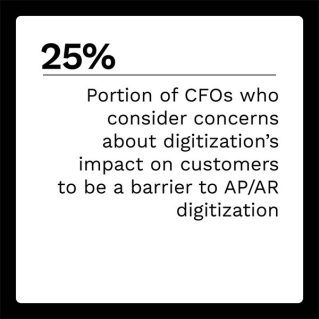

Chief financial officers (CFOs) have a similar view, with most saying it is critical to digitizing accounts payable (AP) and accounts receivable (AR) to increase their customers’ lifetime value. At the same time, 43% of finance leaders reported that their end-to-end AP functions are still manual and that lack of automation likely contributes to the fact that companies spend 53% of finance time on AP processes.

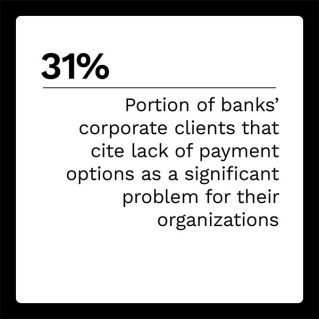

The changing needs of their business customers have financial institutions (FIs) feeling the pressure to provide seamless bill payment features, and many banks are seeking innovative payments offerings in response. Sixty-four percent of surveyed FIs reported that they are “very” or “extremely” willing to adopt new technologies such as application programming interfaces (APIs) that will help with the consumerization of B2B payments. For FIs looking to serve business customers better, it is helpful to look at how B2B payments have evolved in the past several years to understand where they are going and what technologies can help.

The April edition of the Next-Gen Commercial Banking Tracker®, a PYMNTS and FISPAN collaboration, examines the latest trends and developments shaping the next-gen commercial banking space and how FIs can serve business clients’ changing needs through adaptable payment APIs.

Around the Commercial Banking Space

Digital-first payment solutions continue to grow in importance for businesses looking to digitize their B2B payment processes in response to the needs and demands of their industries. FIs can meet this need for better payment solutions with such products as virtual cards but will need to innovate their payment solutions for business clients alongside the variety and types of solutions offered to regular customers. According to a study, just 9% of FIs would describe their current customer experiences as “excellent,” meaning there is a significant opportunity for FIs to develop solutions that help them stand out among their competitors.

Digital-first payment solutions continue to grow in importance for businesses looking to digitize their B2B payment processes in response to the needs and demands of their industries. FIs can meet this need for better payment solutions with such products as virtual cards but will need to innovate their payment solutions for business clients alongside the variety and types of solutions offered to regular customers. According to a study, just 9% of FIs would describe their current customer experiences as “excellent,” meaning there is a significant opportunity for FIs to develop solutions that help them stand out among their competitors.

Many businesses rely on APIs to facilitate better and faster communications with their FIs to keep pace with the changing demands in their industries. Firms are now approximately three times as likely to use APIs for their interactions with FIs than they are to engage face-to-face and applying digital solutions to both their internal communications and their interactions with clients. There is still a lot of work to be done, and each industry has its unique challenges and barriers. In the construction industry, for example, 70% of firms report a lack of access to omnichannel cash management tools they need to facilitate flexible spend management.

For more on these stories and other next-gen commercial banking developments, check out the Tracker’s News and Trends section.

Fifth Third Bank on Improving B2B Payments With APIs

The rapid transition in the consumer payments space following the beginning of the pandemic has changed the expectations of businesses as well. In this month’s Feature Story, Laura Listwan, head of commercial payments products at Fifth Third Bank, talks about creating holistic, end-to-end B2B payment solutions that simplify accepting payments for clients and enable them to focus on their core business.

PYMNTS Intelligence: Meeting Changing Bill Pay Needs With APIs

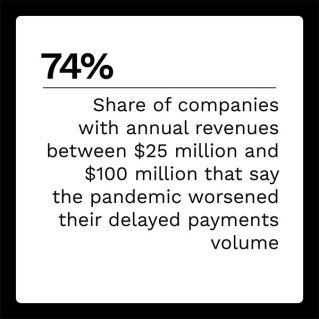

During the accelerated digital transformation that accompanied the pandemic, 76% of surveyed accounting and finance leaders said that the global crisis fast-tracked their AP digital transformation initiatives. There remains a lot of work to be done to bring businesses to the point that meets the expectations of B2B clients, with 24% of large firms’ B2B payments still being made by paper check. This creates an opportunity for FIs that can offer products and services to match that demand.

This month’s PYMNTS Intelligence looks at how FIs can stand out in the digital payments marketplace with digital payment tools such as API-powered bill payment solutions.

About the Tracker

The Next-Gen Commercial Banking Tracker®, a PYMNTS and FISPAN collaboration, examines the latest trends and developments shaping the next-gen commercial banking space and how FIs can serve business clients’ changing needs through adaptable payment APIs.