The traditional avenues of lending are narrowing, signaling tougher times ahead for smaller businesses seeking access to credit.

As detailed Monday (July 31) in the Federal Reserve’s Senior Loan Officer Opinion survey, which is issued quarterly, banks are tightening their underwriting standards.

Drill down a bit, and the banks are also looking to tighten standards through at least the rest of the year. Perhaps no surprise, the respondents cited a “less favorable” and “more uncertain” economic outlook as key considerations in tightening those standards. The banks also cited a deterioration in their own liquidity positions.

The survey is largely qualitative in nature. The banks reported having tightened standards on commercial and industrial loans to large and middle-market firms and small firms.

Of the largest banks queried, 50% of lenders said they’d tightened underwriting at least somewhat on smaller firms applying for loans, with annual sales of less than $50 million. The remainder said that standards remained unchanged, where, we note, through the last quarterly reports, standards had already been getting a bit more stringent.

Advertisement: Scroll to Continue

Roughly 80% of the officers said that demand for loans had been either the same or “moderately stronger” across the board. Only a bit less than 19% said that demand had been “moderately” weaker. For the banks that had seen weaker demand, there’s been a lessening of enterprises’ investment in plant and equipment, and decreased inventory financing needs through the past few months. At least some Main Street firms, we’d note, are pulling back on activities that would be traditionally tied to expansion, and readying for increased consumer demand.

SMBs Seek Financing

In the meantime, as PYMNTS data have shown, in the ongoing series taking the pulse of Main Street small business health, 40% of small and medium-sized businesses (SMBs) remain more worried about inflation than one year ago. And as many as 15% have said they are concerned about declining revenues.

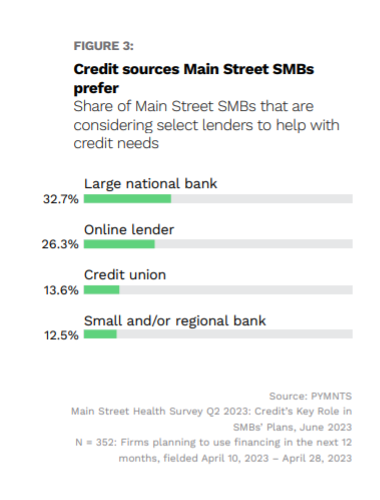

And financing — in the form of credit — may prove to be a significant lifeline for these companies. The data show that nearly half of SMBs are examining how they might obtain new financing in the next 12 months. A third of these smaller firms are looking to national banks to obtain credit.

But: If the banks are tightening their loan parameters, as Monday’s Fed data show, and thus might become a bit more reticent to lend, then this opens up the door for alternative lenders to fill the gap. The accompanying chart shows that 26% have preference for online lenders (read: Not the traditional banks) to get the capital that they need.

We found that while 42% of Main Street SMBs across all revenue tiers have access to business financing sources, only 27% of those with less than $150,000 in annual revenue have that same access — giving these online lenders some greenfield opportunity to gain a foothold with these companies. Smaller firms, of course, seek to become larger companies over time, so getting a relationship in place as these businesses scale may pay dividends, displacing at least some of the largest players in finance.