NEW DATA: What UK And US Businesses Want From Cross-Border Payments Innovations

Businesses around the world are doubling down on their cross-border innovation amid a growing need for faster, more efficient business-to-business (B2B) payments — and their payments decision-makers are given the difficult task of identifying the innovations in which they should invest. There is no one-size-fits-all approach to innovation, after all.

Businesses around the world are doubling down on their cross-border innovation amid a growing need for faster, more efficient business-to-business (B2B) payments — and their payments decision-makers are given the difficult task of identifying the innovations in which they should invest. There is no one-size-fits-all approach to innovation, after all.

There are countless technologies that businesses can tap to help make their cross-border payment flows easier to manage, with each affording unique benefits. The trouble is that businesses have limited time and resources to spare, meaning they can often invest in only so many at once. Businesses must ultimately prioritize when it comes to improving their cross-border operations before setting out on their innovation journeys.

There are countless technologies that businesses can tap to help make their cross-border payment flows easier to manage, with each affording unique benefits. The trouble is that businesses have limited time and resources to spare, meaning they can often invest in only so many at once. Businesses must ultimately prioritize when it comes to improving their cross-border operations before setting out on their innovation journeys.

In Innovating Cross-Border Payments: Innovation Drivers, PYMNTS, in collaboration with Visa, examines the myriad ways in which international businesses headquartered in the United States and the United Kingdom believe B2B innovation can enhance their cross-border operations. We surveyed 456 payments decision-makers from businesses in 22 industries to find out what they believe to be the chief benefits of such innovation as well as how these expected benefits vary depending on their size and location.

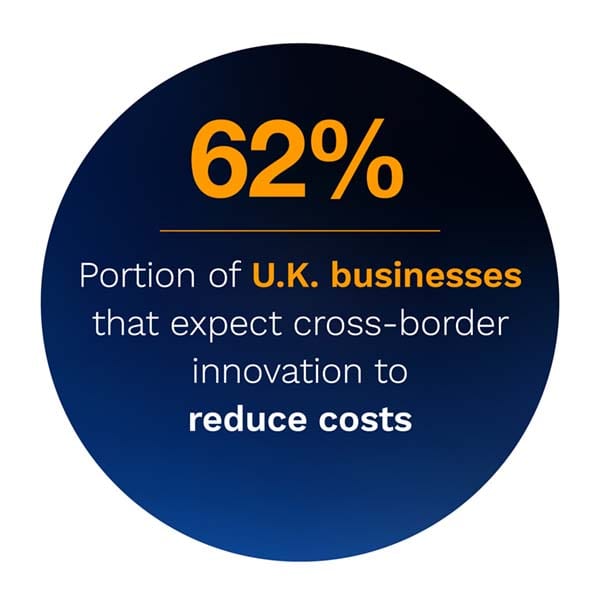

We discovered that although U.S. and U.K. businesses often have different B2B innovation priorities, they tend to agree that the three key benefits it can provide are  reduced cost, improved cash flow management and better protection against fraud — in that order. Sixty-two percent of U.K. businesses say they believe cross-border B2B innovation can reduce the cost of making and receiving cross-border payments, for example, as do 54 percent of U.S. businesses.

reduced cost, improved cash flow management and better protection against fraud — in that order. Sixty-two percent of U.K. businesses say they believe cross-border B2B innovation can reduce the cost of making and receiving cross-border payments, for example, as do 54 percent of U.S. businesses.

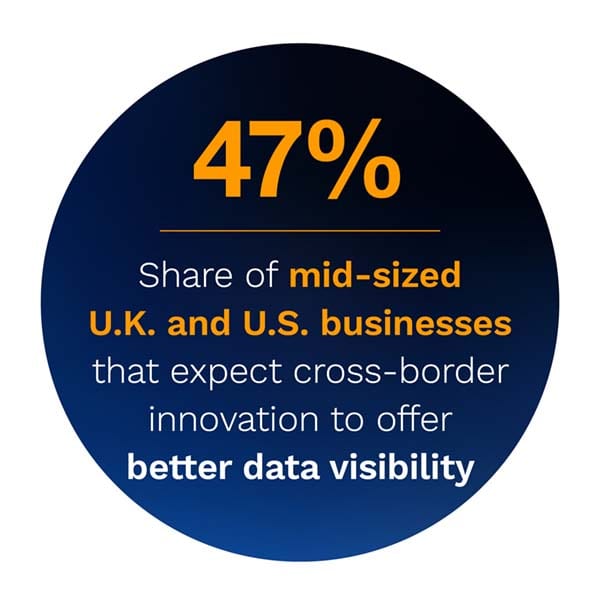

There is also a great deal of variability in the ways in which U.S. and U.K. businesses of different sizes believe innovation can improve their payments operations. Businesses generating between $500 million and $1 billion in revenues are the most likely to cite improved data visibility as a benefit they hope to reap from implementing cross-border innovations, for example, with 47 percent doing so. Businesses that generate between $50 million and $100 million, on the other hand, are the most likely to cite error reduction as an expected benefit of cross-border innovation.

What businesses  want from innovation is one matter, but the innovations they choose to implement to achieve their innovation goals is another. Innovation Cross-Border Payments: Innovation Drivers examines the connection between businesses’ innovation priorities and the technologies they hope to adopt in the years ahead.

want from innovation is one matter, but the innovations they choose to implement to achieve their innovation goals is another. Innovation Cross-Border Payments: Innovation Drivers examines the connection between businesses’ innovation priorities and the technologies they hope to adopt in the years ahead.

To learn more about what U.K. and U.S. businesses hope their cross-border innovations can achieve, download the brief.