Tokenization is gaining momentum on the global stage, and with commercial applications.

The Bank for International Settlements announced Wednesday (April 3) that it is working in tandem with seven central banks — including the Federal Reserve Bank of New York — to test tokenization in a bid to improve cross-border payments.

In addition, Project Agorá, as the initiative is known, will be joined by what is being billed as a “large group” of financial firms convened by the Institute of International Finance, which has 400 members from 60 countries, per its website.

The combined efforts will explore how tokenized commercial bank deposits might work with tokenized wholesale central bank money across a public-private programmable “core financial platform,” the announcement said.

“This major public-private partnership will seek to overcome several structural inefficiencies in how payments happen today, especially across borders, which add a layer of challenges: different legal, regulatory and technical requirements; operating hours; and time zones,” according to the announcement.

In one example of private sector efforts, it was reported in September that J.P. Morgan Chase is considering using blockchain technology to create a digital deposit token for faster cross-border payments and settlements. The bank has already developed the necessary infrastructure for the payment system, which is now pending approval from U.S. regulators to proceed.

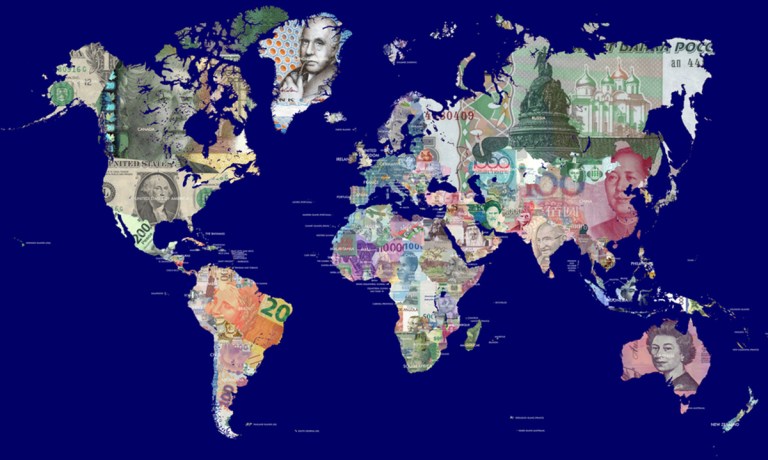

Project Agorá takes its name from the Greek word for marketplace, and the platform model would, at least conceptually, allow all manner of participants to digitize payments and assets. The central banks joining the project are flung far across the globe. In addition to the New York Fed, they include the Bank of England, Bank of France, Bank of Japan, Bank of Korea, Bank of Mexico and the Swiss National Bank.

“The success of tokenization rests on the foundation of trust provided by central bank money and its capacity to knit together key elements of the financial system,” the BIS said in a paper last year.

“A unified ledger transforms the way that intermediaries interact to serve end users,” it added. “Through programmability and the platform’s ability to bundle transactions, a unified ledger allows sequences of financial transactions to be automated and seamlessly integrated.”

PYMNTS Intelligence’s “The Treasury Management Playbook: Spotlight on Cross-Border Payments” found that 59% of Citi’s corporate clients name speed as one of their biggest pain points when it comes to cross-border transactions, followed by 47% who cited cost, and 40% who named transparency as a key area of friction, as tracking and receipt information may be lacking with traditional payments such as wires.