In the face of growing competition, banks around the world are working hard to become the first choice of today’s customers. Recent PYMNTS research indicates that 34.8 percent of banking customers would be interested in switching their financial institutions (FIs) if their branch experiences do not match their digital banking experiences.

In the face of growing competition, banks around the world are working hard to become the first choice of today’s customers. Recent PYMNTS research indicates that 34.8 percent of banking customers would be interested in switching their financial institutions (FIs) if their branch experiences do not match their digital banking experiences.

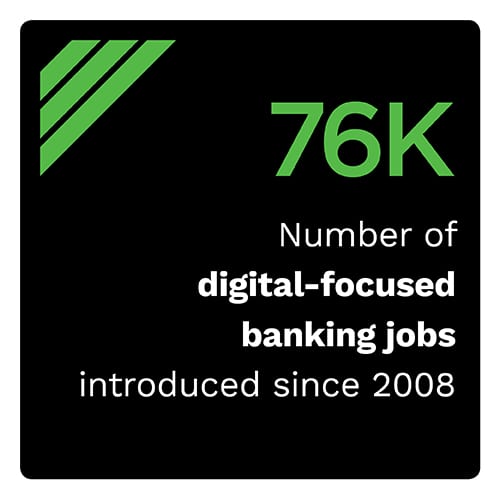

A digital-first approach to banking has become critical to survival, in other words. Customers want to be able to access a full array of services beyond the physical branch through a variety of touchpoints, including ATMs, Internet of Things (IoT) devices and contact centers. Many banks are, thus, taking a digital-first approach to remain relevant and agile, undergoing head-to-toe transformation.

The benefits of taking a digital-first approach to banking go beyond offering an improved in-person banking experience. It is also crucial to improving back-office operations, and enabling bank employees to put the right products in front of the right customers.

The benefits of taking a digital-first approach to banking go beyond offering an improved in-person banking experience. It is also crucial to improving back-office operations, and enabling bank employees to put the right products in front of the right customers.

That being said, it is imperative for banks to not only upgrade their infrastructures, but to stay cognizant of shifting customer needs. Enter the Digital-First Banking Tracker, a PYMNTS and NCR Corporation collaboration, which analyzes how FIs are approaching digital transformations to engage with their customers, and what innovations they are using to do so.

Digital-First Banking Developments Around The World

One of the key customer touchpoints ripe for disruption are ATMs. FIs, such as Santander Bank, are looking to upgrade their ATM infrastructures. The bank recently partnered with technology company NCR Corporation for its self-service ATM, which uses real-time customer data to analyze interactions for a more personalized user experience.

Other banks, such as Wisconsin-based Associated Ban k, are exploring new ways to improve the in-person banking experience. The bank is testing out a themed bank branch, dedicated to the Green Bay Packers football team, and will offer personalized experiences surrounding that theme to in-branch customers.

k, are exploring new ways to improve the in-person banking experience. The bank is testing out a themed bank branch, dedicated to the Green Bay Packers football team, and will offer personalized experiences surrounding that theme to in-branch customers.

Associated Bank is not the only one looking to update its bank branches for a digital-first future. Six New Zealand banks — Associated Banc-Corp, Australia and New Zealand Banking Group, Bank of New Zealand, Kiwibank, TSB Bank and Westpac — are looking to open banking hubs across the country to facilitate the needs of customers who may be frustrated with a lack of banking support. The banks will open four distinct hubs, which will let consumers conduct in-person banking visits, even if their banks do not have any locations nearby.

For more on this and other digital-first banking news, visit the Tracker’s News & Trends section.

How AI-Powered Analysis Drives Digital Transformation

Some banks are better equipped to move to a digital-first banking strategy than others, but regardless of whether a bank is just starting up or trying to untangle decades of legacy banking processes, it is looking for new technologies to help. Artificial intelligence (AI)-enabled tools and chatbots could be key components to move an FI’s digital transformation forward.

That is something Alabama-based Regions Bank has sought to achieve through its AI ROSIE, according to Shawn Bradley, executive vice president of customer insights for the bank. For more on how AI tools like ROSIE are impacting customer services and technology innovations in the digital-first banking world, visit the Tracker’s feature story.

Deep Dive: Banks Take Digital-First Approaches To Meet Customer Demands

Banks that want to experiment with AI-enabled chatbots or other tools need to consider their customers’ comfort with these technologies. They not only need to be innovative solutions, but they must meet customer demands.

Use of data analytics and machine learning are ways that banks can manage shifting customer demands. For more on how banks are unlocking digital experiences for impatient customers using innovative technologies, visit the Tracker’s Deep Dive.

About The Tracker

The Digital-First Banking Tracker, a PYMNTS and NCR Corporation collaboration, examines how banks are digitally transforming to elevate customer experiences and improve efficiency.