Banks lost about $4 billion to account takeover (ATO) fraud attempts last year and the losses are set to further increase as this year progresses. ATO and other fraud methods that rely on using stolen credit card numbers or other personal information are becoming decidedly popular with bad actors, who are employing increasingly sophisticated technologies to execute their scams.

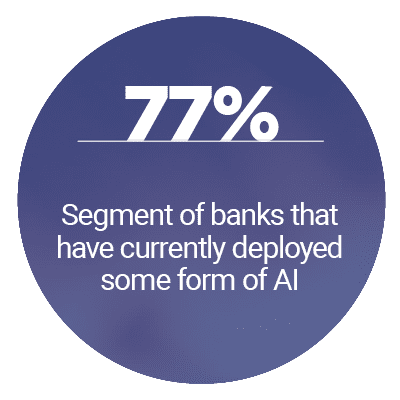

The majority of ATO attacks are automated, meaning that fraudsters are becoming more comfortable utilizing advanced learning tools such as deep learning, artificial intelligence (AI) and machine learning (ML) to target financial institutions (FIs) and their customers. About 40% of all ATO attacks now count as high-risk, meaning banks of all shapes and sizes must reexamine how they think about data protection, security and the tools they use to guard against emerging threats.

In the latest “Digital Banking Tracker,” PYMNTS analyzes the ways in which FIs are working to keep fraudsters from accessing customer information and funds on their mobile and digital channels.

Around the Digital Banking World

FIs worldwide are fending off fraudsters from all angles, with many FIs trying to prevent new attacks while still resolving the aftermath of others. Australian FIs are still feeling the repercussions of a breach to its New Payments Platform (NPP), which exposed the data of an unnamed number of banking customers. Fraudsters made off with account numbers and other personal details, which could later be used for different synthetic identity fraud or related schemes.

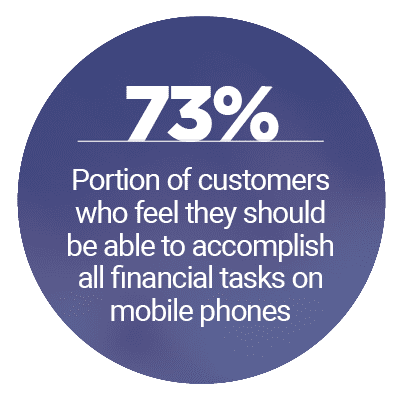

Banks in other regions are also dealing with data breaches of their own, such as U.K. digital bank Monzo. The bank released updates for customers to install on their Android and Apple mobile apps in response to a security breach that may have compromised a little less than a fifth of the bank’s users, following only a few months after Monzo made its U.S. market debut.

Banks still need to be sure that they are keeping the customer experience as easy and seamless as possible in the midst of reacting to a breach.

For more on these and other stories, visit the Tracker’s News and Trends section.

How U.S. Bank Is Using Machine Learning To Tackle Fraud

Fraudsters are knocking at banks’ doors with a growing host of stolen information, as they look to imitate legitimate customers with ease. As such, banks need to be sure that the fraud protection measures they have in place can detect such impersonations — without alienating legitimate customers. This is precisely where technologies like AI and ML can help, says Dominic Venturo, executive vice president and chief innovation officer for U.S. Bank.

To learn more about how banks can use these tools both as fraud protection and to make customers’ lives more convenient, visit the Tracker’s Feature Story.

Deep Dive: How Banks Are Using AI, ML To Fight Account Opening Fraud

There were 4.1 billion customer records exposed in the first half of 2019, and banks need to be ready for potential fraud concerning all of them. Technologies like AI and ML can help to protect against ATO attempts and other such fraud, but banks will need to reexamine the way that they use these technologies to be truly effective at protecting against these schemes.

To learn more about how banks are currently making use of such technologies as part of their fraud protection strategies, visit the Tracker’s Deep Dive.

About the Tracker

The “Digital Banking Tracker,” a Feedzai collaboration, brings you the latest news, research and expert commentary from the FinTech and consumer banking space. It also includes a provider directory featuring the rankings of more than 250 companies serving or powering the digital banking sector.