New Data: Consumers Demanding Better Transaction Controls In Digital Banking Apps

Trust. Control. Identity. Managing for these quintessentially human attributes in the digital domain is a moving target, and it’s what today’s consumers expect from the relevant players.

The May 2021 Mobile Banking App Playbook: Customization as a Key to Meeting Banking Customers’ Expectations, an Entersekt collaboration, third in this ongoing study series, gets right to the point, stating that “control over how transactions are authenticated is one of the most important things consumers seek from their mobile banking app experiences.”

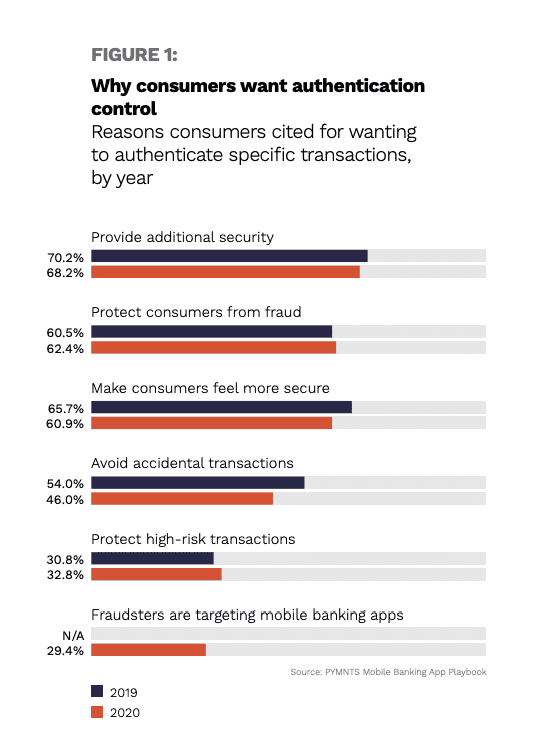

Researchers found that 64 percent of consumers consider the ability to authenticate specific transactions “very” or “extremely” important, while another 24 percent think it is “somewhat” important. Per the Playbook, “This means that 88 percent of consumers believe it is important to be able to authenticate specific transactions.” That rises to 66 percent of bridge millennials.

Security controls that reinforce trust are increasingly what consumers are demanding, clearly, and woe betide financial institutions (FIs) and other stakeholders who downplay it in 2021.

Banking App Micromanagement Is All the Rage

Banking App Micromanagement Is All the Rage

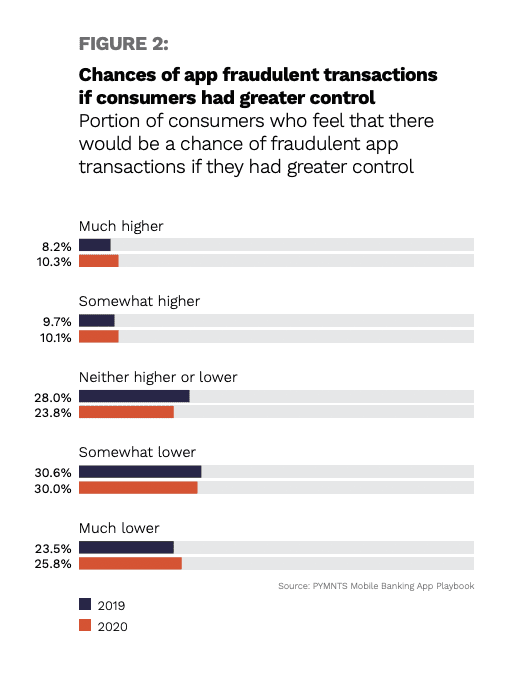

Consumers wanting to control — even micromanage — transactions is a predictable result of living in the age of smartphone apps, and their sense that they can often do a better job at stopping fraud than their banks. The new Mobile Banking App Playbook notes that 56 percent of consumers surveyed believe that fraud risks would be lower if they had more authentication control.

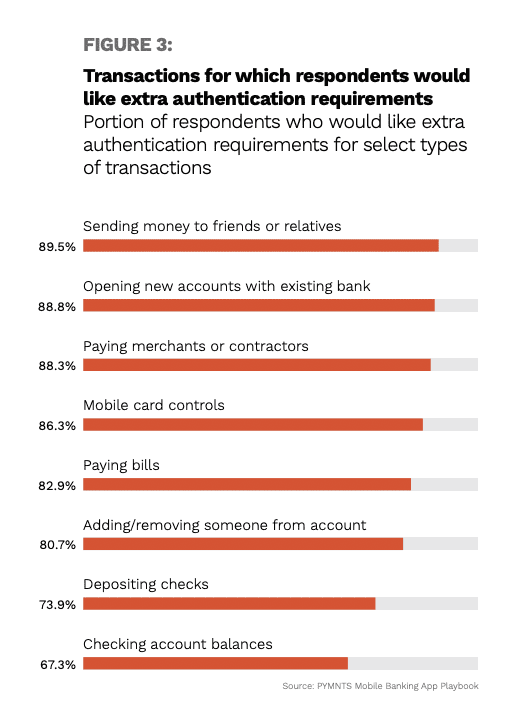

Moreover, 90 percent of consumers want “extra authentication methods when sending money,” as do 89 percent when opening new accounts at FIs where they already bank.

In an odd-seeming twist, the more that consumers trust their bank, the more control they want.

The May Mobile Banking App Playbook states that “consumers’ levels of interest in being able to control which transactions require authentication varies depending on the amount of trust they have in their banks. The more consumers trust their banks, the more control they want over most of their transactions. All consumers who do not trust their banks at all say they would want added authentication to initiate merchant or contractor payments, for example. Eighty-eight percent of consumers who ‘very much’ trust their banks say the same.”

Not surprisingly, researchers also found that consumers “who transact less often express greater interest than those who transact more often.”

Mobile Banking Needs to Get Personal

Mobile Banking Needs to Get Personal

When the conversation turns to in-app controls over bank transactions, we’re obviously in the mobile world, and that’s where the action is for consumers and their banks.

Something mobile apps enable in new and creative ways is a personalized experience, which is another kind of control consumers would like to exert over their bank dealings.

Noting that almost a third of consumers would use mobile banking apps more if banks covered fraud liability, and another 26 percent would do so if offered more authentication choices, the Mobile Banking App Playbook adds that “interest in a personalized user experience is especially high among credit union members, who would use their apps more if they offered more functionalities. Twenty-four percent said they would like to be able to retrieve their credit scores, and 58 percent of credit union users would like their banking apps to send them real-time account activity notifications.”

As the latest Playbook concludes, “FIs would do well to keep their mobile banking apps convenient and deliver on a more personalized authentication experience, especially as doing so helps keep transactions secure and safe from fraud. This will not only boost consumer engagement, but also enhance overall customer satisfaction.”