Report: Data Security Concerns Keep Nearly Half of US Consumers From Switching to Digital Only Banks

Bank customers have made it clear for years that they like the convenience and ease of use provided by technology-based services. This preference has always pushed the banking industry and its competitors to develop new products and services.

During the past two years, the disruption to people’s everyday lives and workplaces has made it clear that all providers of banking services face growing urgency to innovate and stay ahead of the technology curve.

PYMNTS’ research found that there are many opportunities for banks and nonbank providers, including companies like Amazon and Apple, to meet consumers’ growing demand for digital banking services.

In Digital Banking: The Brewing Battle For Where We Will Bank, a PYMNTS and Optherium collaboration, we surveyed 2,225 consumers in the United States from July 1 through July 7 to gauge consumers’ interest in using digital banking services more in the future than they do now. We assessed the interest consumers have in using more digital banking services from trusted brands that offer convenience and ease of use while at the same time guaranteeing customers secure transactions, security for their personal information and financial assets and protection from fraud.

PYMNTS’ research identified consumers’ readiness to bank with companies that offer digital banking products. This readiness extends to a wide range of companies that can lay claim to trusted brand names and the ability to protect customers’ security and privacy. A banking service provider’s core business model is of little interest to many consumers.

At the same time, companies are not meeting much of this consumer, which is a wake-up call for the banking industry. It presents a tremendous opportunity for nonbank competitors to enter the market. Retailers, telecommunication services providers and technology companies are all candidates to make a play for market share.

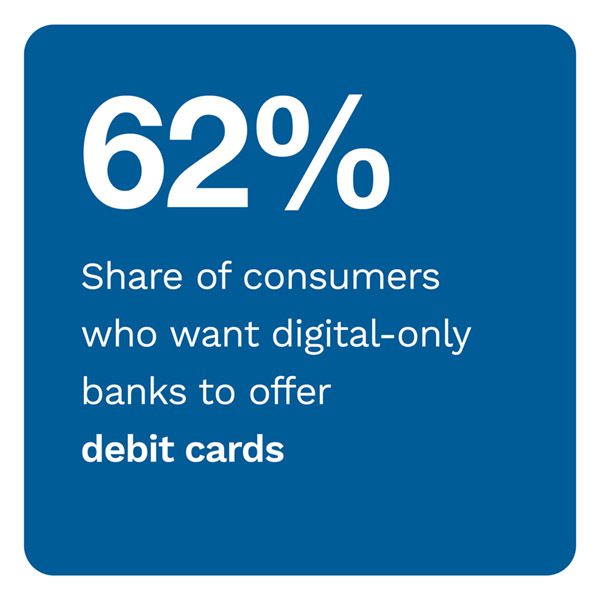

Consumers stressed interest in certain expected features, regardless of the firm providing the banking service. Twenty-four percent said they want convenience, and many others said ease of use is important. At the same time, many consumers said they want to trust a provider of banking services and know data security is a priority.

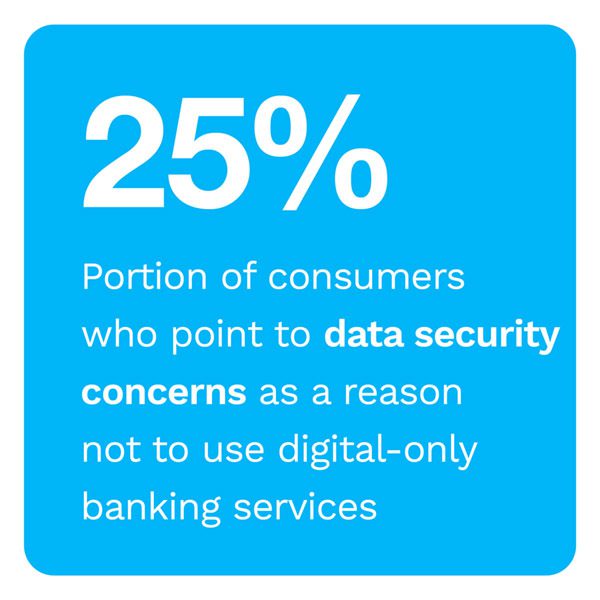

Data security is so important to consumers that 47% said it is a reason for not switching accounts to a digital-only bank. Consumers’ concerns about data security should remind all competitors in the market, including banks and nonbanks, that they must address this issue to succeed.

To learn more about the steps banks and nonbank providers must take to widen the acceptance of digital banking services, download the report.

About the Report

Digital Banking: The Brewing Battle For Where We Will Bank, a PYMNTS and Optherium collaboration, takes a comprehensive look at the broad acceptance of digital banking across all age groups.