The corner bank branch — the brick-and-mortar kind — may be giving way to a digital one embedded in our phones.

We’re seeing the rise of banking done electronically, 24/7, on the smallest of screens. And the report “How Consumers Use Digital Banks,” a collaboration between Treasury Prime and PYMNTS based on a survey of more than 2,100 people, weighed in on how often consumers are turning to these high-tech channels to get their banking done.

Fully two-thirds of consumers said that they have used a digital bank; and more than half said they have tapped into the services provided by Venmo and PayPal, indicating a growing familiarity with using faster and on-demand ways to move money. As many as 84% of millennials and members of Generation Z have used FinTech banking services in some form.

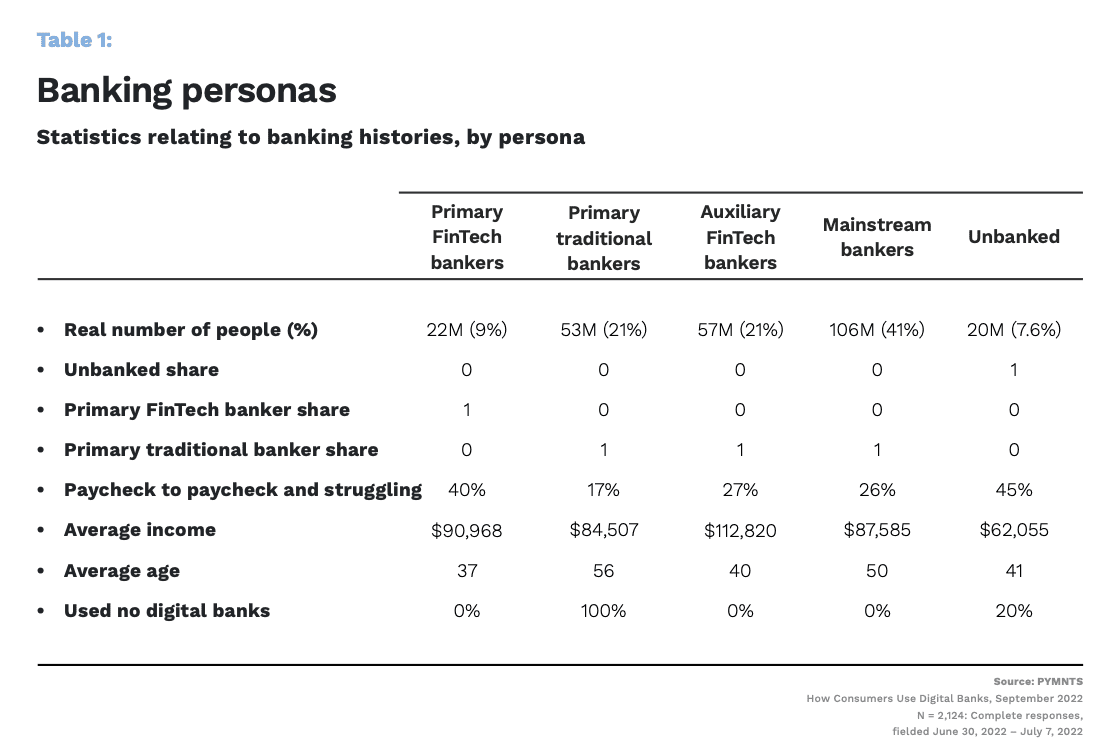

Six out of 10 consumers say they would be interested in joining a digital bank. Drilling down a bit, PYMNTs research has identified five “personas” of consumers that use digital or “traditional” banking conduits, or a combination thereof.

A small but significant slice of the population uses FinTech, digital-only options to bank. As many as 22 million, or 9% of the consumers surveyed, use FinTechs as their “primary” banks — and they tend to be younger than the “traditional” banking customers who don’t use digital channels at all. The FinTech-focused individuals make nearly $91,000 annually, and 40% of them report living paycheck to paycheck — and struggling.