Digital banking has become the primary way many members engage with their credit unions. These interactions are typically quicker and more convenient than traveling to a physical branch or an ATM. However, these transactions are also more susceptible to fraud. Criminals can more easily impersonate an employee or account holder and leverage social engineering to pilfer funds or personal data.

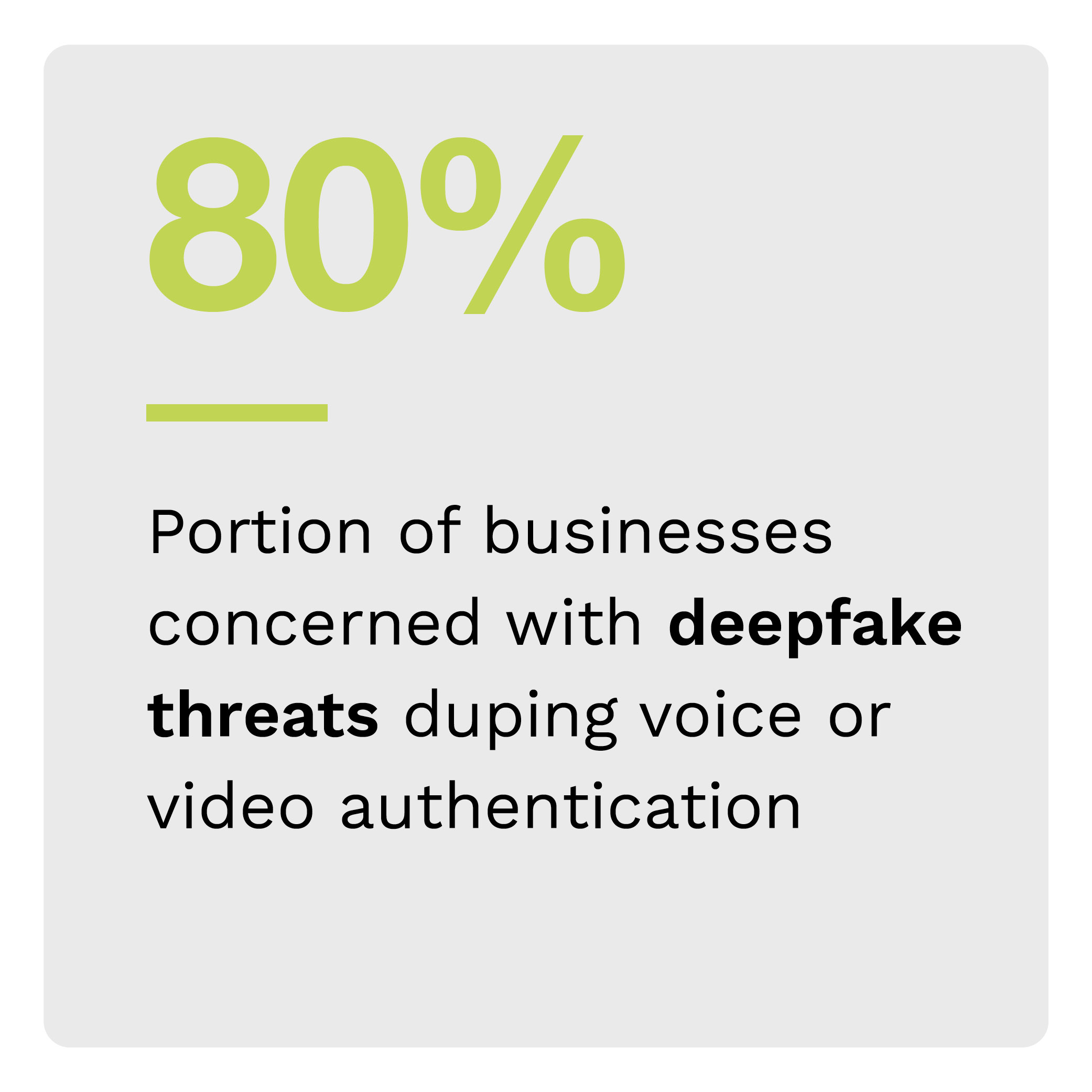

Artificial intelligence (AI) represents an incredible opportunity for both committing and combating fraud. AI tools increase the potency of fraud methods and the prevalence of fraud attacks. For example, fraudsters can use generative AI to make synthetic identities more convincing, while other AI tools can allow a them to orchestrate hundreds or thousands of scams simultaneously. Credit unions must deploy AI tools to combat fraudsters on their terms.

The “Credit Union Tracker®” examines how AI programs such as ChatGPT have made phishing and other fraud techniques even more dangerous for credit unions.

Around the Credit Union Space

Data breaches are among organization’s most dreaded concerns, especially for financial institutions handling highly sensitive information. The Maine-based Franklin Mint Federal Credit Union recently confirmed that a data breach compromised members’ personal information. The breach included the names, Social Security numbers and account numbers of more than 140,000 members.

Data breaches are among organization’s most dreaded concerns, especially for financial institutions handling highly sensitive information. The Maine-based Franklin Mint Federal Credit Union recently confirmed that a data breach compromised members’ personal information. The breach included the names, Social Security numbers and account numbers of more than 140,000 members.

With the rise of digital banking, fraud attacks can now cause wider, more extensive harm than before. A recent attack at Connecticut-based Charter Oak Federal Credit Union left members locked out of online accounts for several days. Security personnel had to temporarily disable mobile and web access to prevent attackers from gaining entry. Soon after the system shut down, phony websites appeared, baiting members into logging in with their credentials. Thanks in part to generative AI tools such as ChatGPT, malicious actors can employ these tactics with the greatest of ease.

For more on these and other stories, visit the Tracker’s News and Trends section.

Countering Rising Fraud Threats to Credit Unions

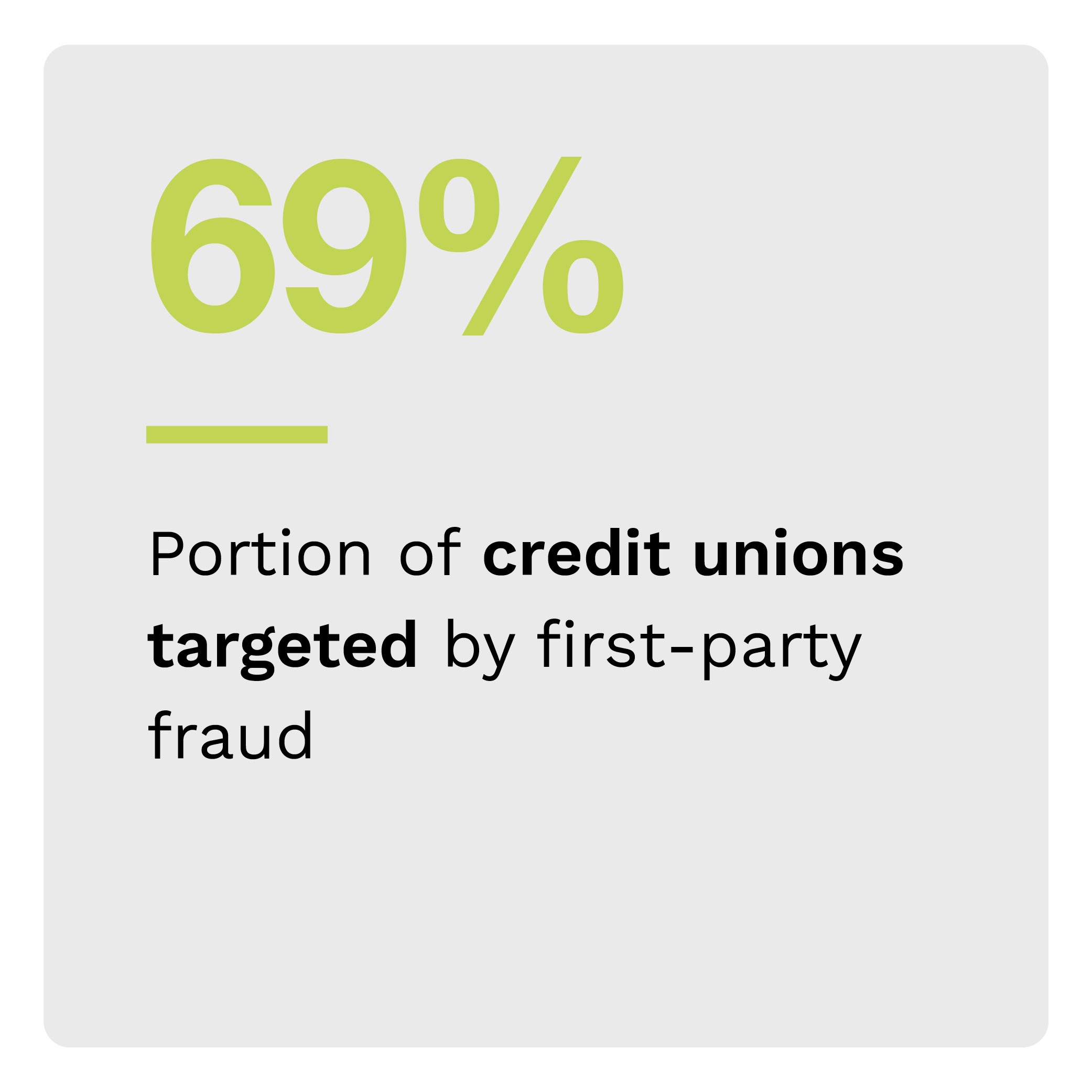

Fraud attacks against banks and CUs are nothing new, but consumers are taking them much more seriously than they used to. A recent study found that 74% of consumers rate fraud protection as a top-three priority when opening a new financial account, outstripping ease of use at 61% and good value for the money at 46%. CUs must implement strong measures to protect themselves and their members from fraud — or watch members take their business elsewhere.

This month’s PYMNTS Intelligence explores emerging fraud threats within the CU landscape and the strategies institutions can deploy to safeguard their members.

About the Tracker

The “Credit Union Tracker®,” a collaboration with PSCU, examines how AI programs have made phishing and other fraud techniques even more dangerous for CUs.