Traditional financial institutions (FIs) have an opportunity to increase customer retention by embracing embedded banking.

Consumers worldwide quickly embraced the industry’s seismic shift toward digitization, which was hastened by the pandemic. Many FIs that had hesitated to invest in their digital offerings found themselves left behind as their customers sought banking capabilities that had evolved to now fit with their increasingly connected habits.

Online banking has now become the norm, for example, and consumers have shown increased willingness to try new things when banking in recent years. PYMNTS’ data from early 2022 found that 76% of consumers had opened new accounts in the 12 months previous to being surveyed, illustrating this phenomenon.

However, consumer-led shifts toward online banking have been only part of the industry’s financial innovations revolution. Another solution on a fast track toward wide adoption is embedded banking.

The difference between embedded finance and banking should be noted. Embedded finance, in which banking services are directly embedded in commercial products, has been in play for decades in forms such as private-label credit cards. The tool has found a resurgence as an integrated feature into non-finance business’ platforms through (mostly) FinTech-offered innovations such as digital wallets or buy now, pay later (BNPL) platforms that aren’t necessarily backed by traditional FIs. Embedded banking underpins these financial products offered by nonfinancial organizations, such as Lyft’s debit card, with the security and reliability an FI might provide.

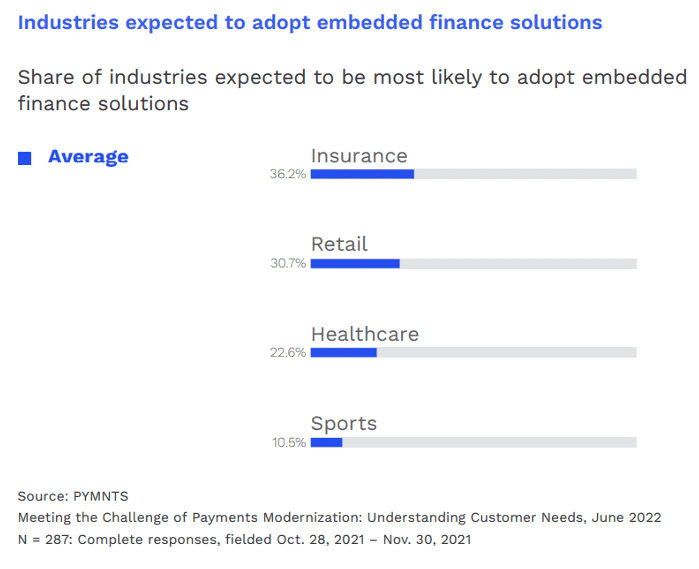

As noted in the latest “Embedded Finance Tracker®,” a PYMNTS collaboration with Galileo, businesses across multiple industries are considering adopting embedded finance solutions.

Advertisement: Scroll to Continue

In particular, the widespread interest in embedded finance across the insurance, retail and healthcare sectors is telling. Although queried about embedded finance, given the trust and institutional backing embedded banking could provide, a sizable portion of these businesses may also have an interest in the latter. This is where the opportunity for FIs may come in. Should traditional FIs sit out, business customers within those industries could turn from traditional banks to meet their needs, leading an exodus that could well reach consumers at large.

The interest in embedded payment adoption has been fueled by the success of its use by early adopters “taking banking to the customer.” However, embedded finance tools and Banking-as-a-Service (BaaS) have so far mostly been offered by FinTechs and neobanks, not traditional FIs. This may be an error on the part of these FIs. They have a unique opportunity to focus part of their innovations budget to engage digital-first customers through embracing this potential market disrupter and turning the embedded finance revolution into an embedded banking transformation.

In an interview with PYMNTS’ Karen Webster, Treasury Prime CEO Chris Dean explained why this collaboration is vital to embedded finance’s mainstream success.

“It’s exactly the right time, right now, for embedded banking because it’s a real revenue generator for the banks and for corporates,” he said.

“You can’t sidestep these banks,” he added. “They’re the ones that hold the charters, they’re the ones that have been doing this for hundreds of years. You simply cannot outsource the compliance.”

As embedded banking becomes a consumer-driven necessity instead of a “nice to have,” traditional FIs may consider serious focus on integrating the innovation into their current offerings. Otherwise, in this competitive climate, they could find themselves left in the same dust as their digital-adverse former brethren.