Manually entering credit card information for each online purchase is such a source of friction and irritation that more than half of consumers are setting their security concerns aside and choosing to store their payment credentials with retailers.

The findings come from the new study “How We Pay Digitally: Stored Credentials Edition,” a PYMNTS and Amazon Web Services collaboration, that asked over 2,100 U.S. consumers why they use stored credentials, and how doing so is making transactions smoother.

With 56% opting to do so, it’s becoming a widespread practice after a three-year immersion in digital-first living.

“PYMNTS’ latest research found that 80% of online shoppers used stored credentials, while just 18% exclusively entered their information manually. Storing payment information on merchants’ or marketplaces’ websites and apps represents the most popular method, used by 60% of respondents, followed by enabling browsers to store and auto-populate payment fields at 46% and using digital wallets at 39%,” the study states.

Get your copy: How We Pay Digitally: Stored Credentials Edition

A key takeaway from the new data is the appeal of conveniently stored credentials.

A key takeaway from the new data is the appeal of conveniently stored credentials.

Advertisement: Scroll to Continue

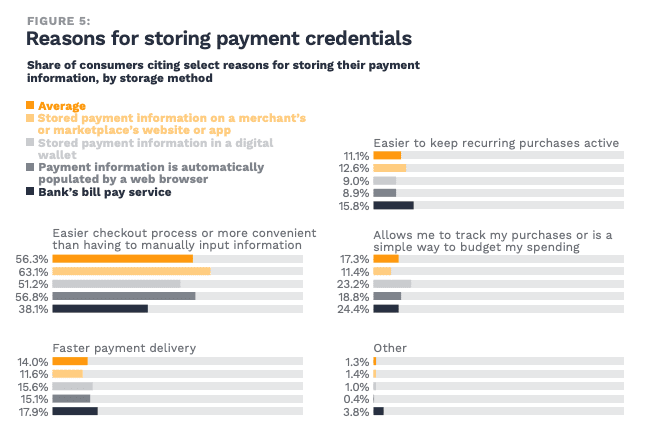

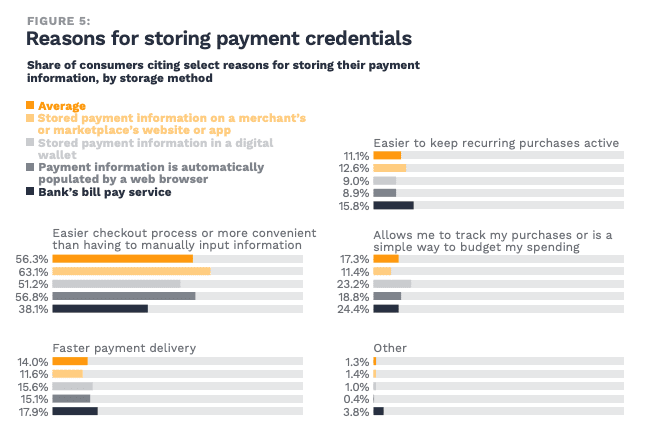

As the study notes, “56% of consumers opted to store their payment data because it provides an easier checkout process, given that it is more convenient than manually entering information. A higher share of respondents who use a merchant’s website or app to store credentials cited convenience as a reason, compared to those who use browsers or digital wallets.”

See it now: How We Pay Digitally: Stored Credentials Edition