Increased online grocery shopping is a souvenir of the COVID shift, but supermarkets aren’t going anywhere.

Now approaching three full years since the health emergency was declared and restaurant delivery aggregators became our go-to for grub, the grocery sector has shown the magnetism of in-store shopping, but with a digital twist that’s now part of our lives.

A key underlying factor is inflation, whose intense pressure began making delivery seem too extravagant for many, sending people flocking back to grocery stores and apps, hunting for bargains, trading down to bargain brands, and generally cutting back the food free-for-all.

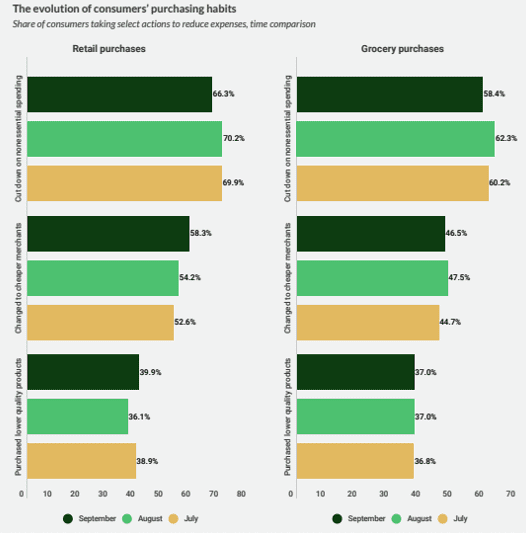

As part of PYMNTS’ ongoing series “Consumer Inflation Sentiment: Consumers Buckle Down on Belt-Tightening,” we found in the October edition that “two-thirds of retail shoppers say they are spending less on ‘nice-to-have’ products than they did a year ago, and 58% of grocery shoppers say the same. Although consumers are cutting back on nonessential retail and grocery spend, this belt-tightening is hitting retailers much harder than grocers.”

As the battle for grocery wallet share heated up in a cooling economy, Amazon and Walmart turned the category into a battleground, and it’s one of the few places Walmart is winning against its eCommerce rival.

“The Battle for Consumer Retail Spend: Amazon Versus Walmart Q2 2022 — The Discretionary Spend Play” noted that Amazon Subscribe & Save is a shot across Walmart’s bow, and it is having an impact, although Walmart is holding onto its title as America’s biggest grocery.

The report stated that “competing for grocery market share is not as easy as it used to be, with other leaders such as Kroger, Target and Costco taking a bigger slice of sales. As of the second quarter of 2022, Amazon maintains only a 2% share of the food and beverage market, which has not significantly changed since it acquired Whole Foods in 2017. During Q1 2019, Amazon held 1.7% of this market, meaning its share has increased by only 0.3% in the past three years.”

With Kroger and Albertsons announcing merger plans in October, enterprise-level money is betting on the grocery sector because recession or not, groceries are essential, and therefore reliable from a recurring revenue perspective.

“A combined entity could deliver benefits like increased purchasing power and shopper rewards, as well as boost resources for technology investments,” PYMNTS reported.

Add to this comments made to PYMNTS by Rom Kosla, executive vice president of information technology and chief information officer for Ahold Delhaize USA’s services company, Retail Business Services, who said Friday (Dec. 23) that the U.S. wing of the grocer, including thousands of stores in the Giant, Food Lion and Stop & Shop brands as well as digital-first offerings Peapod and FreshDirect, is seeing an uptick in consumers’ digital usage in the holiday season.

“We’re also a strong engagement on eCommerce,” Kosla told PYMNTS. “From a technology standpoint, we have a fairly robust trend tracker of all transactions are coming through, and it’s highest we’ve seen — at least, during Thanksgiving it was the highest number of transactions — since all the previous holidays.”

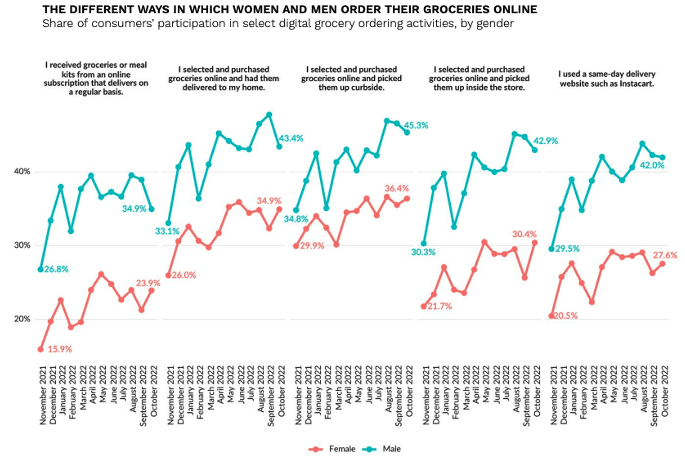

Those most digitally habituated when it comes to food are men, as we found in the PYMNTS study “The ConnectedEconomy™ Monthly Report: The Gender Divide.”

“Men are especially predisposed to ordering their groceries via Instacart and other same-day delivery services,” the study stated. “A grand total of 52.4 million men ordered at least some of their groceries via same-day delivery in October, compared to just 36.6 million women who did the same, with 15.9 million more men using such services than women that month.”

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.