A false decline is a legitimate card transaction that is ultimately denied, either by a bank or a merchant because it is mistakenly considered a fraud attempt.

The result is a consumer who abandons the shopping cart, which is finally translated into lost sales that cannot be regained by the merchant.

“Fraud Management, False Declines and Improved Profitability” is a PYMNTS Intelligence and Nuvei collaboration that examines failed payments in the eCommerce space. According to the study, on average, U.S. firms experience 11% of failed payments on online sales transactions. Nearly two-thirds of these failed payments are difficult to recover.

False declines cause customers an unpleasant digital shopping journey and result in reputational damage. Many consumers are inclined to put the declined cards at the “back” of the wallet and opt to use the cards that are not being declined.

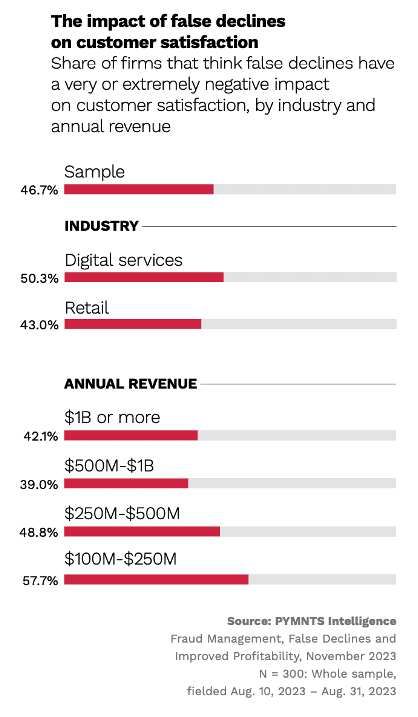

Aside from the direct loss of sales, merchants recognize that false declines have a detrimental effect on customer satisfaction, with 47% of online players indicating a very or extremely negative impact. Fifty-eight percent of companies with revenues between $100 million and $250 million are affected.

Elizabeth Graham, product manager at Entersekt, said in an interview with PYMNTS posted in April that false declines carry significant risks for merchants, where consumer loyalty is critical.

Advertisement: Scroll to Continue

“False declines are such a problem in the industry that 80% of merchants use this measure as a key metric within the organization,” Graham told PYMNTS.

“It’s incredibly frustrating and causes consumers to feel not only that it’s a nuisance — because they cannot buy the product they want to — but also almost like there’s been a personal insult,” she added.

In most instances, it is impossible to figure out whether the failure in the transaction was tied to the merchant or bank, or due to a technical issue with the credit card. According to data from the study, 8 in 10 online retailers cited difficulties in identifying the causes of failed payments.

Technology offers various options for stakeholders to efficiently combat fraud and ensure that customers can complete their transactions.

“We can mitigate some of the challenges that we experience with false declines as open banking payments integrate with existing options such as credit cards, debit cards and digital transfer services typically offered by eCommerce retailers at checkout,” Graham said.

Nearly all eCommerce firms are actively innovating their anti-fraud tools and screening mechanisms or planning to do so within 12 months, PYMNTS Intelligence found.