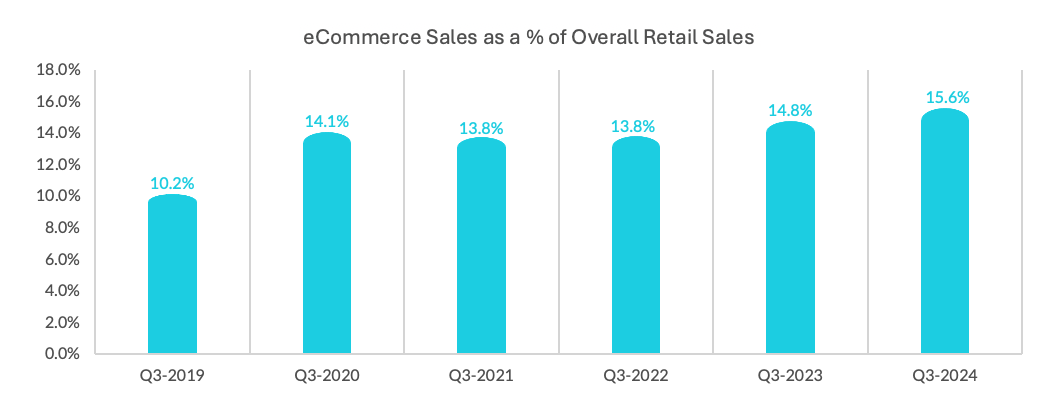

Digital continued to take a larger slice of retail spending in the third quarter of 2024.

However, a slowing pace of overall spending may send mixed signals to merchants headed into the last few weeks of the year.

Data from the U.S. Census Bureau released Tuesday (Nov. 19) confirmed that a shift toward paying online, through computers and mobile devices, remains firmly entrenched.

On an unadjusted basis, eCommerce sales hit $288.8 billion, a 2.2% sequential increase, and up 7.5% since last year. As a percentage of overall retail, online sales hit 15.6% of the total $1.8 trillion, where that measure was 15.2% in the third quarter and 14.8% in the same period last year. The percentage contribution outstrips what was seen during the pandemic.

As measured year over year, the 7.5% growth in eCommerce sales was leagues above the 2.2% increase in total sales. The read-across is that consumers continue to value the convenience of always-on commerce.

As measured year over year, the 7.5% growth in eCommerce sales was leagues above the 2.2% increase in total sales. The read-across is that consumers continue to value the convenience of always-on commerce.

The data does not make distinctions between sales that are browsed for and completed at home or perhaps curbside or even in the aisles of brick-and-mortar locations. As PYMNTS detailed in the latest survey of click-and-mortar shopping, across several countries monitored, only 29% of consumers said they used online channels exclusively. The eCommerce growth indicates there’s room to bring the digital into the physical realm.

The Census Bureau’s data came the same day Walmart reported that eCommerce sales in the United States surged by 22% in the most recent quarter. The company’s eCommerce Marketplace sales were 42% higher.

Walmart’s earnings report includes the month of October, and the company’s momentum may be outpacing retail in general.

Separate Census Bureau data indicated last week that although October’s retail sales were up 0.4% month over month, much of that gain was tied to auto and auto parts sales. The month itself saw a deceleration in non-store sales, which is a broad category but is about 85% online commerce. The non-store category was up 0.3% month over month, down from the 1.7% surge from August to September.

The October data may represent a pause from the third quarter (which ended in September). If there is a pause, perhaps it’s a matter of consumers considering what they will spend in the next few weeks of the holiday shopping season. October’s reading on retail sales noted that sporting goods, hobby, musical instrument and book stores, as well as health and personal care items (all conceivably gift-giving categories), slipped by 1.1% each. Spending on apparel was down by 0.2%.