Online commerce carries a number of risks related to digital fraud and payment failure that can result in lost sales and an erosion of brand reputation. This is common to any company that operates online, regardless of its industry and size. However, PYMNTS Intelligence data shows that online trading in international markets carries higher risks and greater exposure to payments frictions than solely operating in the U.S. domestic market.

These are just some of the insights extracted from “The Role of Fraud Screening in Minimizing Failed Payments,” a PYMNTS Intelligence research study in collaboration with Nuvei that examines the efficacy of the fraud screening mechanisms eCommerce merchants use. The study draws on insights from a survey of 300 heads of payments or fraud departments from international eCommerce companies.

According to PYMNT Intelligence research, on average, U.S. firms experienced roughly 11% of failed payments on online transactions they processed over the last 12 months. This represents a potential impact of approximately $89 billions of retail online sales during the three first quarters of 2023, as extracted from the data reported by the U.S. Census Bureau.

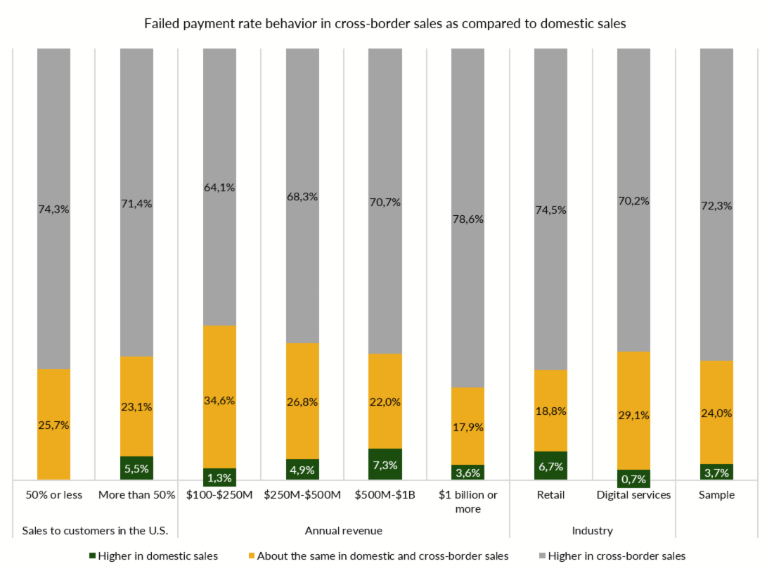

The failed payments rate is significantly higher among those online businesses operating internationally. Specifically, 70% of U.S. experienced higher rates of failed payments in cross border sales compared to domestic sales, per PYMNTS Intelligence research. This underscores the need for businesses to implement effective mechanisms and screening tools to prevent fraud and minimize payment frictions, ultimately enhancing payment experience and customer retention.

While the potential of a seamless payment experience in cross-border commerce is a multi-billion-dollar opportunity, for financial institutions and other payment providers, capturing that opportunity is a challenge.

Amit Agarwal, global co-head of Payments and Receivables, Treasury and Trade Solutions (TTS) at Citi, told in this regard in a recent interview with PYMNTS that “Cross-border payments inherently have more points of failure compared to domestic payments.”

PYMNTS Intelligence reported in a different research study that less than a quarter of smaller businesses say that current cross-border payment solutions are very satisfactory.

“The rise of embedded payments and platforms,” Agarwal said, demands that providers think about the “payments experience” itself — not just about whether to provide ACH, wire or instant options, but where to provide those options and when.”

Agarwal noted as well that partnerships between merchants and payment providers are critical to maximize 24/7 availability and reliability of cross-border payments. “There are many pieces of the jigsaw puzzle that have to come together to create a better experience,” he added, “and if payments are not embedded, the rest of the experience is not going to be possible.”

PYMNTS research revealed that nearly 4 out of 10 merchants are already collaborating extensively with PSPs by adopting tools for identifying potential fraud as the cause of failed payments.

The velocity of payments has increased thanks to instant methods, and the number of participants in the eCommerce ecosystem has increased exponentially in the last decades. The risk of fraud and failed payments are only increasing with the rapid expansion of online commerce. The piece of the eCommerce pie is now bigger, but it is crowded with many firms aiming to address those frictions occurring in cross-border sales.