PYMNTS Intelligence: RTP® Network Limit Increase Opens New Business Opportunities

Even as the economy has recovered, inflation and other economic pressures are continuing to create problems for businesses’ cash flow. Sixty percent of all businesses surveyed said cash flow is a top concern in the current business climate. Supply chain delays add to the problems and create an advantage for businesses that can offer suppliers faster and more dependable payments. Nearly half of the surveyed suppliers identified late payments as their biggest challenge, and 12% said they wanted greater payments visibility. Nearly 60% of suppliers reported having to contact customers up to 10 times each month regarding late payments, and 10% said they were contacting customers more than 10 times a month.

Throughout 2021, the share of corporate buyers willing to make online purchases of $500,000 or more rose from 27% to 35%. There is a clear advantage in making such purchases when they can be completed in a single transaction rather than broken into multiple payments due to transaction limits. At the same time, confidence in making transactions for $1 million or even more is rising globally, particularly in the U.S. and China.

From real estate closings to commercial loans and supplier payments, corporate users are increasingly interested in making larger real-time payments. This month, PYMNTS Intelligence examines the RTP network transaction limit increase from $100,000 to $1 million and the advantages of sending and receiving larger real-time payments to various industries.

Growth in Real-Time Payments

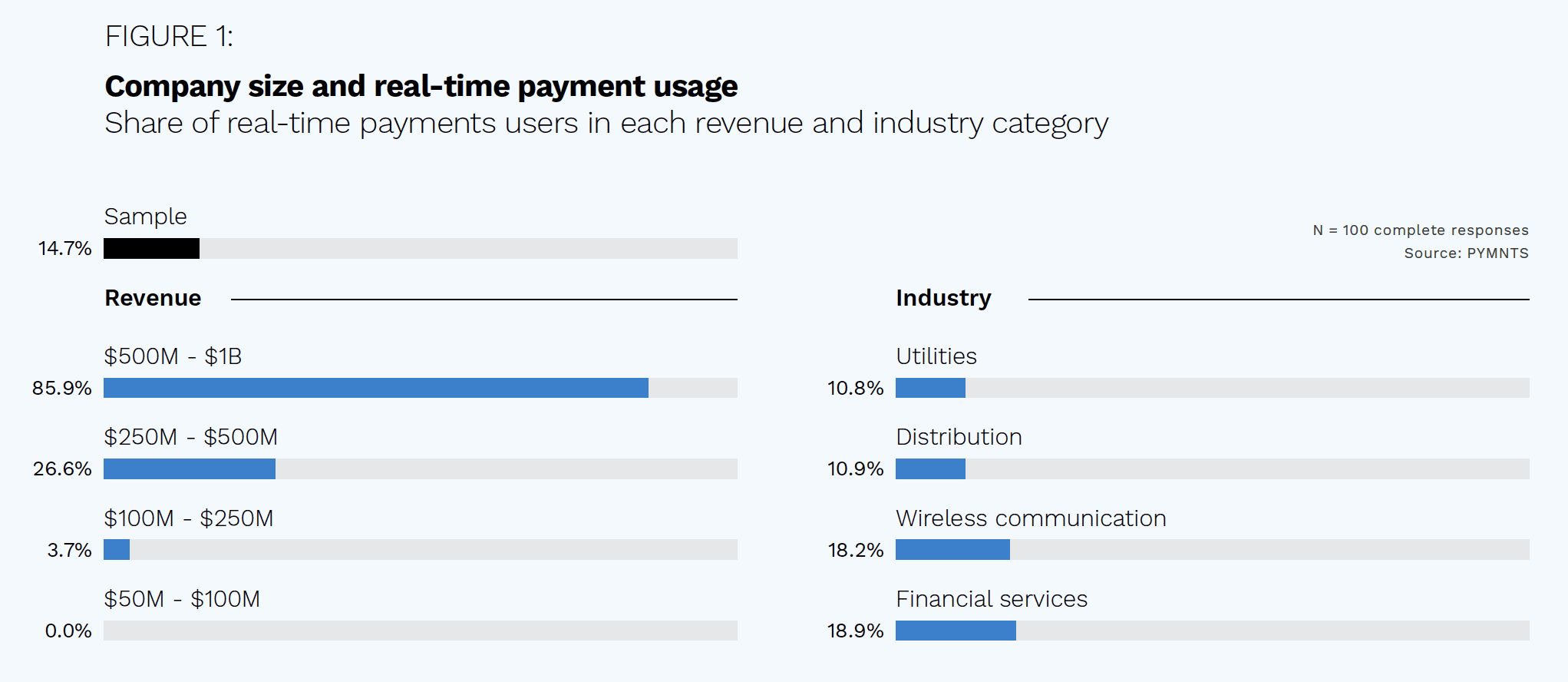

When the RTP network launched in 2017, the transaction limit was $25,000. Since then, real-time payments have become integral to business-to-business (B2B) payments. Approximately 41% of U.S. firms are now engaged in using some form of real-time payments. The greatest interest has come from larger companies. Nearly 86% of surveyed businesses with between $500 million and $1 billion in annual revenue said they use real-time payments, and these companies account for two-thirds of those using real-time payments. The RTP network has found uses in a variety of industries, from 19% of financial companies surveyed to 18% of wireless communication companies.

Among surveyed companies generating $500 million to $1 billion in annual revenue that are not currently using real-time payments, 50% said they are working toward real-time payments capabilities. Forty-eight percent of companies expect real-time payments innovation will produce improved cash flow, 47% anticipate more transparent payment processes and 46% expect it will make it easier to make urgent payments.

Respondents to a Federal Reserve study indicated their interest in faster payments, with more than half of medium-sized and larger businesses accelerating faster payment implementation plans. Sixteen percent of respondents said they would even pay a modest fee to have funds available within 10 seconds or less.

A similar increase in the transaction limit for same-day automated clearing house (ACH) payments in March has demonstrated the potential of the limit increase for the RTP network. The year-over-year dollar value of same-day ACH payments rose $290.3 billion, while transaction volume grew 7.8%. Kevin Heras, CEO of InvestNext, called the limit increase a “game-changer” for the real estate industry.

Looking Forward

As real-time payments become more common in B2B transactions, James Colassano, senior vice president of product development at TCH, said he anticipates the limit increase on the RTP network will hasten the transition away from checks in commercial transactions. In addition, the limit increase will enable that transition without an interim move toward ACH payments, which do not offer the same finality and speed as real-time payments.

When the RTP network increased the transaction limit to $100,000 from $25,000, it was able to capture approximately 98% of the size of transactions seen on TCH’s ACH network. Since then, RTP network transaction volumes have grown by double-digit percentages each quarter. At the same time, TCH continued to receive interest in an even higher limit, furthered by the accelerated digital transformation that accompanied the pandemic.

Additionally, having payments and all related payment information sent and received in real time adds a level of security for large transactions while also limiting the potential for errors or transaction rejections after a deal is complete. By being able to handle such significant sums in real time and moving funds directly between accounts, businesses can take comfort in knowing that transactions are final and that the intended recipient has received the money.