With the advent of digital payments, instant reimbursements have gained popularity, providing employees with convenience and quick access to funds.

However, there is still a need for businesses to promote and address concerns regarding instant payment options.

In “Generation Instant: Business Expense Reimbursements,” PYMNTS Intelligence drew on insights gathered from a survey of more than 2,600 consumers to examine consumers’ satisfaction with disbursements received from government and nongovernment entities.

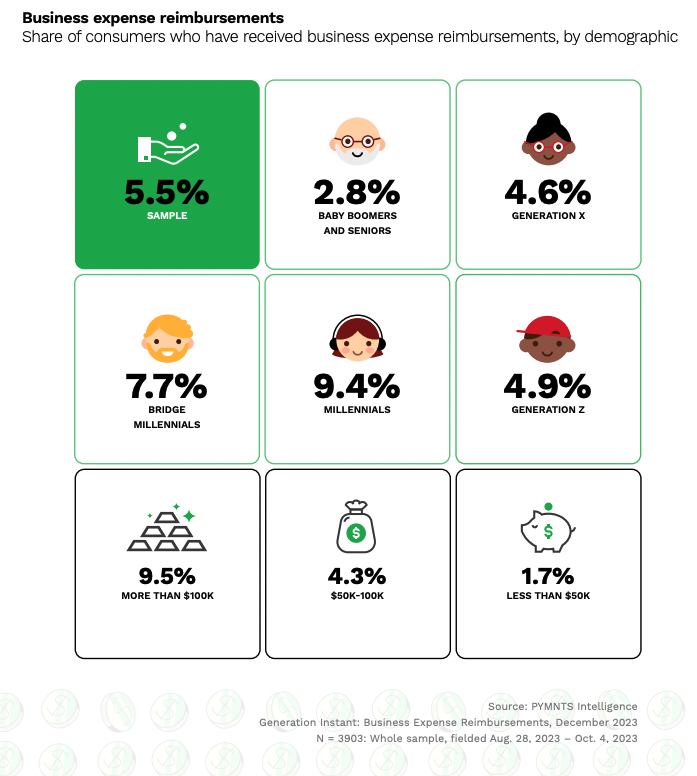

The survey revealed that there has been an increase in business travel since the height of the pandemic, as professionals attend industry conferences and meet with clients. Consequently, the percentage of consumers receiving business expense reimbursements has risen from 3.5% in 2021 to 5.5% in the last year. The surge in reimbursements reflects the growing expenses incurred by employees on behalf of their companies.

Traditionally, these reimbursements were often made via check, separate from payroll. However, the rise of digital payments has led to a shift in expectations. Employees now prefer their reimbursements to be delivered sooner and without the hassle of waiting for a physical check.

Against this backdrop, instant payments for business expense reimbursements have witnessed a notable increase, with 43% of consumers who receive business expense reimbursements now doing so via instant payments, a 15% increase from the previous year.

Additionally, among all consumers receiving reimbursements, 58% used instant payment methods at least once in the last 12 months. It is worth noting, however, that 71% of consumers still received reimbursements via other methods such as cash or non-instant digital wallets.

On average, consumers receiving business expense reimbursements received 10 disbursements in the last year, totaling $15,300 per receiver. The average size of each disbursement was $1,488, with instant transactions slightly higher at $1,552 compared to non-instant transactions at $1,424.

Overall, instant payments for reimbursements have resulted in high employee satisfaction, reaching a record high of 78% this year. The satisfaction rate surpasses the overall satisfaction level of 70% across all payment methods.

However, the survey also revealed that some consumers are still hesitant to choose instant payment options. Concerns about sharing payment credentials and a lack of awareness about instant payment availability were cited as reasons for not selecting instant payments.

Further data analysis revealed that only 2.8% of baby boomers and seniors, and 1.7% of consumers earning less than $50,000 annually received these disbursements. In contrast, millennials and high-income consumers were the most likely to receive reimbursements, at 9.4% and 9.5%, respectively.

Businesses need to proactively promote instant payment options and address concerns regarding payment security to meet employees’ evolving demands.