Grocery stores, convenience stores and pharmacy retailers seeking to modernize their in-store payments systems to give consumers more options are prioritizing real-time payments.

Real-time payments are being explored as an eCommerce option, but some merchants are also exploring the possibility of bringing the method into physical stores. The study “Instant Payments Transformation Guide: Grocery, Pharmacy and Convenience Retailers,” a PYMNTS and ACI Worldwide collaboration, found that there is enthusiasm among U.S. and U.K. retailers to implement real-time payments over the next three years. The reason cited for the investment is consumer choice, but real-time ,account-to-account (A2A) payments give merchants an option with a lower cost of acceptance.

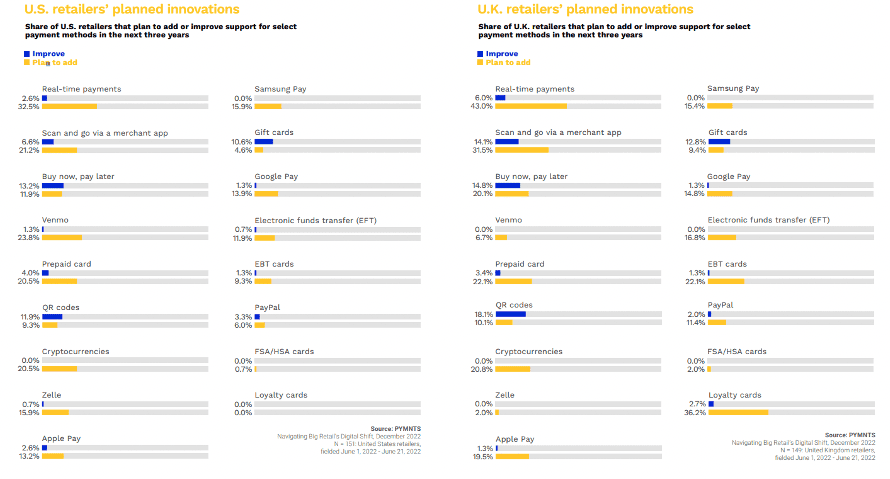

Larger retailers are already expanding their available payments, including real-time options. The study “Navigating Big Retail’s Digital Shift: The New Payments Strategy Evolution,” another PYMNTS and ACI Worldwide collaboration, showed that 56% of U.S. retailers with annual revenues between $1 billion and $5 billion are adding more payment choices, along with 53% of surveyed retailers with revenues of more than $5 billion.

Retailers’ focus seems targeted on displacing debit as a payment option at those stores where consumers use debit more than credit — and for which chargebacks are less problematic.

For PYMNTS’ “Executive Insight Series: Top of Mind,” Neil Erlick, chief corporate development officer at payments platform Nuvei, lent some insight into how he’s noticed real-time payments benefiting merchants.

“Anytime we’re able to add even a 1% increase for these clients in terms of authorization rates or approvals, it goes right to their bottom line,” Erlick said. “That’s what we’re seeing. So, it’s kind of a cost center to revenue accelerator.”

Offering the right mix of payment choices is key for merchants seeking to boost customer retention and growth.