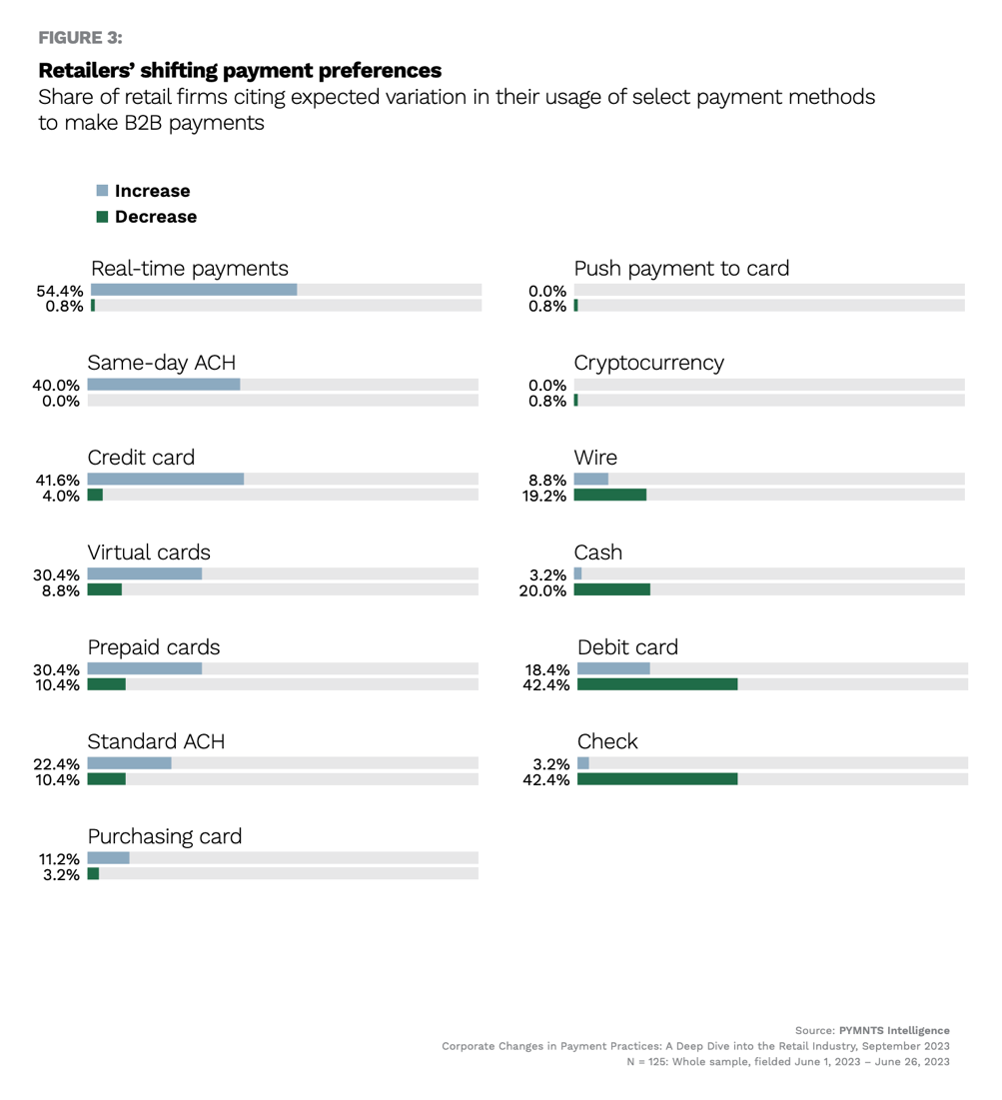

In an environment with high interest rates and the expansion of instant payment systems, retailers are shifting their payment preferences by leaving traditional methods and replacing them with faster and lower-cost systems such as real-time payments and instant ACH. Forty-two percent of retail firms in the U.S. predict they will rely less on checks for making B2B payments, paralleled by a similar decline in debit cards, at 42%, and cash at 20%. On the other side of the balance, they foresee increasing usage of real-time payments and same-day ACH by 54% and 40% respectively.

These are some of the key results drawn from the study “Corporate Changes in Payment Practices: A Deep Dive Into the Retail Industry,” a survey of 125 U.S. payment executives at enterprise retailers conducted by PYMNTS Intelligence in collaboration with The Clearing House in June.

To understand the motivation behind this transition, we asked retailers which B2B methods they think real-time payments are most likely to replace when making payments. Ninety-four percent stated these systems would supplant checks. Debit cards also appear vulnerable, with 80% of retailers indicating this shift. Even time-tested standard ACH does not escape from real-time payments expansion, as 74% of retailers predict to replace ACH with these instant payment systems.

Behind this shift toward real-time payments, we don’t find just a single reason, but a sum of factors. These systems not only offer retailers faster processing and lower costs but also unlock other benefits. Real-time payments are cleared instantly, providing improved liquidity and immediate cash flow to firms. Studies show that 64% of businesses encounter delayed payments, with suppliers waiting an average of 43 days to get paid, according to another PYMNTS Intelligence report. This allows merchants to negotiate better rates and discounts from suppliers, restock faster, and as a result reduce costs. And real-time payment transactions bypass card intermediaries, resulting in fewer declines, chargebacks and card fraud.

While real-time payment systems offer numerous benefits, retailers must overcome challenges related to system integration and back-office operations. Legacy back-office systems designed for batch processing can create bottlenecks in payment operations, slowing down real-time front-end payments. To fully capitalize on the opportunities presented by real-time payments, retailers need to transform their back-office payment operations and upgrade their existing payment infrastructure. This investment in these areas can be particularly significant for smaller retailers with limited resources.

Despite these challenges, the benefits of real-time payments outweigh the costs by providing a faster, more efficient and secure payment experience. If retail firms continue embracing real-time payments in B2B operations, other firms’ counterparts will be motivated to do so as well, amplifying a broader network of acceptance.