In today’s competitive job market, traditional benefits like retirement plans and paid time off are falling short as workers demand immediate access to their earnings. Rising financial pressures and living costs are driving this shift, pushing employers to adapt or risk losing top talent.

A PYMNTS Intelligence report, “No-Wait Wages: Leveraging Instant Payments to Boost Employee Satisfaction,” created in collaboration with The Clearing House, highlights how instant payroll solutions are becoming essential in addressing the growing demand for financial flexibility.

Workers today are grappling with increased financial pressure, driving a new urgency for on-demand pay. According to the report, 83% of workers desire more frequent pay schedules, a significant shift from the traditional biweekly or semimonthly pay periods.

The push for instant payroll is driven by inflation and a 24% increase in average spending per person, which has strained many workers’ budgets. This financial burden often pushes workers toward high-interest payday loans, worsening their debt. Instant payroll addresses this by giving employees timely access to their earnings, helping them manage expenses and avoid costly loans.

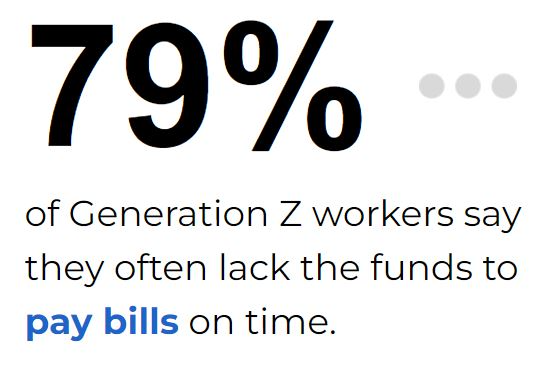

For younger workers, the need for real-time access to earnings is even more critical. About 70% of Americans report feeling stressed about their personal finances, with 75% of adults aged 18-34 expressing significant financial anxiety. Among Generation Z, 79% of hourly workers admit they frequently lack sufficient funds to cover their bills on time.

According to the report, workers are willing to pay for real-time payroll, but employers seeking to create a healthy working environment should offer this benefit for free. As demand for real-time payroll increases, many companies are adopting these solutions, but some workers are already using costly third-party services with annual interest rates up to 330%.

Companies like DailyPay, which recently raised $175 million and partners with major employers such as Hilton and Target, show that integrating earned wage access (EWA) platforms can improve hiring and retention. For employers, investing in in-house real-time payroll solutions offers a strategic advantage in boosting employee satisfaction and loyalty.

Providing employees with instant access to their wages can significantly boost job satisfaction and retention. Consider that 78% of consumers express high satisfaction with instant payouts, although only 36% currently receive their disbursements this way. Fee-free instant payments have been shown to increase satisfaction by 11% and nearly double the likelihood of employee loyalty.

For businesses facing staffing challenges, the impact of offering no-fee instant payroll can be profound. Forty-six percent of small to medium-sized businesses (SMBs) struggle with staffing shortages, and 42% report difficulties with employee retention.

In such an environment, implementing real-time payroll can provide a competitive edge. Not only does it address the growing demand for financial flexibility, but it also improves employee morale and reduces turnover. As businesses navigate a tight labor market, the ability to offer instant, fee-free payroll could become a crucial factor in attracting and retaining talent.

As employee expectations evolve, the demand for instant payroll reflects broader changes in financial needs. Workers seek flexibility and immediate access to their earnings, compelling employers to adapt. Real-time payroll solutions help address these financial pressures, enhancing job satisfaction and retention.