The countdown’s on to the end of 2022, which FinTech IPO investors would rather forget.

Earnings season is now all but over, with the exception of a few stragglers. The double-digit percentage gyrations — up and down — have been a hallmark of the past few days, weeks and months. Last week was short, thanks to Thanksgiving. Now back to reality, as they say.

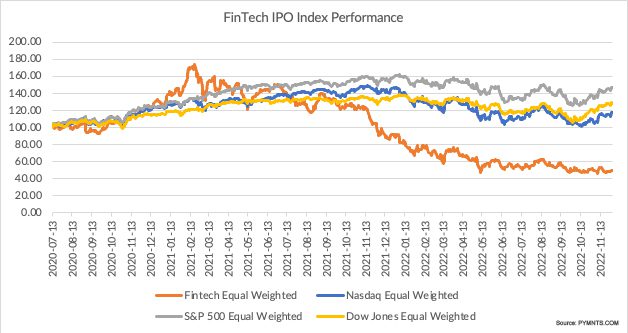

Though the past week offered up a slight gain, at 1.5%, the index, with slightly less than a month left, is down more than 46%.

If past is prologue, then we’re setting up to see a tough year ahead. The enthusiasm to bring new companies to market simply has … waned. As reported by Reuters on Wednesday, the proceeds from public listings is down by 93% year on year, according to Lynn Martin, president of the New York Stock Exchange.

“There is a lot of uncertainty and there’s a lot of different forces that are impacting markets,” said Martin during an interview with the wire. She stated that companies want to list, but are waiting for volatility to subside.

The wait may be long, we note.

It may be the case that our group of more than 45 FinTech IPO firms — all of which, save two (Bill.com and 10x Capital) are trading as “busted” IPOs — will offer a cautionary tale to other firms that aim to go public.

Even heady gains — the ones where stocks leap 40% or more — have not been enough to get investors back to breakeven. A few pennies here and there on names that trade for $1 or a bit more wind up having a dramatic (percentage) impact.

The rallies we’ve seen this week come on the heels of a massive surge across markets as Fed Chair Jerome Powell signaled that the central bank may moderate rate hikes. The read-across is that the toughest period of grappling with the rising cost of capital, and some of the biggest hurdles to a continued rebound in consumer spending, may be behind us.

Katapult gained 41%, as the company looks toward Nancy Walsh coming on board as CFO later this month, having served earlier as CFO of LL Flooring Holdings.

Huize was up 9%, continuing to surge through the past few weeks, extending a notable rally on the wake of nearly month-old earnings reports that showed 24% revenue growth.

Nuvei gained 6.2%. The company said this week that it has partnered with U.K.-based airline Virgin Atlantic. The companies said in a release that Virgin Atlantic will gain access to Nuvei’s proprietary modular platform designed to boost acceptance rates and accelerate revenue.

Triterras and Enfusion Lose Ground

Among the notable losers, Triterras sank 26%. The company reported its six-month operating results at the end of last month.

The company said that, for the first half of the 2023 fiscal year, and per the comments of CEO Srinivas Koneru: “The first half of fiscal year 2023 was clearly very challenging for the Company. Although global trade flows have stabilized, many of our customers, micro-, small- and medium-enterprise traders continue to suffer from reduced availability of, and increased premium rates for, trade credit insurance, reduced liquidity and financial difficulties in the trade finance marketplace, reduced trading activity, and business suspensions and liquidations.” Total transaction volume for the period was $989.6 million compared to $4.0 billion in the prior fiscal year comparable period.

Enfusion lost 21.5%. The company said this week that Stephen Dorton has resigned from his position as chief financial officer and reiterated its business outlook from earnings last month. Separately, Deirdre Somers is joining the company’s board of directors, effective Jan. 1.