CBZ Holdings, Zimbabwe’s largest bank, is suspending Visa cards for transactions made locally, with the high costs associated with Visa cards and cash shortages being the main reasons.

According to a report by Reuters, CBZ Chief Executive Nyevero Nyemudzo said: “We have told our clients it is cheaper for them because the charges by Visa are very high, and that is compelling enough for our clients to restrict the use of the Visa card.”

In November, the Reserve Bank of Zimbabwe introduced a so-called “bond note” currency in an attempt to reduce the cash shortages in the nation, but long lines still remain at banks. Banks have imposed strict limits on cash withdrawals as a result. To date, the central bank has released $79 million in bond notes, noted the report.

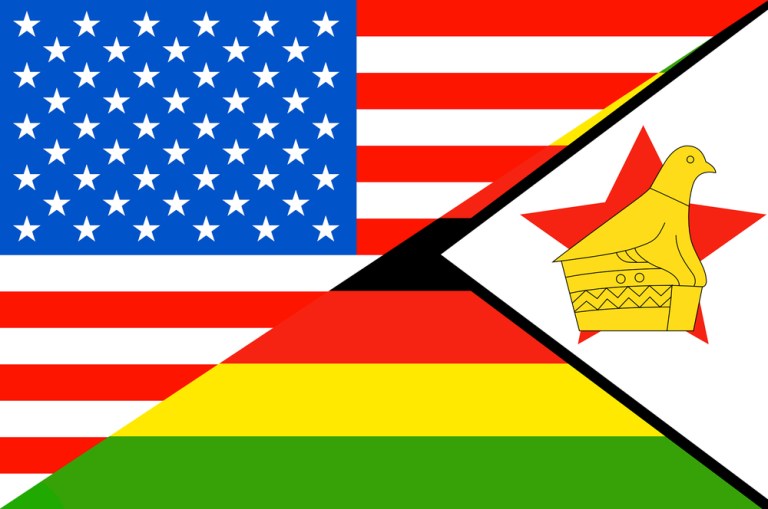

Zimbabwe may not be the first place people think of when they talk about a cashless economy, but the country is speeding toward a cashless future, according to The New York Times. And there is one reason for it: The country is running out of cash, particularly the U.S. dollar, which was adopted in 2009. According to an NYT report, while most of the country’s population works in the informal economy, the citizens aren’t high-tech and blackouts are a common occurrence, it is becoming a cashless society, as many citizens worry about the country and, as a result, are taking money out of the country.