For women around the world, freelancing in the digital economy isn’t just convenient – it’s empowering, especially as gender pay disparity comes under scrutiny across the corporate workspace. But what’s not empowering are the steep transaction fees and currency challenges, such as forex fluctuation or non-acceptance of customers’ preferred tender.

The new way of working has “unquestionably broken down barriers to women’s economic empowerment,” according to Meghan Hagberg, senior vice president, Business Council for International Understanding.

It enables moms to work from home while raising children; it enables craftswomen to sell their wares on global platforms. U.S. respondents said it improved their physical and emotional well-being, reducing stress; additionally, they enjoyed the flexibility it afforded around family obligations. India respondents said they were able to earn more participating in the digital economy than the traditional one.

Yet this way of doing business is not without its flaws.

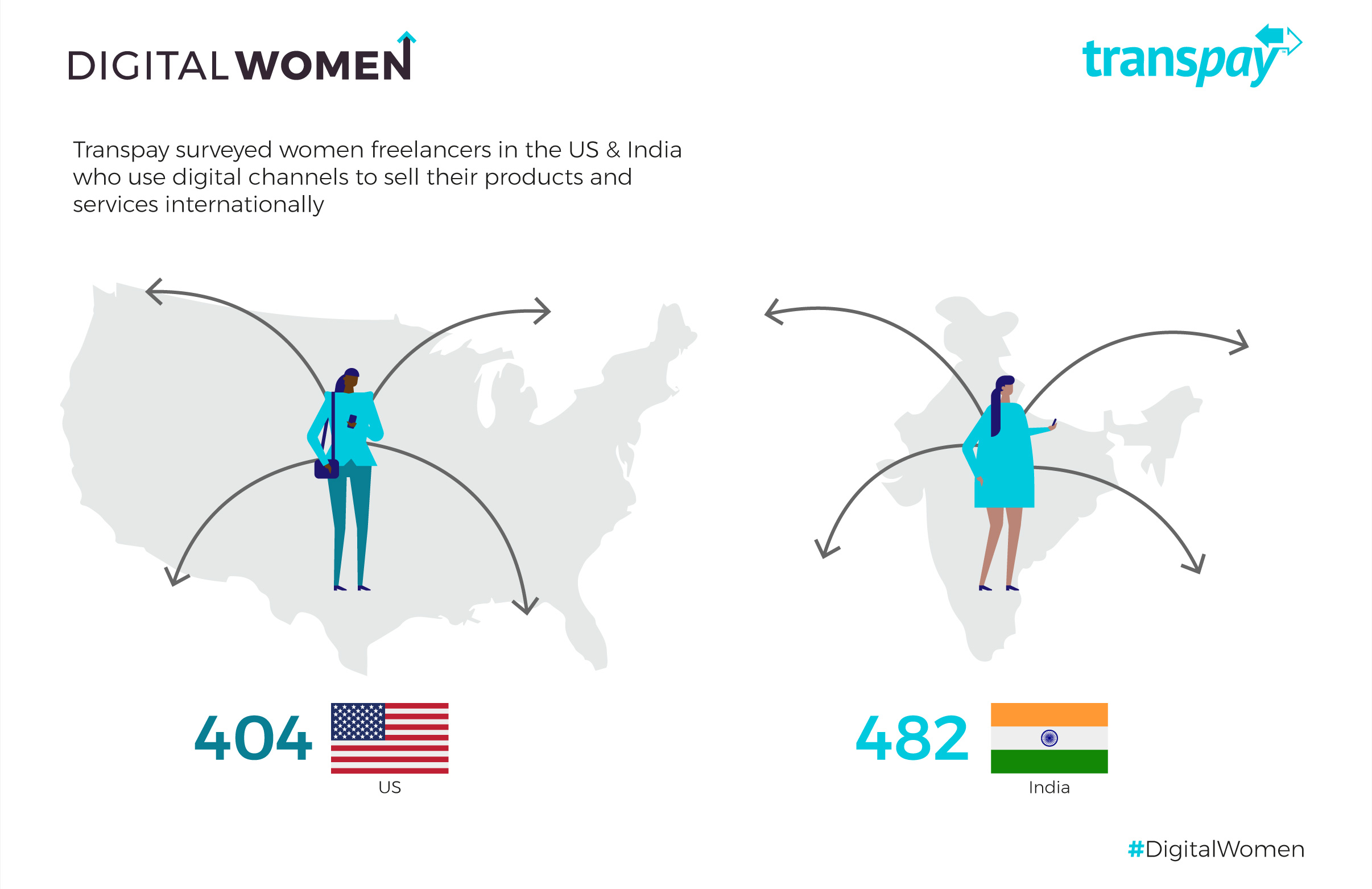

According to a recent survey by Transpay, 41 percent of U.S. respondents identified transaction fees on payments as one of the greatest obstacles to their success in the digital economy – while a whopping 90 percent of Indian respondents said the same.

Fluctuations and limited acceptance of currencies were cited as detrimental to business by 49 percent of Indian respondents and 24 percent of those from the U.S.

“In a time of great debate over gender-based pay, the growing digital economy is a supportive resource for women seeking empowerment and financial well-being,” said Peter Shore, general manager of Transpay. However, “The transaction fee and currency conversion issues prevalent among traditional cross-border payment channels are diminishing digital entrepreneurs’ compensation.”

Losing money to fees is just one of the challenges entrepreneurs face, however. Direct-to-bank deposit was cited as a preferred method of payment by 40 percent of U.S. respondents and 48 percent of those in India – yet only 30 percent of U.S. respondents are paid this way, and none in India are.

The digital economy has created good opportunities, but it’s clear that it still has some evolving to do. U.S. respondents have higher hopes for payments becoming seamless and real-time over the next five years, while Indian respondents put more stock in cryptocurrency disrupting cross-border payments entirely.